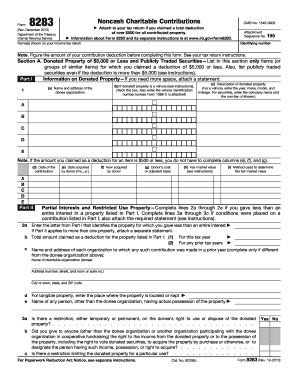

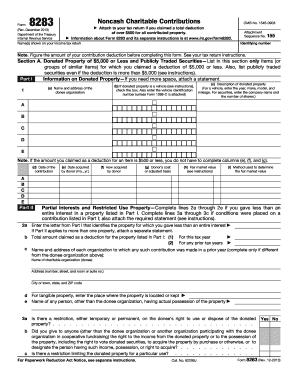

Irs Form 8283

What is Irs Form 8283?

Irs Form 8283 is an official document issued by the Internal Revenue Service (IRS) in the United States. It is used by taxpayers to report noncash charitable contributions and claim deductions for these contributions on their tax returns. This form allows the IRS to track and verify the value of donated property, ensuring that taxpayers are accurately reporting their contributions.

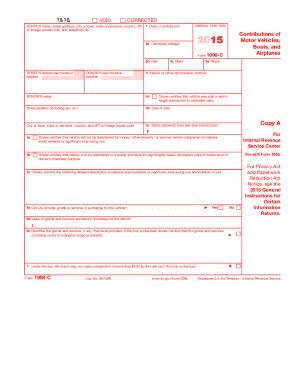

What are the types of Irs Form 8283?

There are two types of Irs Form 8283 based on the value of the donated property:

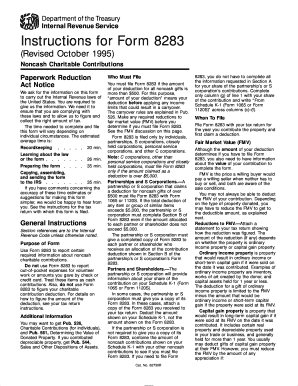

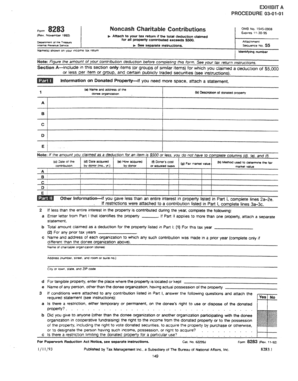

How to complete Irs Form 8283

Completing Irs Form 8283 is a simple process that requires the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.