Loan Form - Page 2

What is Loan Form?

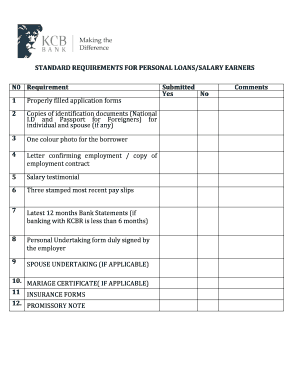

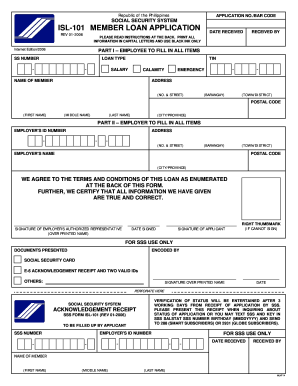

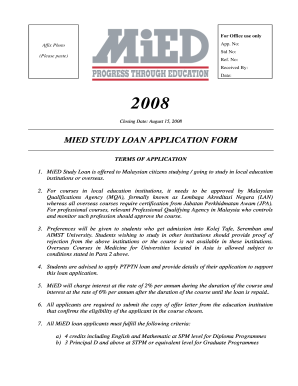

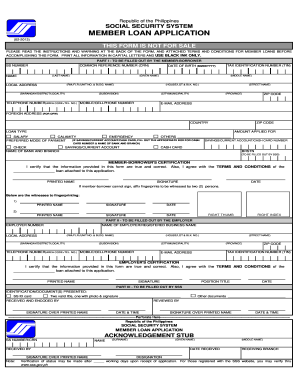

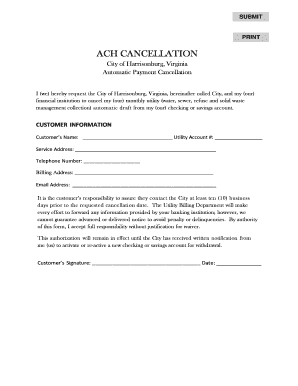

A Loan Form is a document that is used to apply for a loan. It contains all the necessary information required by the lending institution to assess the borrower's creditworthiness and make a decision on whether to grant the loan or not. The Loan Form typically includes personal details, employment information, financial statements, and the purpose of the loan.

What are the types of Loan Form?

There are different types of Loan Forms available depending on the type of loan one is applying for. Some common types of Loan Forms include:

How to complete Loan Form

Completing a Loan Form may seem daunting, but with the right guidance, it can be a smooth process. Here are the steps to complete a Loan Form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.