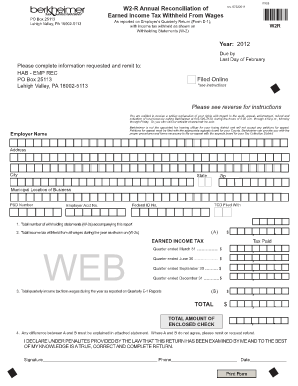

Get the free berkheimer

Get, Create, Make and Sign berkheimer w2 r annual reconciliation form

How to edit berkheimer w2 reconciliation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out berkheimer w2 r form

How to fill out berkheimer w2 reconciliation form:

Who needs berkheimer w2 reconciliation form?

Video instructions and help with filling out and completing berkheimer

Instructions and Help about w2 r

Hello we are going to do aw to reconciliation we're at the end of the year when everybody has questions about their w-2 and they sometimes either don't understand it or they may think that it looks incorrect so what we wanted to do is provide you a quick video to show you how you can reconcile your w-2 to your pay stub in order to do this you must have the last paycheck of the year as well I'm sorry the pay stub of the year as well as your w-2 if you do not have your pay stub the last one of the year you cannot reconcile your w-2 if you've been given a report from your administrator at your office you can use that as well as long as it has a year-to-date wage for the end of the year so let's get into this and show you how this is done if you notice I have a pay stub here or on the right side of my screen and I have a w-2 over here on the left side of my screen you will see here that I have circled that this is the last check date for this particular example it is the last check date of the year now inside here you're also going to see the year-to-date gross wages I see that circle you'll see all your different wages broken out here okay these wages must be the taxable wages so if you're being taxed on it for ninety-nine percent of you watching this you'll be able to use this information here the nest next thing you're going to need to know is you're going to need to make sure that you have all of your adjustments or what we call deductions for this particular purpose of reconciling to w2 you just need to make sure that you can, you see your retirement adjustment on there as well as any type of pre-tax health insurance this could be pre-tax medical pre-tax dental pre-tax evasion it could be pre-tax disability or other pre-tax items we for this example we will call those section 125 deductions or pre-tax deductions it should be indicated by a 125 on the deduction or a two your w-2 is reporting taxable wages to report it to the government not necessarily actual wages and that is where we are doing this reconciliation so at a glance if you don't know how to reconcile w to you would see that this employee made ninety-seven thousand dollars but the w-2 does not even have anywhere close to that in fact the w-2 has different numbers all over the place, so you may be scratching your head going my w-2s wrong well that's not true and let's take a look on how we do this first in order to do a reconciliation you need to understand two rules the first rule is that one section 125 or pre-tax deductions located here reduce boxes 1 35 16 and 18 if you notice each box has a number on their let me just draw a little square around it, you'll see that each box has a number those boxes are what dictate what these rules are for retirement deductions that only reduces boxes 1 16 and 18 now let's just take a look at these rules since rule number one says section 125 or pre-tax reduce those boxes which deductions actually reduce the boxes let's take a look health 125 yes...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in berkheimer w 2 annual reconciliation without leaving Chrome?

How do I edit w2 r annual reconciliation form 2018 straight from my smartphone?

How do I fill out berkheimer w 2 reconciliation form using my mobile device?

What is berkheimer w2 r form?

Who is required to file berkheimer w2 r form?

How to fill out berkheimer w2 r form?

What is the purpose of berkheimer w2 r form?

What information must be reported on berkheimer w2 r form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.