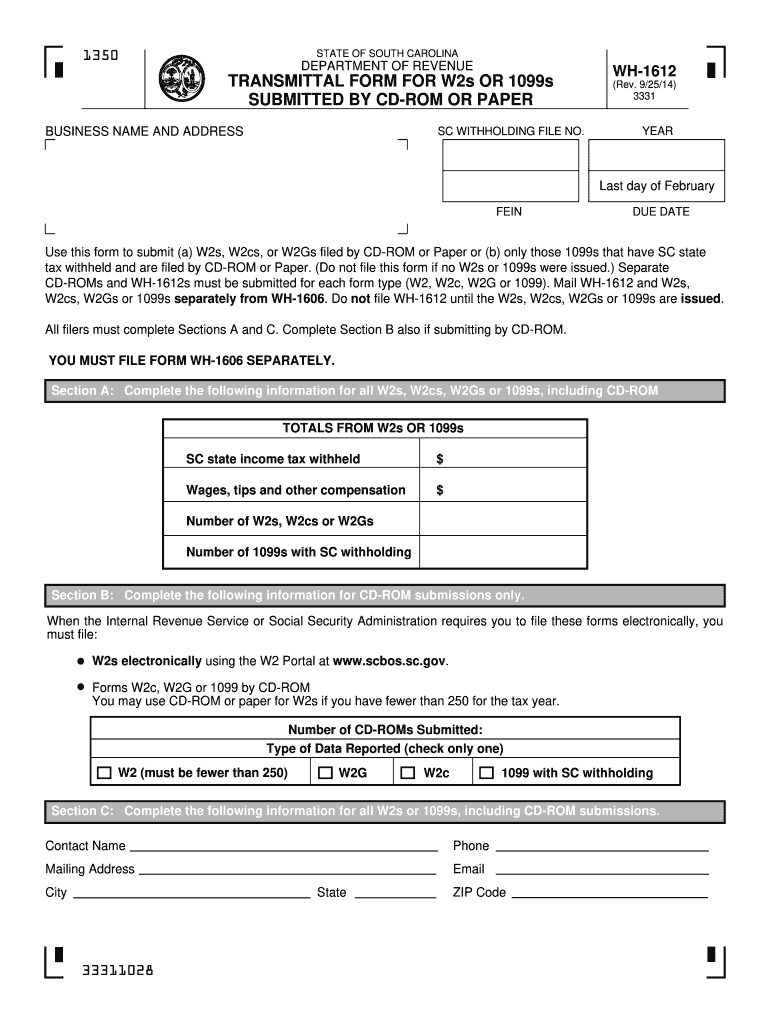

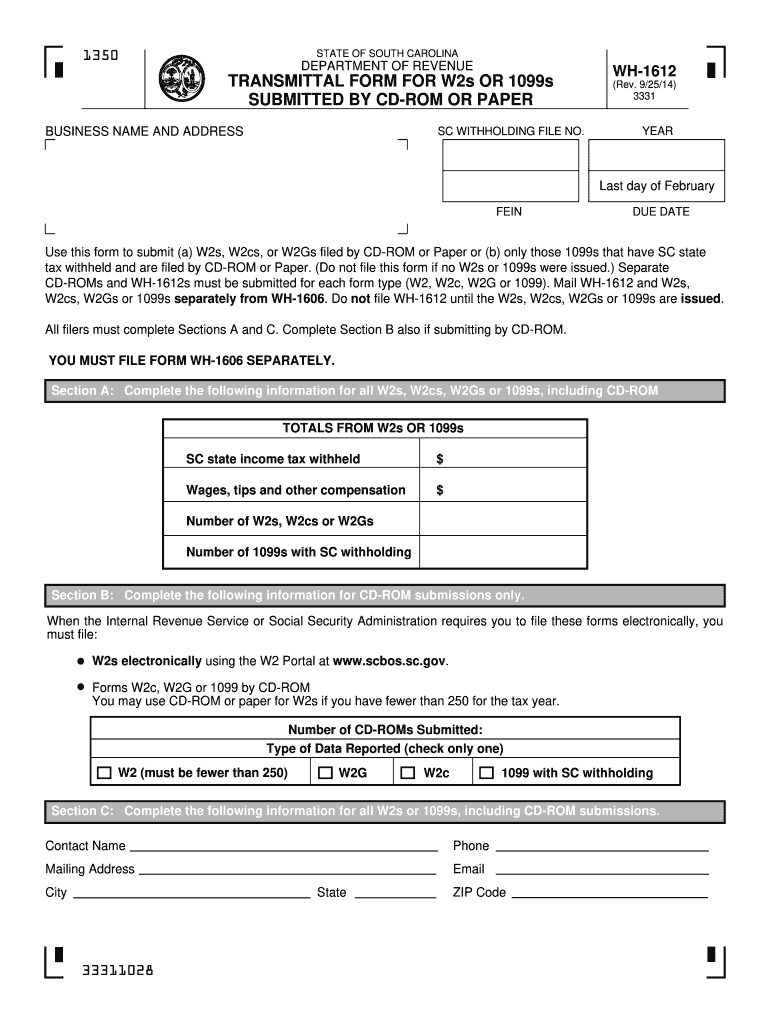

SC DoR WH-1612 2014 free printable template

Get, Create, Make and Sign form 1606 sc1612

Editing form 1606 sc1612 online

Uncompromising security for your PDF editing and eSignature needs

SC DoR WH-1612 Form Versions

How to fill out form 1606 sc1612

How to fill out SC DoR WH-1612

Who needs SC DoR WH-1612?

Instructions and Help about form 1606 sc1612

The increased speed of the xf64 T leads to increase productivity so in the time it takes to order a summer drink you could print three posters on the OF in the time it takes to change a flat tire you could print ten banners and in the time it takes to make a pizza and delivered across town you could print a vehicle wrap and all that productivity leads directly to increase profits if you're selling banners at four dollars per square foot you can make a profit after ink and media costs of over 1,500 dollars per hour do that for just four hours a day five days a week 52 weeks a year bottom line that's what we call a return on your investment

People Also Ask about

What is the SC non resident tax withholding?

What taxable income is not subject to withholding?

How much state tax is withheld in South Carolina?

What is the state tax withholding for SC?

What is the out of state withholding in South Carolina?

Can you opt out of tax withholding?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 1606 sc1612 directly from Gmail?

How do I edit form 1606 sc1612 on an Android device?

How do I complete form 1606 sc1612 on an Android device?

What is SC DoR WH-1612?

Who is required to file SC DoR WH-1612?

How to fill out SC DoR WH-1612?

What is the purpose of SC DoR WH-1612?

What information must be reported on SC DoR WH-1612?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.