Employee Form

Description of an employee form

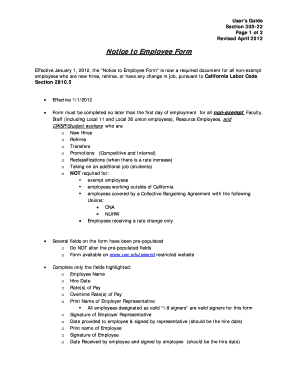

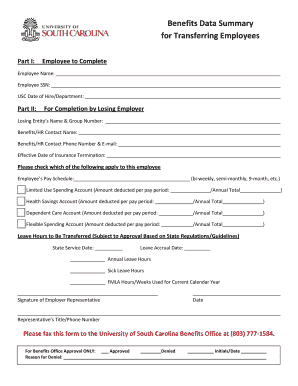

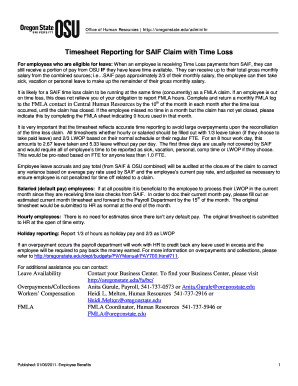

An employee forms are kind of documents which new employees are asked to fill in when are hired or reinstated. Every new employee has to complete such form before getting his/her first paycheck. There are three most frequently used employee forms such as W-4, I-9 and job application form.

How to fill such forms?

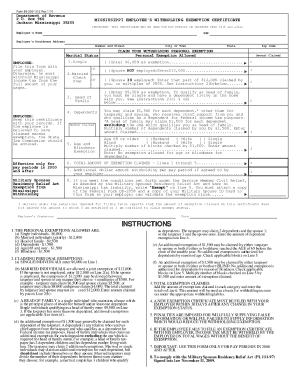

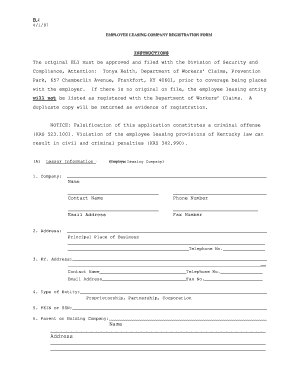

Form W-4 is an employee's withholding allowance certificate which is filled in by an employee in order the correct federal income tax to be deducted from his/her payment. It is filled out before a person receives his/her first pay and contains information about person`s address, marital status, his/her dependants and withholding amounts. Frequency of making changes and additions to a form W-4 depends on employee`s wish.

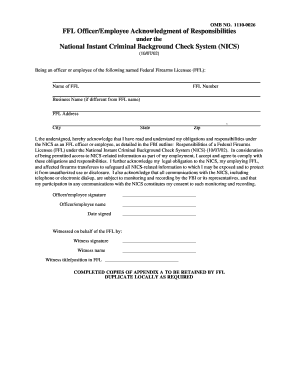

Next document is form I-9 which is a verification of an employee`s eligibility. This kind of a document specifies if a person is empowered to work in U.S. and further is kept in the employer`s record. An employee must provide the evidences of his/her eligibility to work in U.S, and an employer in his/her turn must check if an employment authorization and information provided in a form is true and correct.

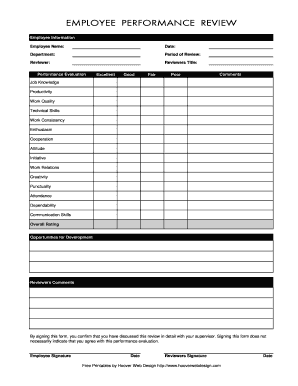

One form that is to be complete by an employee is a job application form, where an individual provides his/her general information, personal data, specifies qualifications and professional/technical skills.

Proper completion of these forms and providing all required documents to an employer will ensure successful employment. A person should follow specified instructions and provide only true and correct information to avoid potential misunderstandings. Download several form templates and choose those you need. For convenience, it is possible to fill out, sign and submit forms online directly to an employer.