Get the free fsa 2242 blank form - forms sc egov usda

Show details

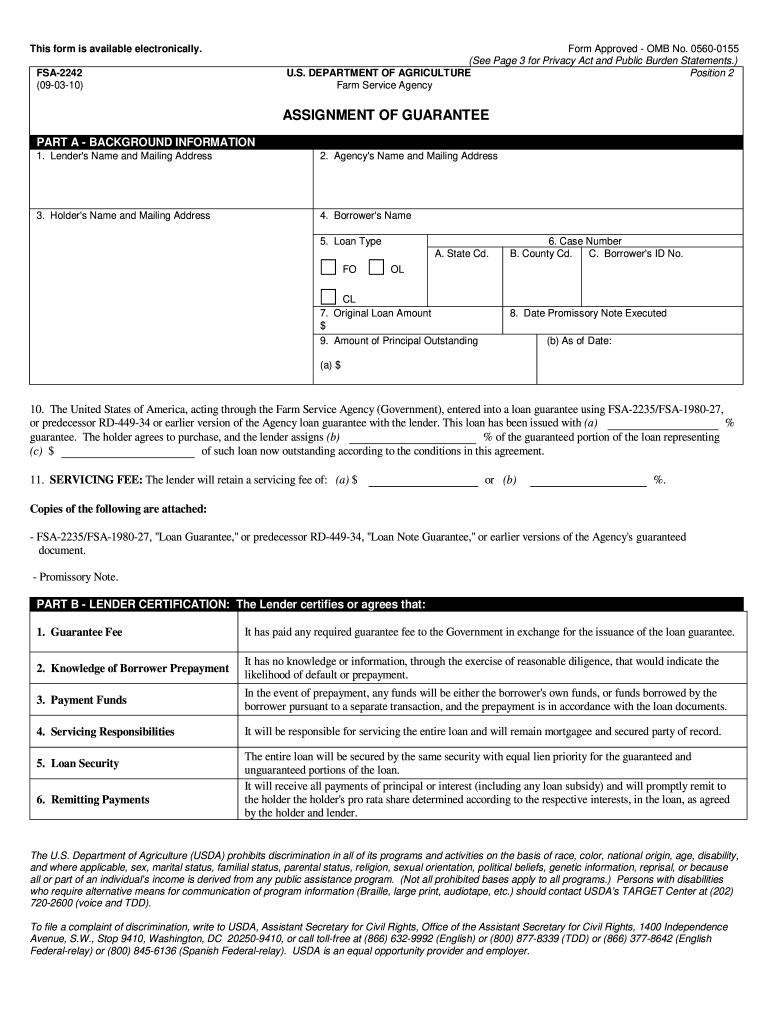

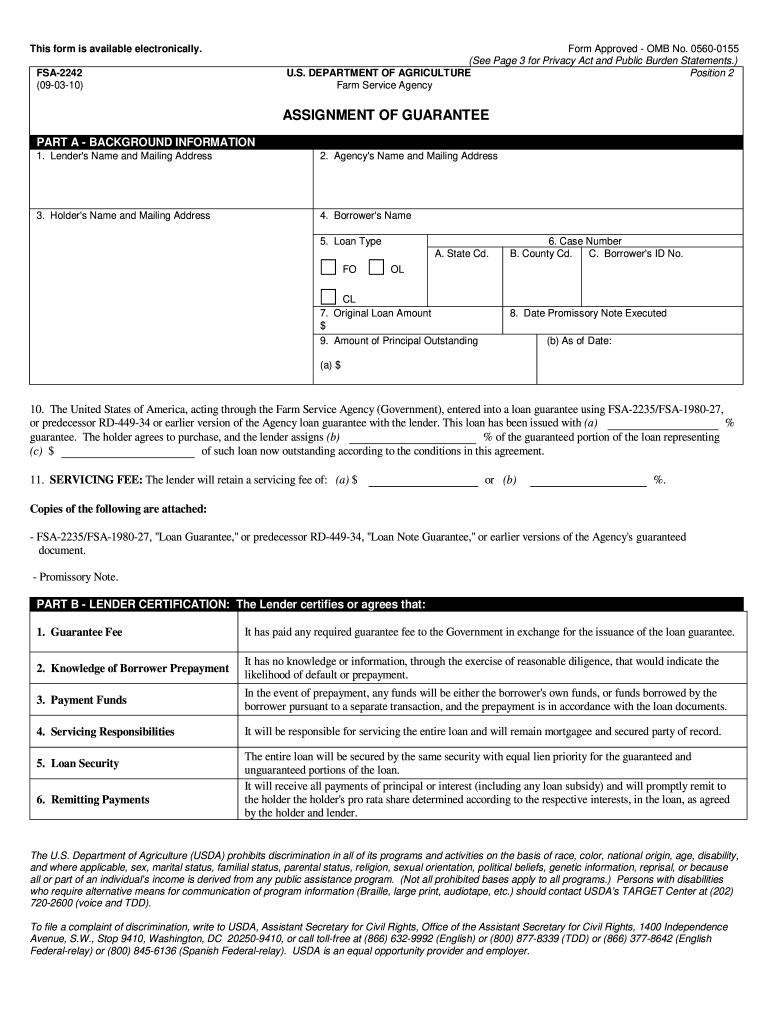

This form is available electronically. Form Approved OMB No. .... misrepresentation by the lender or any unenforceability of the loan guarantee by the lender. 2. ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fsa 2242 blank form

Edit your fsa 2242 blank form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fsa 2242 blank form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fsa 2242 blank form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fsa 2242 blank form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fsa 2242 blank form

How to fill out fsa 2242 blank form:

01

Gather all the necessary information and documents needed to complete the form.

02

Begin by entering the date at the top of the form.

03

Fill in your personal information, including your full name, address, and contact details.

04

Provide the required information about your financial situation, such as income, assets, and liabilities.

05

Indicate the purpose of the form and provide any additional relevant details.

06

Review the completed form for any errors or missing information, ensuring that all sections are properly filled out.

07

Sign and date the form at the designated space.

08

Submit the filled-out fsa 2242 form according to the instructions provided.

Who needs fsa 2242 blank form:

01

Individuals or families who are applying for financial aid or assistance.

02

Students who are applying for scholarships, grants, or loans.

03

Employees who are requesting income-based repayment plans or loan forgiveness programs.

Note: The specific requirements and reasons for needing the fsa 2242 blank form may vary depending on the organization or institution requiring its completion. It is important to consult the instructions or guidelines provided by the relevant authority to ensure accurate and appropriate submission of the form.

Fill

form

: Try Risk Free

People Also Ask about

How does a FSA guaranteed loan work?

FSA Guaranteed loans are made and serviced by commercial lenders, such as banks, Farm Credit System institutions, or credit unions. FSA guarantees up to 95 percent of the loss of principal and interest on a loan. Farmers and ranchers apply to an agricultural lender, which then arranges for the guarantee.

What is a guaranteed loan vs non guaranteed loan?

A guaranteed loan is backed by a third party, and if the borrower defaults, the third party repays the loan. With a guaranteed loan, the borrower may be required to pay a utilization fee. A secured loan is backed by an asset that is used as collateral, and the lender will seize the asset if you default.

How do FSA guaranteed loans work?

FSA Guaranteed loans are made and serviced by commercial lenders, such as banks, Farm Credit System institutions, or credit unions. FSA guarantees up to 95 percent of the loss of principal and interest on a loan. Farmers and ranchers apply to an agricultural lender, which then arranges for the guarantee.

What is the minimum credit score for FSA loan?

FHA Loan Down Payments An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 – 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans.

What is the difference between a guaranteed loan and a direct loan?

The primary difference between USDA direct loans and USDA guaranteed loans is who funds the actual loan. With the USDA direct loan, the USDA acts as the lender. Conversely, with the guaranteed loan program, private lenders fund the loan while the USDA backs each loan against default.

What is a guaranteed personal loan?

Also known as payday loans, guaranteed personal loans are usually secured by your paycheck. Basically, lenders use this type of loan to approve anyone, regardless of his or her credit score.

Do you have to pay back a FSA loan?

When you receive a loan from FSA or another lender, you have to pay back the loan amount (principal), plus an additional amount of interest. “Rate” is the interest rate charged on your loan from FSA or your commercial lender.

Is guaranteed loan legit?

But are they really guaranteed? The answer is no. “Guaranteed” loans — a term that's sometimes used to refer to no-credit-check loans like payday loans and some short-term installment loans — still have minimum requirements.

What is a guaranteed loan program?

A guaranteed loan is a type of loan in which a third party agrees to pay if the borrower should default. A guaranteed loan is used by borrowers with poor credit or little in the way of financial resources; it enables financially unattractive candidates to qualify for a loan and assures that the lender won't lose money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fsa 2242 blank form to be eSigned by others?

To distribute your fsa 2242 blank form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit fsa 2242 blank form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share fsa 2242 blank form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out fsa 2242 blank form on an Android device?

Use the pdfFiller Android app to finish your fsa 2242 blank form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is fsa 2242 blank form?

The fsa 2242 blank form is a form used by the Farm Service Agency (FSA) to collect information about farm income and expenses.

Who is required to file fsa 2242 blank form?

Farmers and ranchers who participate in FSA programs or receive FSA loans may be required to file the fsa 2242 blank form.

How to fill out fsa 2242 blank form?

To fill out the fsa 2242 blank form, you need to provide accurate information about your farm income and expenses. The form should be filled out according to the instructions provided by the FSA.

What is the purpose of fsa 2242 blank form?

The purpose of the fsa 2242 blank form is to assess the financial status of farmers and ranchers who participate in FSA programs or receive FSA loans. It helps the FSA determine eligibility for various assistance programs.

What information must be reported on fsa 2242 blank form?

On the fsa 2242 blank form, you must report information such as gross income, expenses, net income, farm assets, and farm liabilities. Additional information may be required depending on specific program requirements.

Fill out your fsa 2242 blank form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fsa 2242 Blank Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.