What is state withholding tax definition?

State withholding tax refers to the amount of money that an employer withholds from an employee's wages or salary and is paid directly to the state government. This tax is typically based on the employee's income and is used to fund various state programs and services. The withholding tax helps ensure that individuals meet their tax obligations throughout the year, rather than having to pay a large sum at the end of the tax period.

What are the types of state withholding tax definition?

There are several types of state withholding taxes that individuals may encounter. These include:

Income tax withholding: This is the most common type of state withholding tax and is based on the employee's taxable income.

Unemployment insurance tax withholding: This tax is used to fund unemployment benefits for eligible workers who are unemployed through no fault of their own. Employers are responsible for withholding this tax from their employees' wages.

Disability insurance tax withholding: Some states require employers to withhold a portion of their employees' wages to fund disability insurance programs. This tax is used to provide income replacement for workers who become disabled and are unable to work.

Local tax withholding: In addition to state taxes, some local jurisdictions may impose their own withholding taxes. These taxes are used to fund local programs and services within the community.

Miscellaneous withholding taxes: Depending on the state, there may be other types of withholding taxes, such as reciprocity agreements with neighboring states or taxes specific to certain industries.

How to complete state withholding tax definition

Completing state withholding tax forms may vary depending on the state, but here are some general steps to follow:

01

Determine if you are required to withhold state taxes: Check with your state's tax authority to find out if you are required to withhold state taxes and what the threshold for withholding is.

02

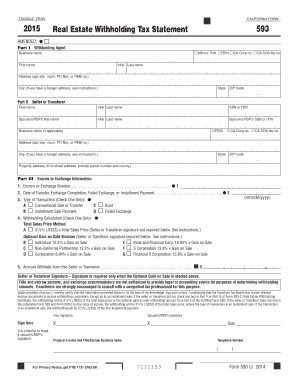

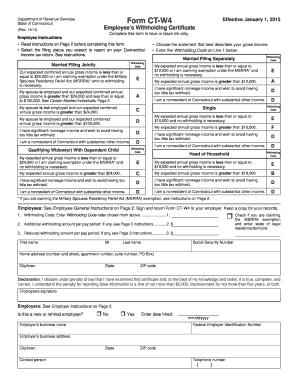

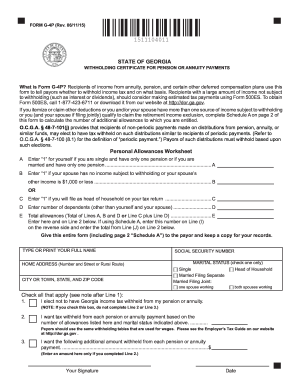

Obtain the necessary forms: Most states provide forms for employers to withhold state taxes. You can usually download these forms from the state's tax website or request physical copies.

03

Gather employee information: Collect the necessary information from your employees, including their full name, social security number, address, and the amount of their wages subject to state withholding.

04

Calculate the withholding amount: Use the state's tax withholding tables or online calculator to determine the appropriate amount to withhold from each employee's wages.

05

Withhold the taxes: Deduct the calculated amount from each employee's wages and set it aside to remit to the state.

06

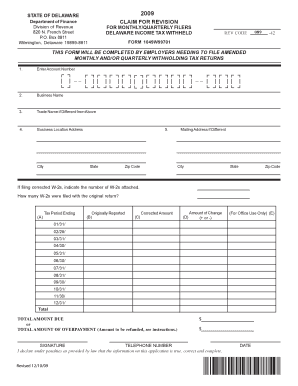

Submit the withholding taxes: Depending on the state's requirements, you may need to submit the withheld taxes on a monthly, quarterly, or annual basis. Be sure to adhere to the deadlines set by the state.

07

Keep accurate records: Maintain detailed records of the state withholding taxes you have withheld and remitted. This will help ensure compliance with state requirements and facilitate any necessary reporting in the future.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.