What is federal tax calculator 2016?

A federal tax calculator for the year 2016 is a tool that helps individuals and businesses calculate the amount of federal taxes they owe for that specific year. It takes into account various factors such as income, deductions, and credits to determine the tax liability.

What are the types of federal tax calculator 2016?

There are several types of federal tax calculators available for the year 2016. These calculators cater to different needs and circumstances. Some of the common types include:

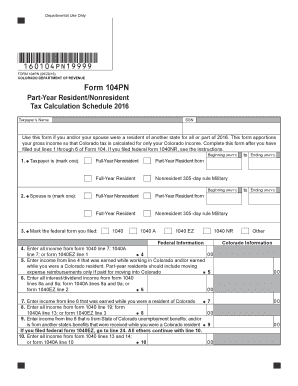

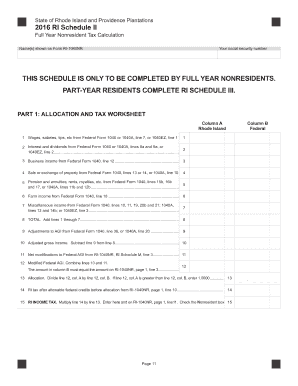

Individual income tax calculator: This calculator is designed for individuals to calculate their income tax liability based on their income, deductions, and credits.

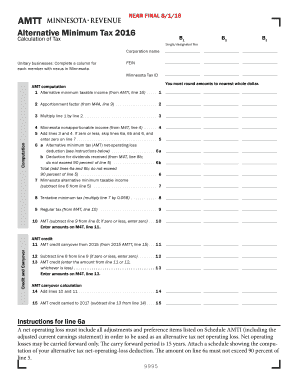

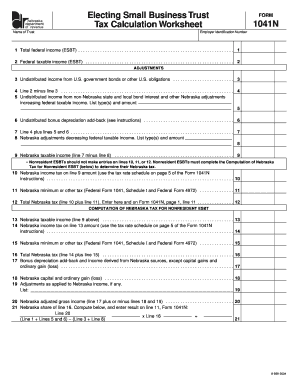

Business tax calculator: This calculator is specifically designed for businesses to calculate their federal tax liability based on their business income, expenses, and deductions.

Self-employed tax calculator: This calculator is tailored for self-employed individuals to determine their federal tax liability considering their self-employment income and deductions.

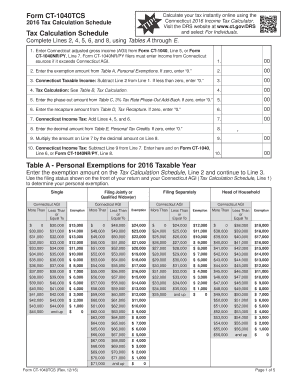

How to complete federal tax calculator 2016

Completing a federal tax calculator for the year 2016 is a straightforward process. Here are the steps:

01

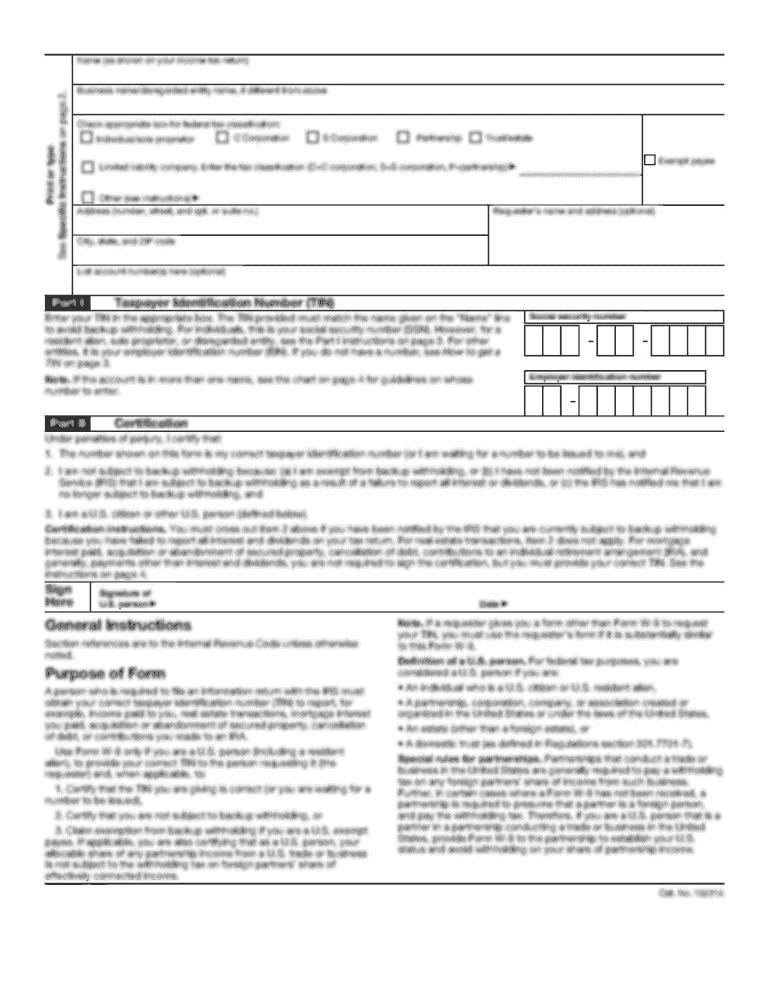

Gather necessary information: Collect all relevant financial documents such as W-2 forms, 1099 forms, receipts, and records of deductions and credits.

02

Enter income details: Provide accurate information regarding your income from various sources, including wages, dividends, interest, and capital gains.

03

Include deductions and credits: Enter the details of deductions and credits you are eligible for, such as mortgage interest, student loan interest, childcare expenses, and educational credits.

04

Review and calculate: Review all the provided information and ensure its accuracy. Click the calculate button to determine your federal tax liability.

05

Get your results: Once the calculation is complete, the federal tax calculator will display your estimated tax liability. Use this information to plan your finances and meet your tax obligations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.