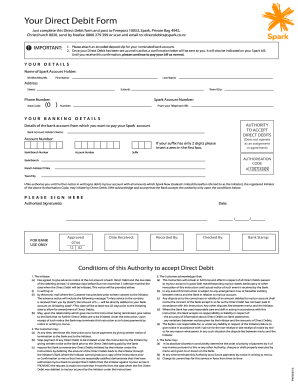

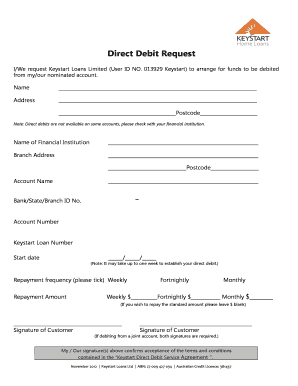

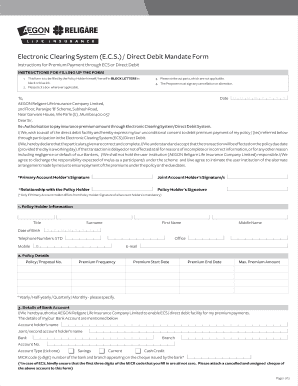

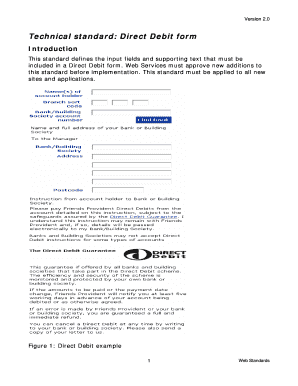

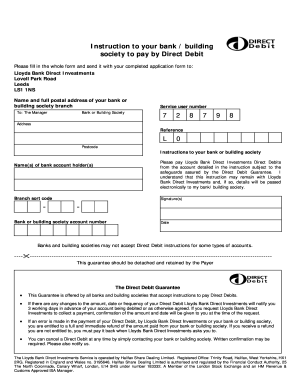

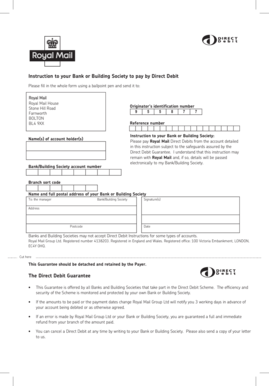

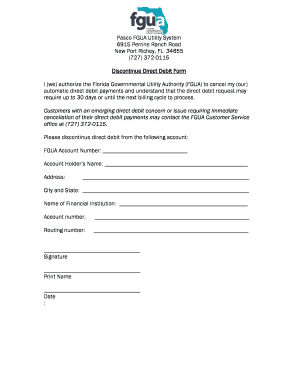

What is Direct Debit Form?

A Direct Debit Form is a legal document that allows individuals or organizations to authorize automatic payments from their bank accounts. It is a convenient and time-saving way to make recurring payments, such as utility bills, mortgage payments, or membership fees. By filling out this form, you give permission to the payee to collect payments directly from your account, eliminating the need for manual transactions or writing checks.

What are the types of Direct Debit Form?

There are several types of Direct Debit Forms, each catering to different purposes. Some common types include:

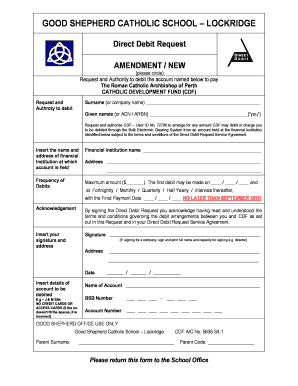

Standard Direct Debit Form: This form is commonly used for regular payments, where the amount and date of payment remain consistent.

Variable Direct Debit Form: This form allows the payee to collect varying amounts from your account on different dates, making it ideal for bills with fluctuating amounts, such as electricity or phone bills.

Fixed Direct Debit Form: This form is suitable for installment payments or loans, where you agree upon a fixed amount to be debited from your account at regular intervals.

Advance Notice Direct Debit Form: With this form, you receive prior notification from the payee about the upcoming debits, enabling you to review and make any necessary changes before the payment is collected.

Pay-as-you-go Direct Debit Form: This form enables you to make one-time payments whenever you require a service or product, giving you more control over your expenses.

How to complete Direct Debit Form

Completing a Direct Debit Form is a straightforward process. Here are the steps you need to follow:

01

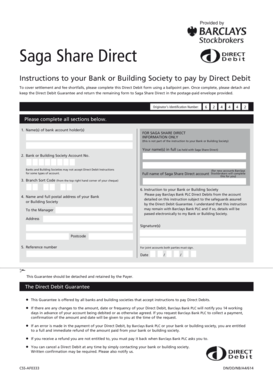

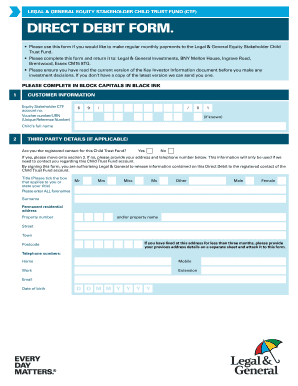

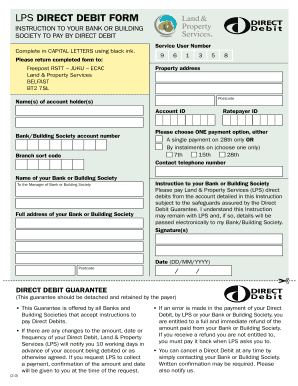

Provide your personal information, including your full name, address, and contact details.

02

Enter your bank account details accurately, including the account number and sort code. It's important to double-check these details to ensure the correct account is debited.

03

Specify the payee's information, such as their name, address, and contact details.

04

Indicate the frequency and amount of the payments. Depending on the type of Direct Debit Form, you may need to specify if the payments are fixed or variable.

05

Sign and date the form to authorize the Direct Debit payments.

06

Retain a copy of the completed form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.