Loan Calculator Mortgage

What is loan calculator mortgage?

A loan calculator mortgage is a helpful tool that allows you to estimate the monthly mortgage payments for a specific loan amount, interest rate, and term. By inputting these details into the loan calculator, you can quickly determine how much you can afford to borrow and what your monthly payments would be.

What are the types of loan calculator mortgage?

There are various types of loan calculator mortgage available to borrowers. These include:

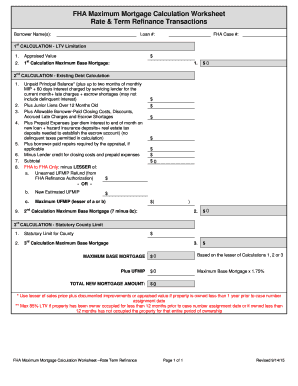

Basic loan calculator: This type of calculator helps you estimate the monthly mortgage payments based on the loan amount, interest rate, and term.

Advanced loan calculator: This calculator provides more detailed information, such as the total interest paid over the loan term and the principal balance over time.

Amortization schedule calculator: This calculator generates an amortization schedule, which shows how your monthly payments are divided between principal and interest over the term of the loan.

How to complete loan calculator mortgage

Completing a loan calculator mortgage is a simple process. Follow the steps below:

01

Enter the loan amount: Input the total amount you wish to borrow.

02

Provide the interest rate: Enter the annual interest rate for the loan.

03

Set the loan term: Specify the duration of the loan in years.

04

Click on 'Calculate' or 'Calculate Mortgage' button: The loan calculator will instantly display the estimated monthly mortgage payments.

With pdfFiller, users are empowered to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out loan calculator mortgage

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a loan sheet in Excel?

How to make a loan amortization schedule with extra payments in Excel Define input cells. As usual, begin with setting up the input cells. Calculate a scheduled payment. Set up the amortization table. Build formulas for amortization schedule with extra payments. Hide extra periods. Make a loan summary.

Is there a mortgage function in Excel?

PMT, one of the financial functions, calculates the payment for a loan based on constant payments and a constant interest rate. Use the Excel Formula Coach to figure out a monthly loan payment.

How do I set up a mortgage calculator in Excel?

0:21 3:47 How to Create a Mortgage Calculator With Microsoft Excel - YouTube YouTube Start of suggested clip End of suggested clip Open microsoft excel let's give a heading name click in a cell and type mortgage calculator in theMoreOpen microsoft excel let's give a heading name click in a cell and type mortgage calculator in the next row type loan amount. And then in the next row type annual.

How do I manually calculate mortgage payments in Excel?

3:55 7:23 How to make a Fixed Rate Loan/Mortgage Calculator in Excel YouTube Start of suggested clip End of suggested clip Well right above. So to calculate the payments. We want to do equals. PMT open parenthesis the rateMoreWell right above. So to calculate the payments. We want to do equals. PMT open parenthesis the rate and what you want for the rate is the monthly. Rate. So right there comma. The number of periods.

What is the formula for a mortgage calculator?

These factors include the total amount you're borrowing from a bank, the interest rate for the loan, and the amount of time you have to pay back your mortgage in full. For your mortgage calc, you'll use the following equation: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1].

Does Excel have a mortgage function?

PMT, one of the financial functions, calculates the payment for a loan based on constant payments and a constant interest rate. Use the Excel Formula Coach to figure out a monthly loan payment.

Related templates