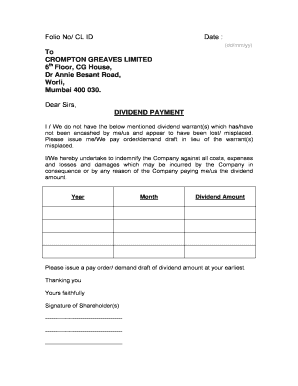

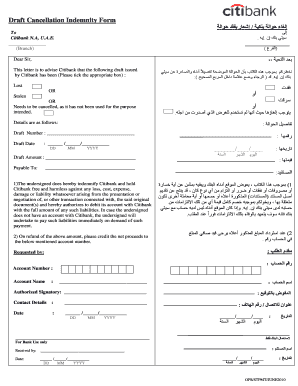

Standard Form Letter Of Indemnity

What is standard form letter of indemnity?

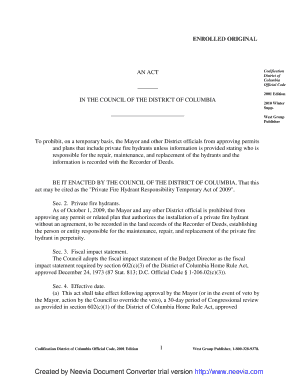

A standard form letter of indemnity is a legal document that provides protection to one party in case of any damages or losses incurred by another party. It is commonly used in various business transactions and contracts to allocate risk and protect against potential claims or liabilities.

What are the types of standard form letter of indemnity?

There are several types of standard form letter of indemnity, including:

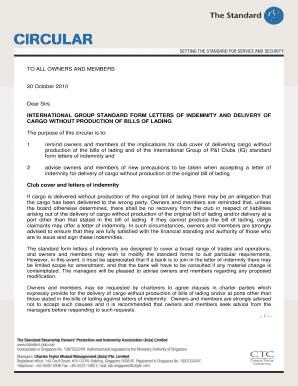

Cargo Letter of Indemnity: This type of indemnity is used in international shipping to protect the carrier against any potential claims or damages related to the transportation of cargo.

Bill of Lading Letter of Indemnity: This type of indemnity is used in maritime shipping to protect the carrier against any claims or damages arising from the issuance of incorrect or lost bills of lading.

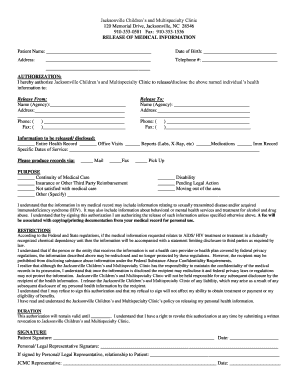

Release and Indemnity Letter: This type of indemnity is used in various business transactions to release one party from any claims, damages, or liabilities that may arise from the transaction.

Contractor Indemnity Letter: This type of indemnity is used in construction projects to indemnify the contractor against any claims, damages, or losses that may occur during the execution of the project.

How to complete standard form letter of indemnity

Completing a standard form letter of indemnity requires attention to detail and adherence to the following steps:

01

Begin by understanding the purpose and terms of the indemnity.

02

Identify the parties involved and clearly state their roles and responsibilities.

03

Provide a detailed description of the potential risks or claims that the indemnity covers.

04

Specify the amount or limit of indemnification.

05

Include any additional terms or conditions that both parties agree upon.

06

Review and revise the letter of indemnity to ensure accuracy and clarity.

07

Sign and date the letter of indemnity to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out standard form letter of indemnity

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is an example of indemnity?

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

How do I write a Letter of indemnity?

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

What is Letter of Letter of indemnity?

A Letter of Indemnity (LOI) is a legally binding document that guarantees that certain conditions will be met in an agreement between two parties.

What does indemnity mean in simple terms?

Put simply, indemnity is a contractual agreement between two parties, where one party agrees to pay for potential losses or damages claimed by a third party.

What are the three 3 methods of indemnity?

There are 3 levels of indemnification: broad form, intermediate form, and limited form. This requires the indemnitor to pay not only for its liabilities but also for the indemnitee's liability whether the indemnitee is solely (i.e. 100%) at fault or partially at fault.

How do you fill indemnity?

How to fill a Letter of Indemnity? A letter of indemnity must include the following key details:- The names and addresses of both parties involved. The name and affiliation of the third party. Detailed descriptions of the items being shipped. Signatures of the parties. Date of execution of the contract.

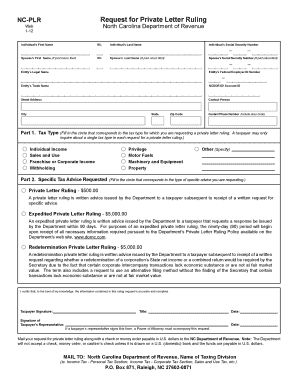

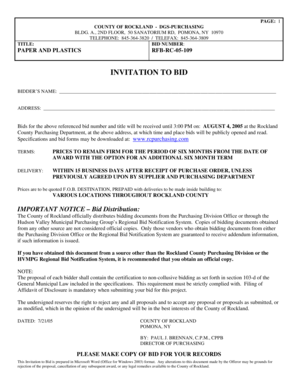

Related templates