What is checkbook register software?

Checkbook register software is a digital tool that helps individuals and businesses track their financial transactions. It allows users to record details such as date, payee, amount, and balance for each transaction, providing a clear overview of their financial activities. By using checkbook register software, users can easily monitor their spending, track income and expenses, and maintain an accurate record of their financial transactions.

What are the types of checkbook register software?

There are several types of checkbook register software available, each offering different features and functionalities to suit various user needs. Some common types include:

Web-based checkbook register software: This type of software can be accessed through a web browser without the need for any installations. It allows users to manage their financial transactions from any device with an internet connection.

Mobile app checkbook register software: These are mobile applications that users can download and install on their smartphones or tablets. They provide convenience and allow users to track their finances on the go.

Desktop checkbook register software: This type of software is installed on a user's computer and offers robust features for managing financial transactions. It provides offline access and can handle large amounts of data.

Cloud-based checkbook register software: This software is hosted on remote servers, allowing users to access their financial records from anywhere using an internet connection. It offers scalability and easy collaboration features.

How to complete checkbook register software

Completing checkbook register software is a straightforward process that involves the following steps:

01

Choose the checkbook register software that best suits your needs and budget.

02

Sign up or create an account with the selected software provider.

03

Familiarize yourself with the software interface and features.

04

Start by entering the opening balance of your checkbook.

05

Record each financial transaction by filling in the required fields such as date, payee, amount, and category.

06

Make sure to update the balance after each transaction to maintain an accurate record.

07

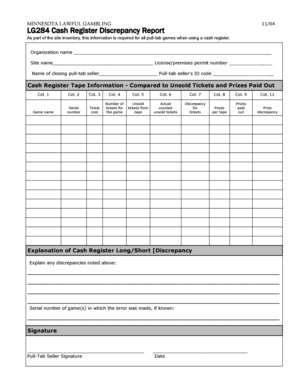

Regularly reconcile your checkbook register with your bank statements to identify any discrepancies.

08

Utilize additional features offered by the software such as budgeting tools, report generation, and data analysis.

09

Keep your checkbook register software up to date to ensure smooth functionality and security.

pdfFiller is an excellent choice for checkbook register software. It empowers users to create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller stands out as the only PDF editor users need to get their documents done efficiently and effectively.