Loan Calculator

What is a Loan Calculator?

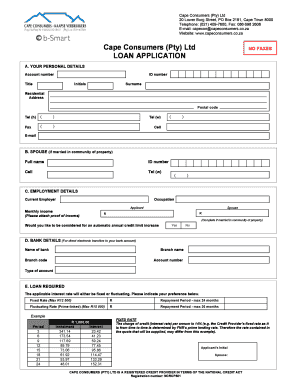

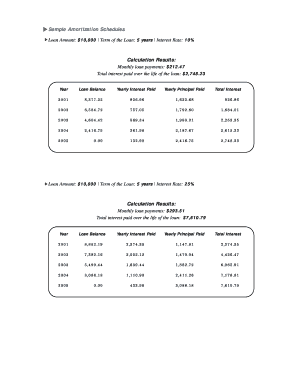

A Loan Calculator is a tool that allows users to calculate the monthly payment amount and total interest cost of a loan based on the loan amount, interest rate, and repayment term. It helps users determine how much they can afford to borrow and plan their loan repayment.

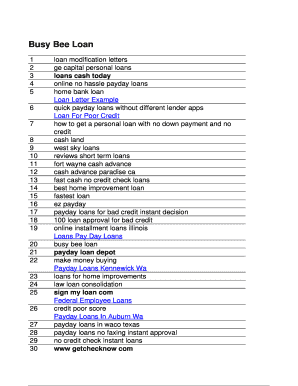

What are the types of Loan Calculator?

There are different types of Loan Calculators available to suit the specific needs of borrowers. Some common types include:

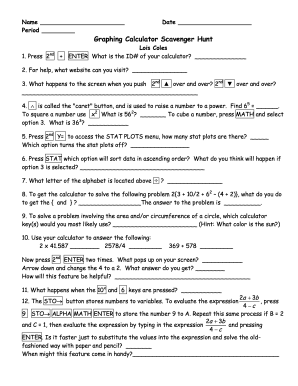

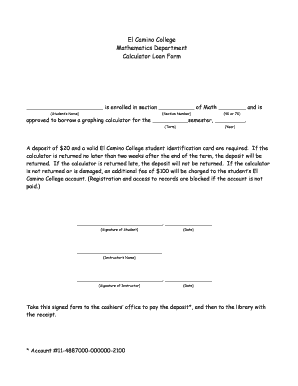

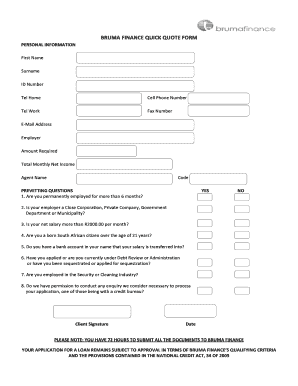

How to complete Loan Calculator

Completing a Loan Calculator is easy and straightforward. Here are the steps to follow:

With pdfFiller, completing a Loan Calculator is even simpler. You can use pdfFiller's unlimited fillable templates and powerful editing tools to easily input the loan details and calculate the payment amount. pdfFiller empowers users to create, edit, and share documents online, making it the go-to PDF editor for all your document needs.