2016 Income Tax Calculator

What is 2016 income tax calculator?

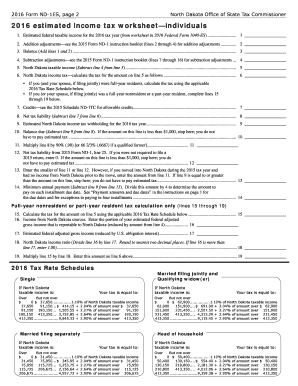

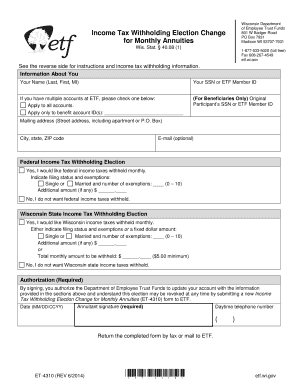

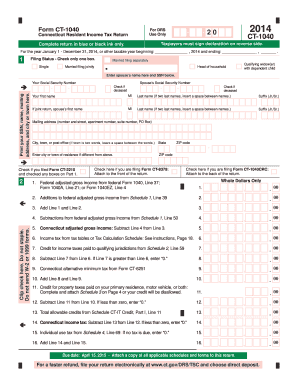

The 2016 income tax calculator is a tool used to determine the amount of tax an individual or business owes to the government for the year 2016. It takes into account various factors such as income, deductions, credits, and other relevant information to calculate the tax liability.

What are the types of 2016 income tax calculator?

There are several types of 2016 income tax calculators available:

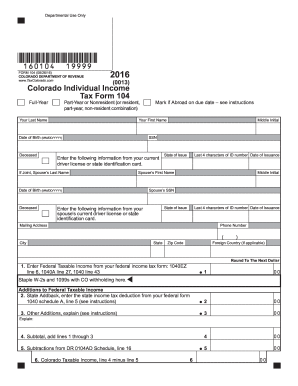

Individual Income Tax Calculator: This type of calculator is used by individuals to calculate their personal income tax.

Business Income Tax Calculator: This calculator is specifically designed for businesses to calculate their income tax liability.

Self-Employment Income Tax Calculator: Self-employed individuals can use this calculator to determine their income tax obligations.

Capital Gains Tax Calculator: This calculator helps individuals calculate the tax on their capital gains.

How to complete 2016 income tax calculator

Completing the 2016 income tax calculator is a simple process. Here are the steps to follow:

01

Gather all necessary financial documents and information, such as W-2 forms, 1099s, and receipts for deductions.

02

Input your income information into the calculator. This includes wages, salaries, and any other sources of income.

03

Enter deductions and credits that you qualify for, such as mortgage interest, student loan interest, and child tax credits.

04

Review the calculated tax liability and ensure accuracy.

05

File your tax return based on the information provided by the calculator.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2016 income tax calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I calculate my taxes for 2016?

Order a Transcript Online Using Get Transcript. They can use Get Transcript Online on IRS.gov to view, print or download a copy of all transcript types. By phone. The number is 800-908-9946. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail.

How do you calculate tax on a calculator?

Find out the net price of a product. Let's use 45 . Multiply your net price by 4%, so by 0.04 , to find out the tax amount: 45 * 0.04 = 1.8 . Add the tax amount to the net price to find out the gross price: 45 + 1.8 = 46.8 .

Can I do 2016 taxes online?

Online Tax Filing FAQs You can submit your tax return online for 2017 to 2020. For 2016 and before, you can prepare your tax return online, download a pdf copy and mail it to CRA. Visit prior-years-tax-filing link.

Related templates