What is indemnity form meaning?

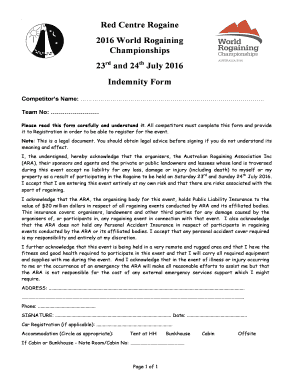

An indemnity form is a legal document that establishes an agreement between two parties, the indemnifier and the indemnitee. It is a form that provides protection against potential losses or liabilities that may arise from a certain event or action. By signing an indemnity form, the indemnifier agrees to compensate or reimburse the indemnitee for any damages, losses, or expenses incurred as a result of the specified event or action.

What are the types of indemnity form meaning?

There are several types of indemnity forms that can be used in different situations. Some common types include:

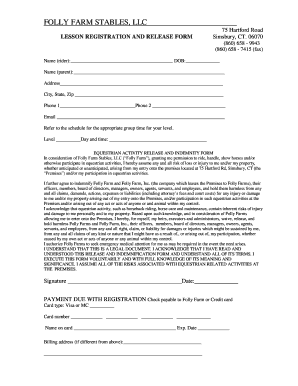

Contractual Indemnities: These are forms used in contracts to allocate the responsibility of potential losses or liabilities to one party.

Professional Indemnity: These forms are often used in professions where the risk of errors or damages is high, such as medical practitioners, architects, or engineers.

Hold Harmless Agreement: This is a type of indemnity form used when one party agrees to assume the potential risks and liabilities of another party.

Product Liability Indemnity: These forms are used in situations where a product manufacturer or seller agrees to compensate any damages or injuries caused by their product.

How to complete indemnity form meaning?

Completing an indemnity form is a straightforward process. Here are the steps you can follow:

01

Obtain the correct indemnity form. Make sure you have the specific form applicable to your situation.

02

Read the form carefully and understand the terms and conditions.

03

Provide accurate and complete information requested in the form, such as names, addresses, and dates.

04

Review the completed form for any errors or missing information.

05

Sign the form and have all relevant parties sign if required.

06

Keep a copy of the completed form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.