What is form 940 instructions?

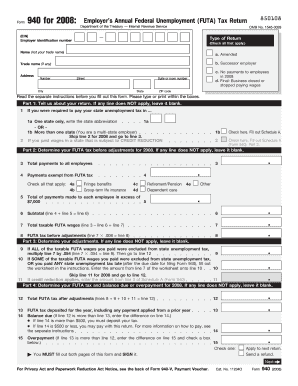

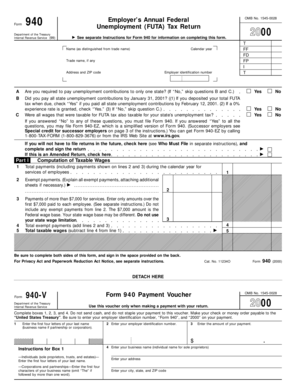

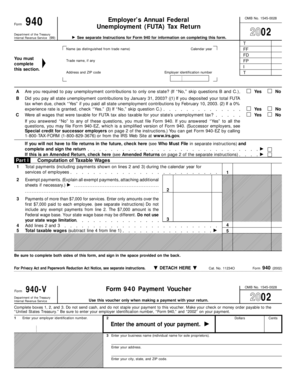

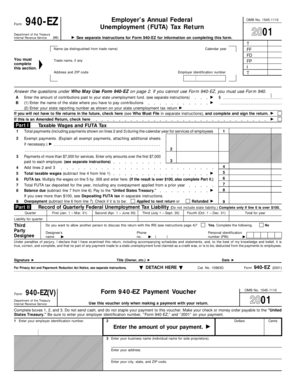

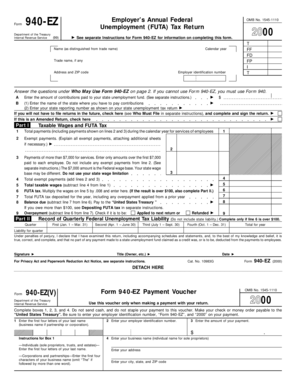

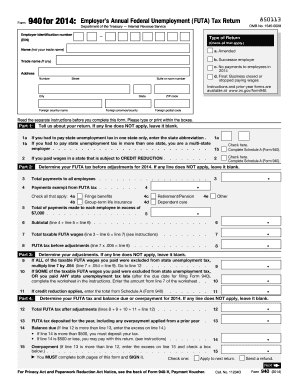

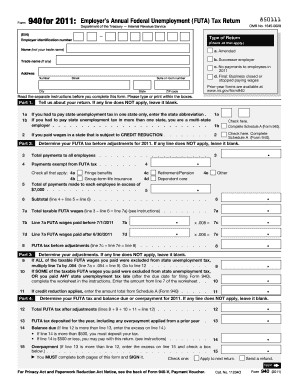

Form 940 instructions are guidelines provided by the Internal Revenue Service (IRS) that help employers understand and complete Form 940, also known as the Employer's Annual Federal Unemployment (FUTA) Tax Return. Form 940 is used to report and pay annual federal unemployment taxes on wages paid to employees.

What are the types of form 940 instructions?

There are several types of form 940 instructions that may vary depending on the specific tax year. Some common types of form 940 instructions include:

General instructions for Form 940 that provide an overview of the form and its purpose.

Specific instructions for each line on Form 940, explaining how to fill in the required information accurately.

Instructions for special situations or exemptions that employers may qualify for, such as agricultural employers or household employers.

Guidance on how to calculate and report federal unemployment tax liabilities and credits.

How to complete form 940 instructions

Completing form 940 instructions may seem daunting at first, but with the right guidance, it can be a straightforward process. Here are the steps to complete form 940 instructions:

01

Gather all necessary information, including your employer identification number (EIN), total payments made to employees, and any exempt payments or credits.

02

Carefully review the form and its instructions to understand the requirements for each line.

03

Enter the appropriate figures and information in each section of the form, ensuring accuracy and completeness.

04

Calculate your federal unemployment tax liability based on the provided formula or using the IRS tax rate table.

05

Double-check all the entered information and calculations for any errors or omissions.

06

Sign and date the form, and include any necessary attachments or schedules as instructed.

07

Submit the completed form and payment to the IRS by the specified deadline.

With pdfFiller, completing form 940 instructions becomes even easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.