Get the free 2011 form 940

Show details

Do not staple Form 940-V or your payment to Form 940 or to each other. Detach Form 940-V and send it with your payment and Form 940 to the address provided in the Instructions for Note. 15 Circular E Employer s Tax Guide for more information about deposits. Caution. Use Form 940-V when making any payment with Form 940. Do not send Form 940 to this address. Instead see Where Do You File in the Instructions for Form 940. See When Must You Deposit Y...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2011 form 940 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 form 940 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 form 940 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 940 form 2011. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

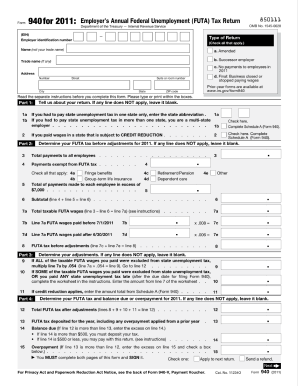

How to fill out 2011 form 940

How to fill out 2011 form 940:

01

Gather all necessary information, including employer identification number (EIN), total wages paid to employees, federal unemployment tax (FUTA) paid, and any adjustments or credits.

02

Fill out Part 1 of the form by providing your business information, such as name, address, and EIN.

03

In Part 2, calculate the total FUTA tax owed by multiplying the taxable wages by the FUTA tax rate. Enter this amount on line 12.

04

If you are eligible for any adjustments or credits, fill out Part 3 accordingly. This may include adjustments for state unemployment taxes or credits for certain hiring practices.

05

Complete Part 4 if your business is a "credit reduction state," which is a state that failed to repay loans from the federal government for unemployment benefits. This may require additional calculations and information.

06

Review the form for accuracy and ensure all required fields are filled. Sign and date the form.

07

Keep a copy of the completed form 940 for your records.

Who needs 2011 form 940:

01

Employers who paid wages of $1,500 or more to employees in any calendar quarter of the year 2011 are required to file form 940.

02

Businesses subject to FUTA taxes, including most employers in the private sector, must also file this form.

03

Form 940 is used to report and pay the employer's share of FUTA taxes, which fund unemployment benefits provided to workers who have lost their jobs.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 940?

Form 940 is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It is used to report and calculate the unemployment tax owed by employers.

Who is required to file form 940?

Employers who paid wages of $1,500 or more to employees during any calendar quarter or had one or more employees for at least some part of a day in any 20 or more different weeks in a calendar year are required to file Form 940.

How to fill out form 940?

To fill out Form 940, you need to provide information about your business, wages paid to employees, and calculate the FUTA tax owed. This includes details such as employer identification number (EIN), total wages paid, taxable wages, and any adjustments or credits applicable. The form can be filled out manually or electronically using tax software or online services.

What is the purpose of form 940?

The purpose of Form 940 is to report and calculate the employer's annual federal unemployment tax liability, which contributes to funding unemployment benefits for workers who have lost their jobs.

What information must be reported on form 940?

Form 940 requires reporting of employer identification number (EIN), business name and address, total wages paid, taxable wages, and any adjustments or credits claimed. It also includes reporting the state unemployment contributions made by the employer.

When is the deadline to file form 940 in 2023?

The deadline to file Form 940 in 2023 is January 31st. However, if all federal unemployment tax liabilities for the year have been deposited on time, employers have until February 10th to file the form.

What is the penalty for the late filing of form 940?

The penalty for late filing of Form 940 is calculated based on the number of days the return is overdue. The penalty rate is generally 5% of the unpaid tax for each month or fraction of a month the return is late, up to a maximum of 25%. There may also be additional penalties for negligence or intentional disregard of filing requirements.

How can I edit 2011 form 940 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 940 form 2011.

How do I fill out 2011 form 940 using my mobile device?

Use the pdfFiller mobile app to complete and sign 940 form 2011 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit 2011 form 940 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 940 form 2011 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your 2011 form 940 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.