Loan Calculator House

What is a loan calculator house?

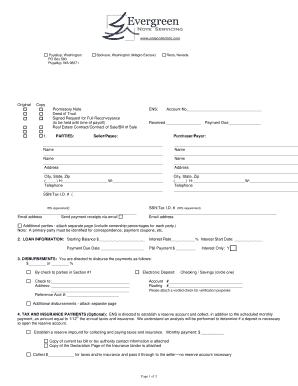

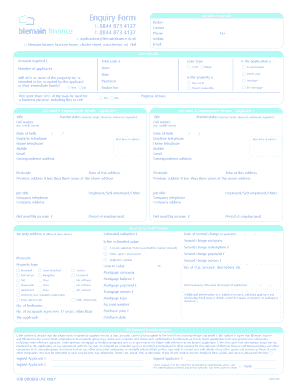

A loan calculator house is a tool that helps individuals estimate the monthly mortgage payments for a house. It takes into account factors such as the loan amount, interest rate, and loan term to provide an accurate calculation of how much a borrower would need to pay each month.

What are the types of loan calculator house?

There are various types of loan calculators available for house financing. Here are some common ones:

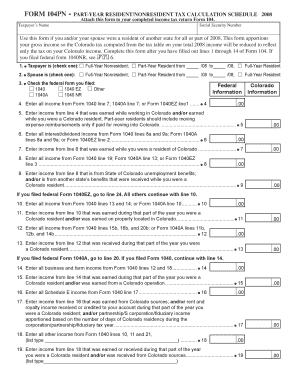

Simple Loan Calculator: This calculator provides basic information on monthly payments, loan term, and interest rates.

Advanced Loan Calculator: This calculator includes additional variables such as property taxes, insurance, and down payments.

Amortization Calculator: This calculator shows the payment schedule over the loan term, including the amount applied towards principal and interest.

Refinance Calculator: This calculator helps determine the potential savings of refinancing an existing mortgage.

How to complete a loan calculator house?

Completing a loan calculator house is a straightforward process. Follow these steps:

01

Enter the loan amount: Input the total amount of money you want to borrow.

02

Specify the interest rate: Provide the annual interest rate for the loan.

03

Set the loan term: Choose the duration of the loan in years or months.

04

Include additional expenses (if applicable): If there are additional costs like property taxes or insurance, enter those.

05

Click 'Calculate' or 'Calculate Payment': The calculator will generate the estimated monthly mortgage payment based on the provided inputs.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out loan calculator house

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I calculate a loan schedule in Excel?

Loan Amortization Schedule Use the PPMT function to calculate the principal part of the payment. Use the IPMT function to calculate the interest part of the payment. Update the balance. Select the range A7:E7 (first payment) and drag it down one row. Select the range A8:E8 (second payment) and drag it down to row 30.

Does Excel have a loan amortization schedule?

Microsoft's Excel loan amortization schedule As you can see, it has a few boxes to enter the loan information, such as loan amount and interest rate. Then it contains an amortization table with information about each monthly payment. It also helps you see how many of your dollars are going to principal vs. interest.

How do I create a loan schedule in Excel?

How to make a loan amortization schedule with extra payments in Excel Define input cells. As usual, begin with setting up the input cells. Calculate a scheduled payment. Set up the amortization table. Build formulas for amortization schedule with extra payments. Hide extra periods. Make a loan summary.

How do you calculate a loan payment schedule?

How to Calculate Amortization of Loans. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 3%, then your monthly interest rate will be 0.25% (0.03 annual interest rate ÷ 12 months). You'll also multiply the number of years in your loan term by 12.

How do I open a loan sheet in Excel?

0:05 5:21 Loan Amortization Calculator (Installed Excel Template) - YouTube YouTube Start of suggested clip End of suggested clip I'm gonna load up Microsoft Excel 2007 go to the menu new and under install templates I'm going toMoreI'm gonna load up Microsoft Excel 2007 go to the menu new and under install templates I'm going to load up the loan amortization schedule hit enter you can call this a calculator or schedule.

How do I calculate a scheduled payment in Excel?

In Excel, the PMT (rate, nper, pv, [fv], [type]) function is used to calculate the payment amount. For consistency in payment frequencies, you should be consistent with the values supplied for the rate and nper arguments: Rate - It is the interest rate per period for the loan.

Related templates