Get the free maryland non resident seller transfer withholding tax exemption form

Show details

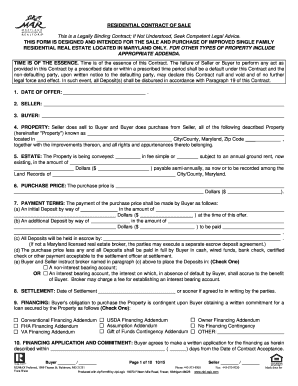

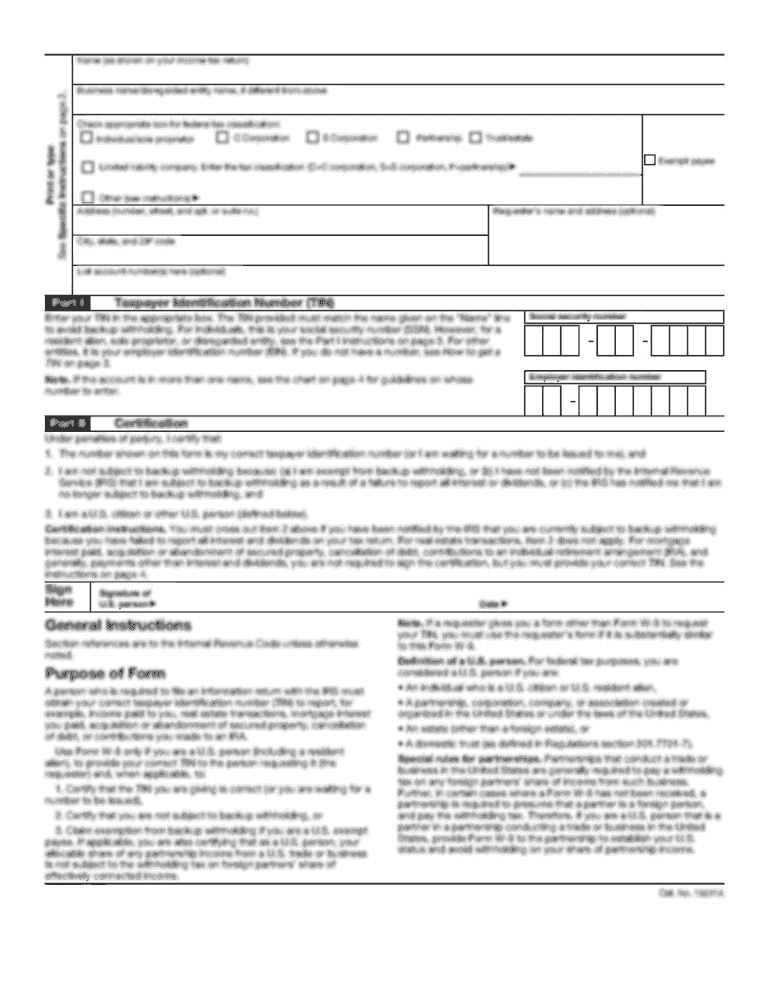

MARYLAND NONRESIDENT SELLER TRANSFER WITHHOLDING TAX ADDENDUM # dated to Contract of Sale dated between Buyer and Seller for Property known as. Seller acknowledges, pursuant to Section 10912 of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign maryland non resident seller

Edit your maryland non resident seller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland non resident seller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maryland non resident seller online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit maryland non resident seller. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out maryland non resident seller

How to fill out Maryland non resident seller:

01

Gather all necessary information and documents, including your personal identification details, the buyer's information, and the details of the property being sold.

02

Download the Maryland non resident seller form from the official website or request a physical copy from the appropriate authority.

03

Fill in your personal information accurately, including your name, address, and contact details.

04

Provide the buyer's information, such as their name, address, and contact details.

05

Fill in the details of the property being sold, including the address, legal description, and any relevant tax identification numbers.

06

Indicate the date of the sale and the agreed-upon purchase price of the property.

07

Sign and date the Maryland non resident seller form, ensuring that you have read and understood all the instructions and declarations mentioned on the form.

08

Submit the completed form to the relevant authority either online or by mail.

Who needs Maryland non resident seller:

01

Individuals who are not residents of Maryland but are selling a property located within the state.

02

Non-resident individuals who have entered into a real estate transaction in Maryland and need to comply with the state's tax laws and regulations.

03

Anyone who wants to ensure legal compliance and avoid any penalties or fines related to the sale of a property as a non-resident seller in Maryland.

Fill

form

: Try Risk Free

People Also Ask about

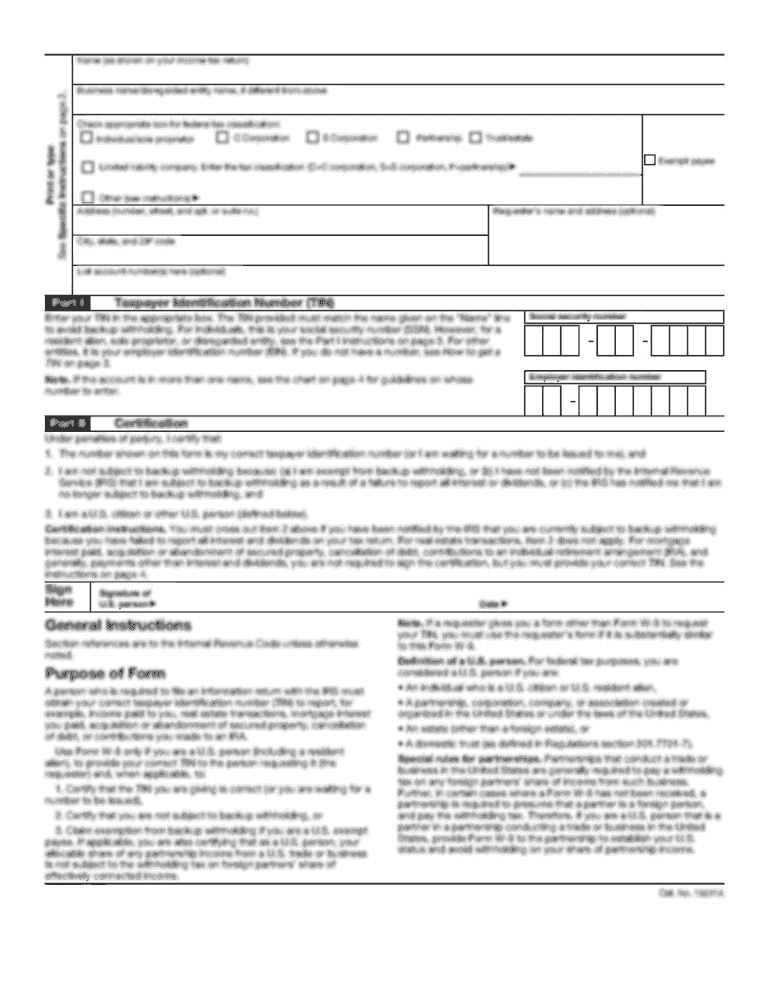

What is the MW507 form?

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Do I have to fill out a MW507 form?

All Maryland residents or employees must complete form MW507 to ensure their employer withholds the correct amount from their paycheck. This document is similar to the W-4 document that all Americans complete for federal withholding of their working wages, only it is specific to the state of Maryland.

How to fill out MW507 example?

1:05 3:24 YouthWorks 2021: MW507 - YouTube YouTube Start of suggested clip End of suggested clip 507. Form if you claim that you are exempt this means that you will have no income tax withheld fromMore507. Form if you claim that you are exempt this means that you will have no income tax withheld from your paycheck. If you do choose to file exempt do not fill out line one of this. Section.

Do I need to fill out MW507?

Yes, you must fill out Form MW507 so your employer can withhold the proper amount of taxes from your income. Failure to do so will result in the employer withholding the maximum amount.

How do I file exempt on MW507?

The sixth line of form MW507 relates to Maryland workers who live in Pennsylvania, except compared to line 5, line 6 exemptions are specific for taxpayers living in York or Adams counties. Write “EXEMPT” on line 6 and line 4 if you are eligible for this exemption.

What is the withholding tax for non resident sellers transfer in Maryland?

For a nonresident individual, the payment is 8% of the total property sale payment made to the individual. A nonresident entity must make an 8.25% payment. See Withholding Requirements for Sales of Real Property by Nonresidents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit maryland non resident seller from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like maryland non resident seller, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send maryland non resident seller to be eSigned by others?

When you're ready to share your maryland non resident seller, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit maryland non resident seller in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your maryland non resident seller, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is maryland non resident seller?

A Maryland non-resident seller refers to an individual or entity that sells property located in Maryland but is not a resident of Maryland.

Who is required to file maryland non resident seller?

Any non-resident seller of real property in Maryland is required to file the Maryland non-resident seller form to report the sale.

How to fill out maryland non resident seller?

To fill out the Maryland non-resident seller form, provide details like the seller's information, property description, sales price, and any applicable deductions or exemptions.

What is the purpose of maryland non resident seller?

The purpose of the Maryland non-resident seller form is to ensure that non-resident sellers comply with Maryland tax law and fulfill their tax obligations on gains from property sales.

What information must be reported on maryland non resident seller?

Reported information includes the seller's name and address, the property's location and description, the sale price, and information regarding any exemptions claimed.

Fill out your maryland non resident seller online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland Non Resident Seller is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.