State Withholding On W2

What is state withholding on w2?

State withholding on W-2 refers to the amount of money withheld from an employee's wages for state income taxes. It is essentially the state's way of collecting income tax throughout the year, rather than requiring individuals to pay one lump sum at the end of the year. The amount withheld is based on the employee's income, tax filing status, and the state tax rates.

What are the types of state withholding on w2?

There are different types of state withholding on W-2, which depend on the specific tax laws of each state. Some common types of state withholding include:

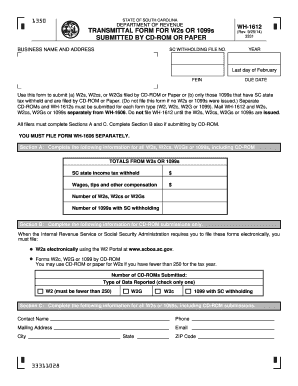

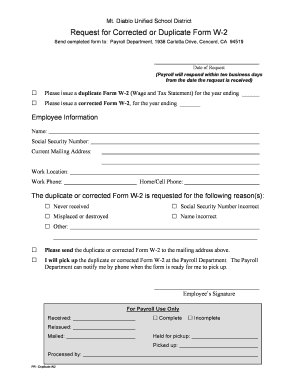

How to complete state withholding on w2

Completing state withholding on W-2 is an important part of the payroll process. Here's a step-by-step guide to help you:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.