Loan Agreement Between Individuals

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is a loan agreement between friends legally binding?

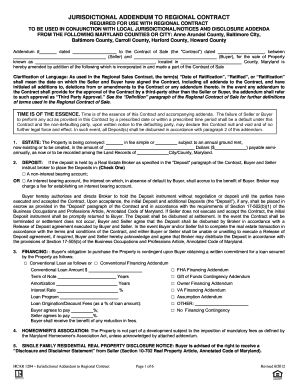

The statute of frauds mandates that certain agreements must be in writing or they are unenforceable. As a result, a handshake agreement with a friend or relative that is not in writing could lead to an inability to legally enforce the agreement for repayment. Another consideration is the tax consequence of a loan.

How do you structure a loan from a friend?

Create a friends and family investment agreement that details loan terms. Include the loan amount, payment schedule, and a business plan. Also, include what will happen if you or the lender does not follow the loan terms. It would be a good idea to have a lawyer or financial professional look over the agreement.

How do you structure a loan to a family member?

Put family loans in writing The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

How do I write a loan agreement for a friend?

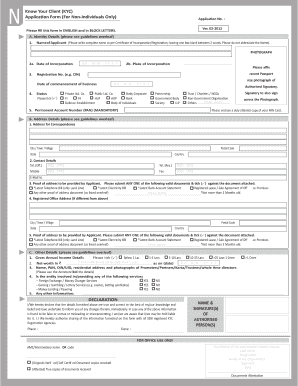

A personal loan agreement should include the following information: Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

How do you write a loan agreement between two people?

A personal loan agreement should include the following information: Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

How do you structure a loan between family members?

The IRS mandates that any loan between family members be made with a signed written agreement, a fixed repayment schedule, and a minimum interest rate. (The IRS publishes Applicable Federal Rates (AFRs) monthly.)

Related templates