Free Mortgage Flyer Word Templates

What are Mortgage Flyer Templates?

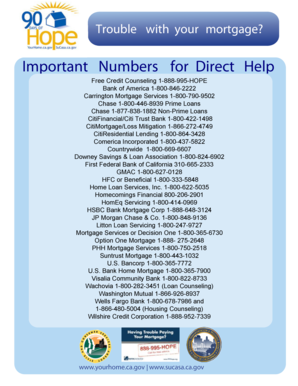

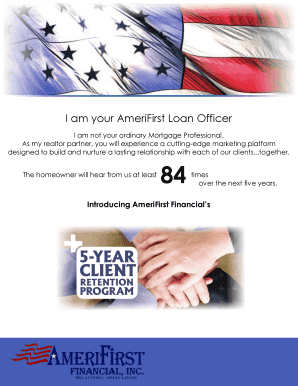

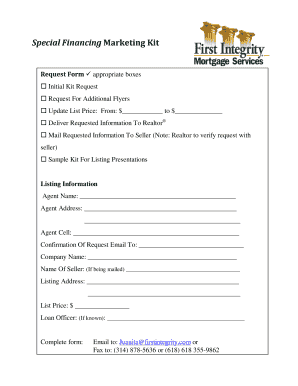

Mortgage flyer templates are pre-designed layouts that individuals or organizations can use to create visually appealing marketing materials for mortgage-related services or properties. These templates usually include placeholders for inserting images, text, contact information, and other relevant details.

What are the types of Mortgage Flyer Templates?

There are various types of mortgage flyer templates available, each catering to different needs and preferences. Some common types include:

How to complete Mortgage Flyer Templates

Completing mortgage flyer templates is a simple and straightforward process that can be done by following these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.