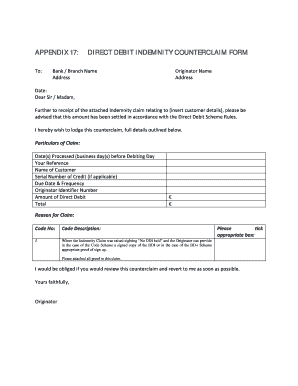

Direct Debit Scheme Rules

What is direct debit scheme rules?

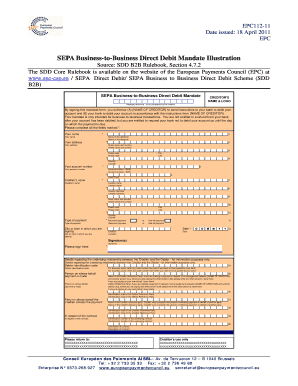

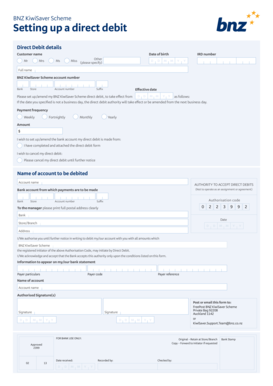

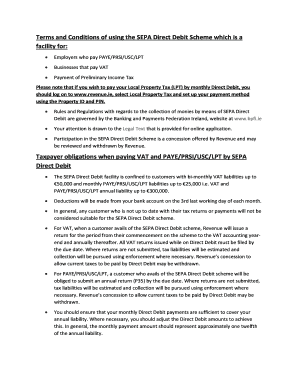

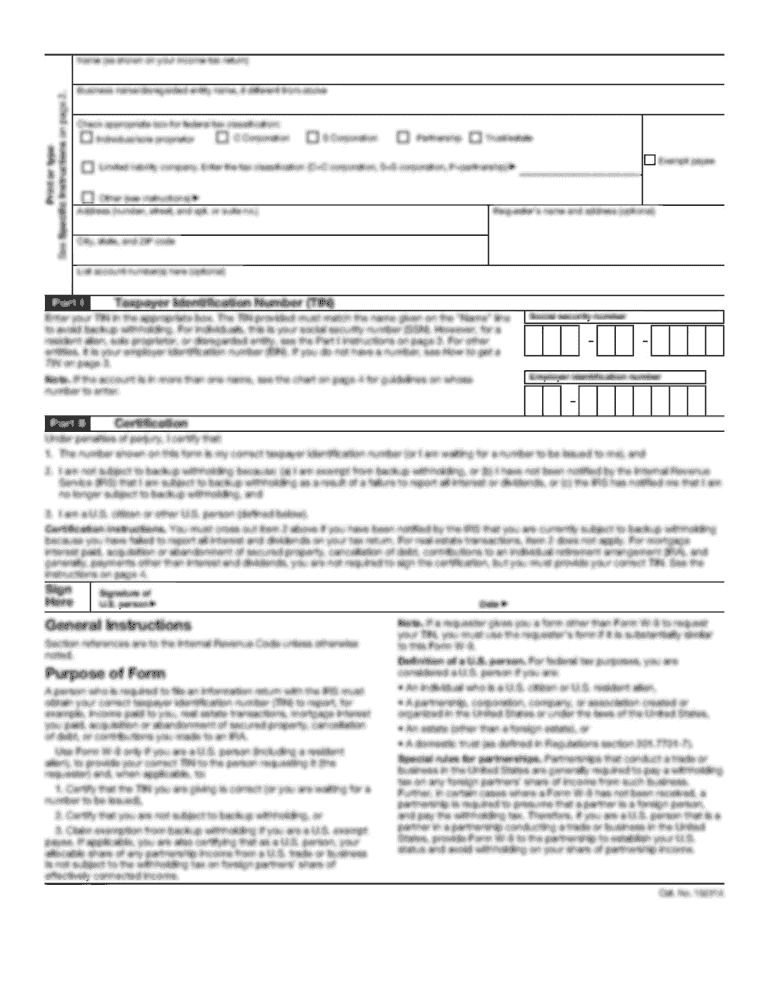

Direct debit scheme rules refer to the guidelines and regulations that govern the process of setting up and managing direct debit transactions. These rules ensure that transactions are carried out securely, efficiently, and in compliance with industry standards.

What are the types of direct debit scheme rules?

There are different types of direct debit scheme rules based on the entities involved and the specific requirements. Some common types of direct debit scheme rules include:

How to complete direct debit scheme rules

Completing direct debit scheme rules involves following a series of steps to ensure compliance and successful implementation. Here is a step-by-step guide to completing direct debit scheme rules:

At pdfFiller, we understand the importance of adhering to direct debit scheme rules. That's why our platform empowers users to create, edit, and share documents online with ease. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to ensure compliance and get your documents done efficiently.