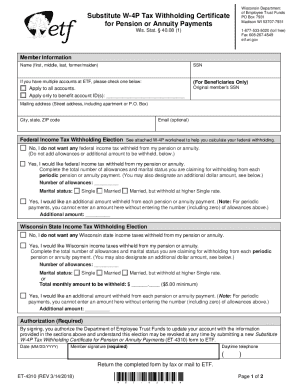

WI ETF ET-4310 2014 free printable template

Show details

1 Jun 2016 ... Yes, I would like Wisconsin income taxes withheld from my pension or annuity. ... etf.wi.gov/calculator.htm, a free tool to help calculate.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI ETF ET-4310

Edit your WI ETF ET-4310 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI ETF ET-4310 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI ETF ET-4310 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit WI ETF ET-4310. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI ETF ET-4310 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI ETF ET-4310

How to fill out WI ETF ET-4310

01

Begin by downloading the WI ETF ET-4310 form from the official website.

02

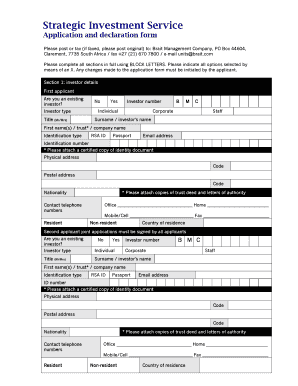

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Indicate your filing status by selecting the appropriate checkbox.

04

Provide details regarding your employment history for the relevant year.

05

Report your income and any tax withholdings accurately.

06

Fill out any additional sections required, such as deductions or credits.

07

Review the form for accuracy and completeness before submitting.

08

Submit the form either electronically or by mail, according to the instructions provided.

Who needs WI ETF ET-4310?

01

Individuals who have received unemployment benefits in Wisconsin.

02

Taxpayers who need to report income from the Wisconsin Employment Trust Fund.

03

Those claiming credits or deductions related to employment benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is a w4r?

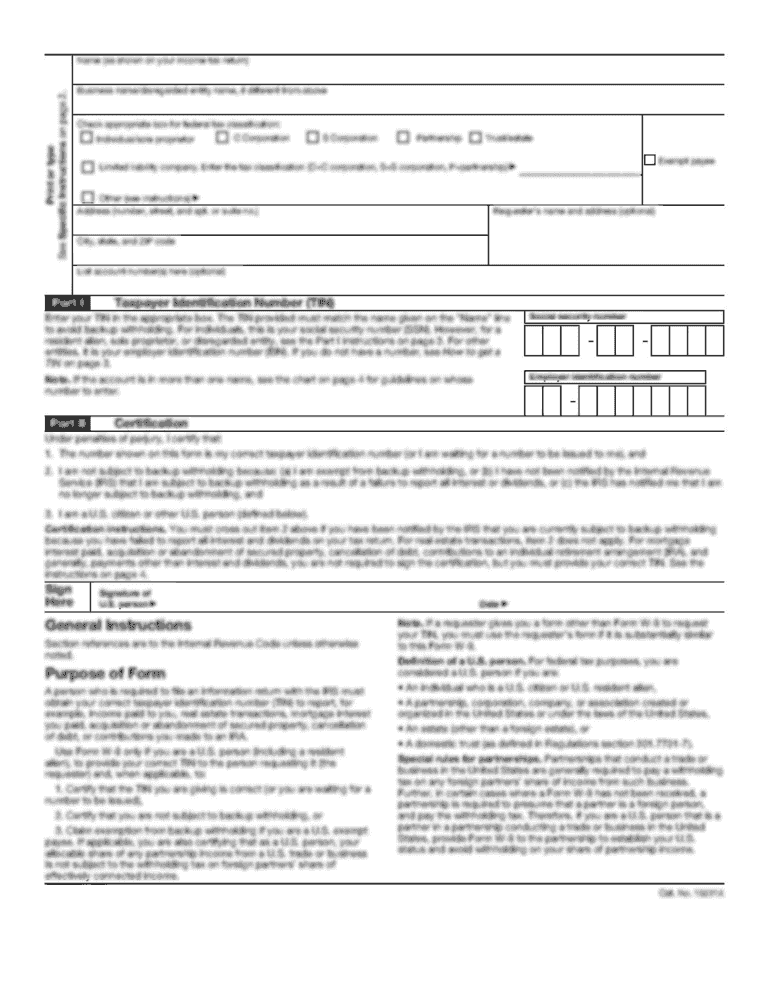

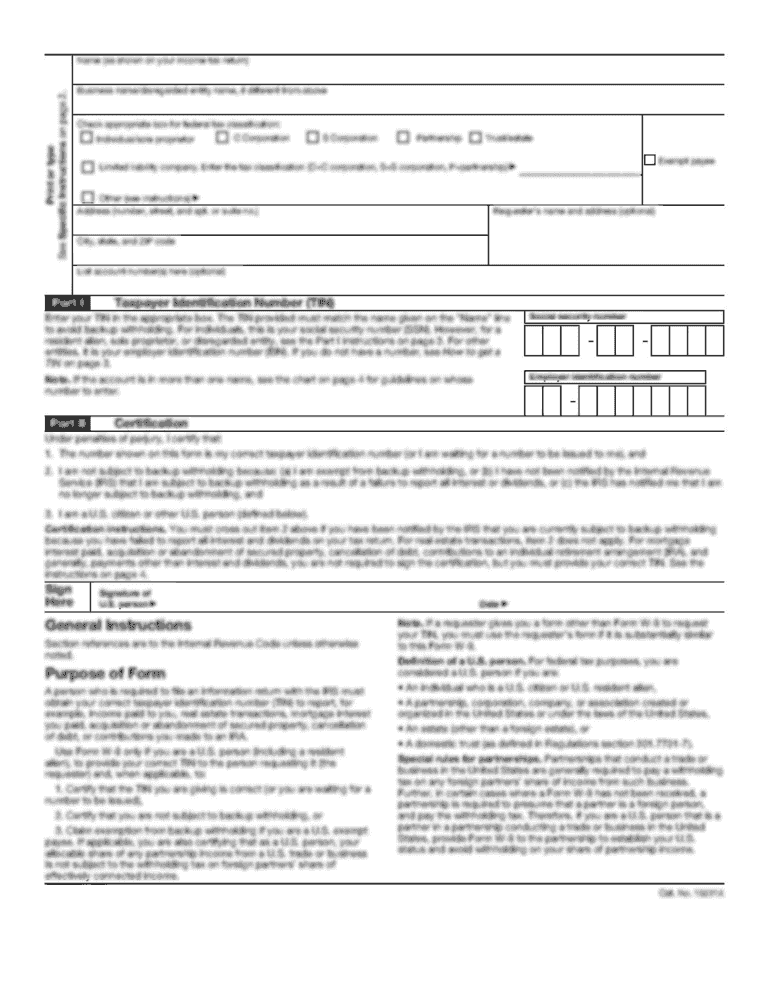

What is Form W-4R? Form W-4R (Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions) is an IRS tax withholding form to withhold the correct amount of federal income tax from nonperiodic payments or eligible rollover distribution from a retirement plan.

What is a W 4P form?

In January 2022, the Internal Revenue Service (IRS) released a new 2022 Form W-4P – Withholding Certificate for Periodic Pension or Annuity Payments and a new 2022 Form W-4R – Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions.

What is a withholding certificate for pension or annuity payments?

Form W‐4P is for U.S. citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Use Form W‐4P to tell payers the correct amount of federal income tax to withhold from your payment(s).

What do you put on a withholding exemption certificate?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax.

What are the withholding requirements for pension distributions?

Unless you've instructed us (on Form W-4R) not to withhold taxes, the IRS requires us to withhold at least 10% of withdrawals from qualified plans. If your withdrawals are delivered outside the U.S. and its possessions, we're required to withhold 10% federal income tax.

What is an IRS withholding certificate?

Form W-4 Employee's Withholding Allowance Certificate Complete Form W-4, Employee's Withholding Allowance Certificate, so that your employer can withhold the correct federal income tax from your pay. Nonresident alien individuals are subject to special instructions for completing the Form W-4.

What is the tax withholding on pension payments?

A mandatory 20% federal tax withholding rate is applied to certain lump-sum paid benefits, such as the Basic Death Benefit, Retired Death Benefit, Option 1 balance, and Temporary Annuity balance. Certain lump-sum benefits are eligible to be rolled over to an IRA to avoid the 20% federal tax withholding.

What is the withholding certificate for pension or annuity payments?

Form W‐4P is for U.S. citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Use Form W‐4P to tell payers the correct amount of federal income tax to withhold from your payment(s).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify WI ETF ET-4310 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your WI ETF ET-4310 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I get WI ETF ET-4310?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific WI ETF ET-4310 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit WI ETF ET-4310 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share WI ETF ET-4310 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is WI ETF ET-4310?

WI ETF ET-4310 is a form used by employers in Wisconsin to report employee wages and contributions to the state's unemployment insurance and employee trust funds.

Who is required to file WI ETF ET-4310?

Employers who have employees in Wisconsin and are subject to reporting wages and contributions to the state's unemployment and employee trust funds are required to file WI ETF ET-4310.

How to fill out WI ETF ET-4310?

To fill out WI ETF ET-4310, employers need to provide information such as their business name, identification number, total wages paid, and the contributions attributable to each employee. The form must be completed accurately and submitted to the Wisconsin Department of Workforce Development.

What is the purpose of WI ETF ET-4310?

The purpose of WI ETF ET-4310 is to ensure that employers report their employees' wages and corresponding contributions to unemployment insurance and employee trust funds, helping to maintain accurate records for state benefits.

What information must be reported on WI ETF ET-4310?

The information that must be reported on WI ETF ET-4310 includes the employer's identification details, the total wages paid to employees, the amount of contributions to be made for unemployment insurance, and details for each employee, including their wages and contributions.

Fill out your WI ETF ET-4310 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI ETF ET-4310 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.