Sample Letter Of Indemnity Agreement

What is a sample letter of indemnity agreement?

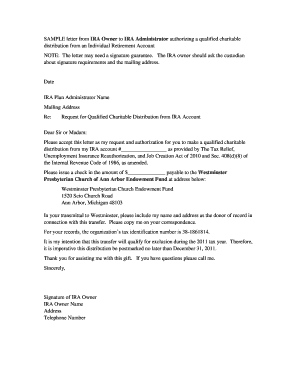

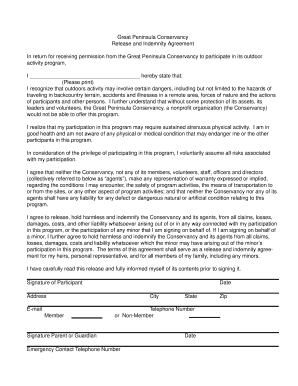

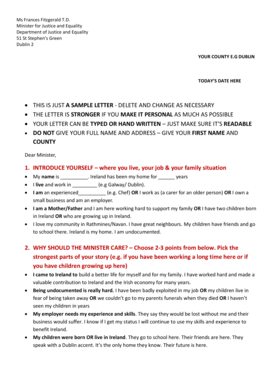

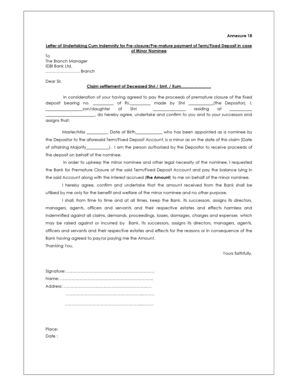

A sample letter of indemnity agreement is a legal document that outlines the responsibilities and liabilities of parties involved in a particular business transaction or activity. It serves as a guarantee or insurance against any potential losses or damages that may occur during the course of the transaction. This agreement ensures that one party will compensate the other party in case of any financial or legal repercussions.

What are the types of sample letter of indemnity agreement?

There are several types of sample letter of indemnity agreements, including: 1. General indemnity agreement: This type of agreement provides broad protection and coverage for all potential risks and liabilities. 2. Specific indemnity agreement: As the name suggests, this agreement focuses on specific risks and liabilities related to a particular transaction or activity. 3. Limited indemnity agreement: This agreement limits the indemnity obligation to a specific amount or certain types of losses or damages.

How to complete a sample letter of indemnity agreement?

Completing a sample letter of indemnity agreement involves the following steps: 1. Start with the header: Include the names and contact information of all parties involved in the agreement. 2. Define the terms: Clearly state the purpose, scope, and duration of the agreement. 3. Outline indemnity obligations: Specify the responsibilities and liabilities of each party involved. 4. Include any limitations or exclusions: Define any restrictions or limitations to the indemnity obligation. 5. Include signatures: All parties should sign and date the agreement to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.