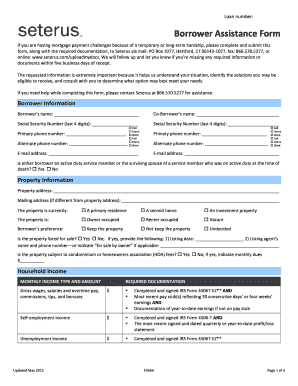

4506 T Form Seterus

What is 4506 t form seterus?

The 4506 t form seterus is a document that allows individuals to request a transcript of their tax return from the Internal Revenue Service (IRS). This form is commonly used by mortgage lenders, banks, and other financial institutions to verify a borrower's income and tax information.

What are the types of 4506 t form seterus?

There are two main types of 4506 t form seterus: the 4506-T and the 4506-T-EZ. The 4506-T is the standard form used to request a transcript of a tax return, while the 4506-T-EZ is a simplified version of the form for individuals who meet certain criteria. Both forms serve the same purpose of providing tax return information to authorized parties.

How to complete 4506 t form seterus

Completing the 4506 t form seterus is a straightforward process. Here are the steps to fill out the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.