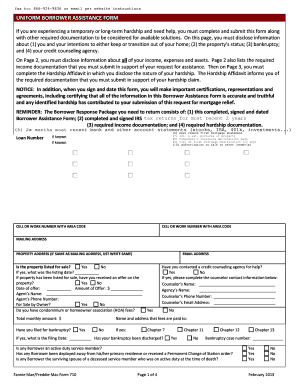

How To Fill Out Uniform Borrower Assistance Form

What is how to fill out uniform borrower assistance form?

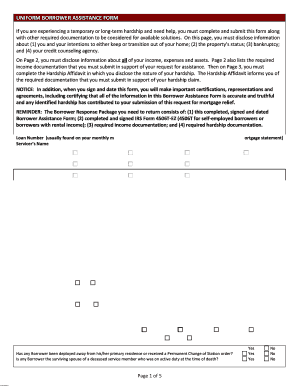

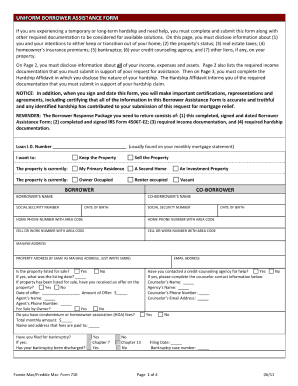

To fill out the uniform borrower assistance form, you will need to provide detailed information about your financial situation and explain why you are seeking assistance. This form helps lenders evaluate your eligibility for various borrower assistance programs and determine the best course of action to help you.

What are the types of how to fill out uniform borrower assistance form?

There are several types of borrower assistance programs available, and the specific form you need to fill out will depend on the program you are applying for. Common types include loan modification, short sale, and deed-in-lieu of foreclosure. Each program has its own requirements and eligibility criteria, so it's important to carefully review the instructions provided with the form.

How to complete how to fill out uniform borrower assistance form

Follow these steps to complete the uniform borrower assistance form:

pdfFiller is a powerful online platform that empowers users to easily create, edit, and share documents, including the uniform borrower assistance form. With unlimited fillable templates and robust editing tools, pdfFiller is the go-to PDF editor for getting your documents done efficiently.