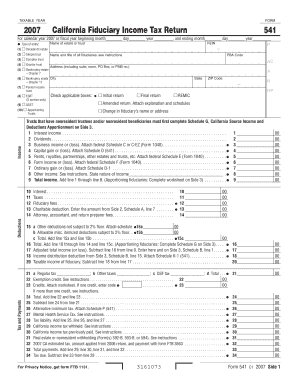

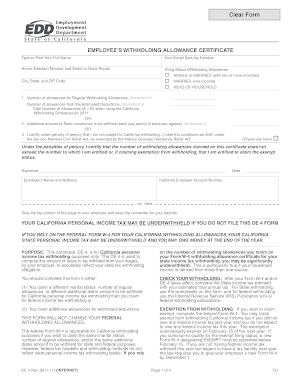

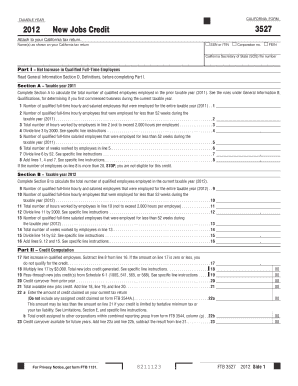

Income Tax Calculator California

What is income tax calculator california?

An income tax calculator california is a tool that helps individuals in California determine the amount of income tax they owe based on their income and other relevant factors. It takes into account various tax brackets, deductions, and credits to provide an accurate estimate of one's tax liability for the state of California.

What are the types of income tax calculator california?

There are several types of income tax calculators available for California residents. Some common types include:

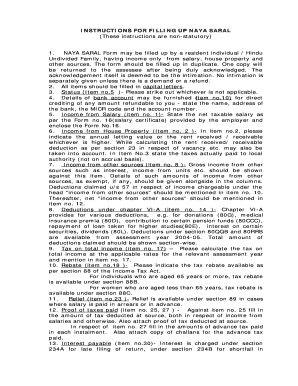

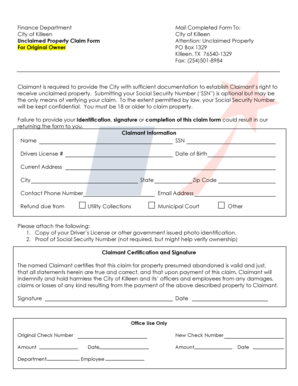

How to complete income tax calculator california

Completing an income tax calculator for California is a straightforward process. Here are the steps to follow:

By using pdfFiller's income tax calculator, you can easily complete and calculate your California income tax. pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. With pdfFiller, you have everything you need to accurately determine your income tax liability for California.