Paycheck Tax Calculator

What is paycheck tax calculator?

A paycheck tax calculator is a tool used to estimate the amount of taxes that will be deducted from an individual's paycheck. It takes into account factors such as the individual's income, filing status, and any deductions or credits they may be eligible for. By inputting this information into the calculator, users can get an idea of how much their net pay will be after taxes.

What are the types of paycheck tax calculator?

There are several types of paycheck tax calculators available, including:

Online paycheck tax calculator: These calculators are accessible through websites and can be used to quickly estimate taxes.

Payroll software calculators: Many payroll software programs have built-in tax calculators to help employers accurately calculate withholding taxes for their employees.

Spreadsheets: Some individuals prefer to use spreadsheet software, such as Microsoft Excel, to create their own customized paycheck tax calculators.

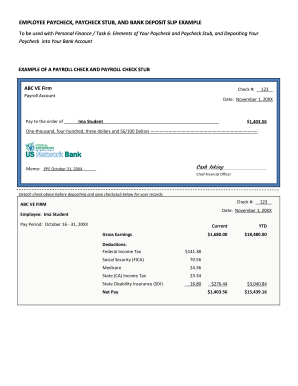

How to complete paycheck tax calculator

Completing a paycheck tax calculator is a straightforward process. Follow these steps:

01

Gather your financial information, such as your income and any deductions or credits you may have.

02

Enter the required information into the paycheck tax calculator. This may include your filing status, income amount, and any other relevant details.

03

Review the results provided by the calculator. This will give you an estimate of your net pay after taxes.

04

Make any necessary adjustments or changes to optimize your tax withholding.

05

Repeat the process periodically to ensure that your paycheck tax withholding remains accurate throughout the year.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out paycheck tax calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I use Excel to calculate my paycheck?

To calculate the gross earnings of an employee during a certain pay period, multiply the cell with the number of hours worked, by the cell with the rate of pay, using the format =(A1)*(B1).

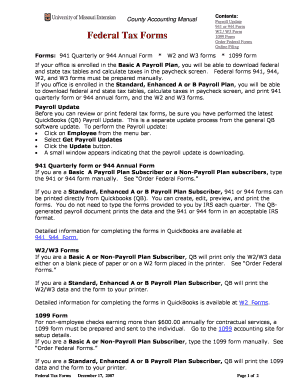

How do I calculate taxes from my paycheck?

How do I calculate taxes from paycheck? Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W-4. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

How do I calculate my paycheck manually?

0:15 2:15 How to Calculate a Paycheck for Your Employees - YouTube YouTube Start of suggested clip End of suggested clip So start out with gross. Pay subtract any pre-tax deductions subtract any employee taxes subtractMoreSo start out with gross. Pay subtract any pre-tax deductions subtract any employee taxes subtract out post tax deduction.

Related templates