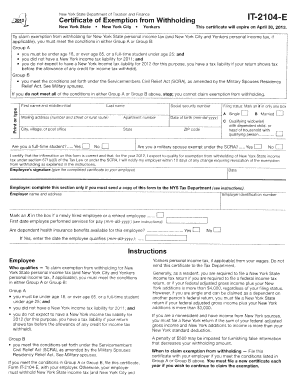

New York State Withholding Form

What is the New York State Withholding Form?

The New York State Withholding Form is a document used by employers in the state of New York to calculate and withhold income taxes from their employees' wages. It is an important form that ensures the correct amount of taxes are taken out of an employee's paycheck to fulfill their tax obligations to the state.

What are the Types of New York State Withholding Form?

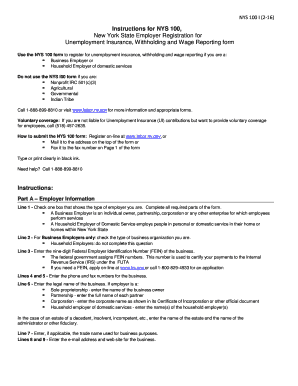

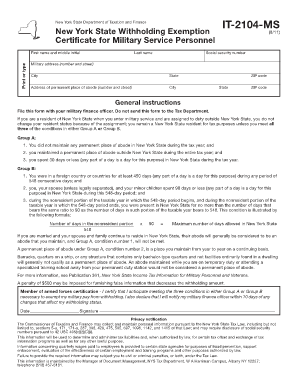

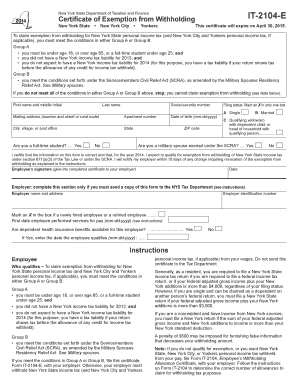

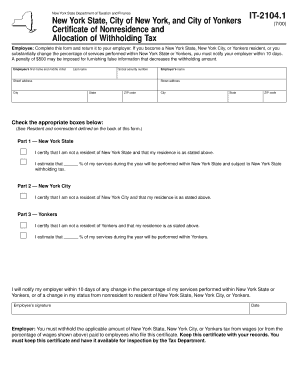

There are different types of New York State Withholding Forms, each designed for specific purposes. The most common types include:

How to Complete New York State Withholding Form

Completing the New York State Withholding Form is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.