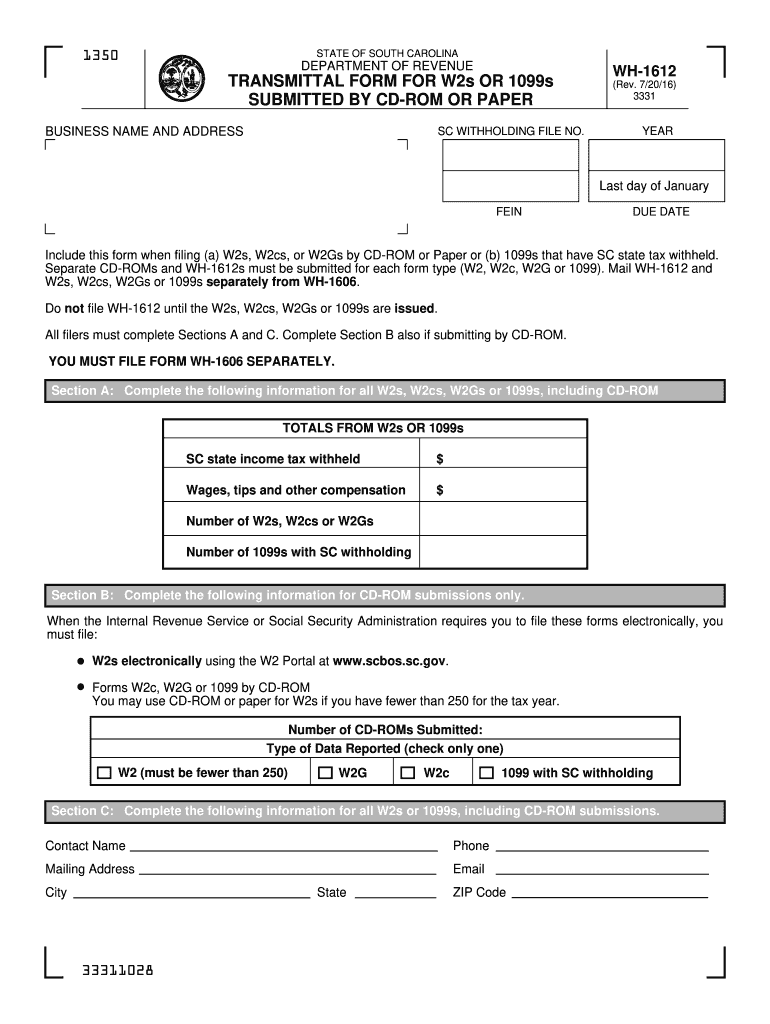

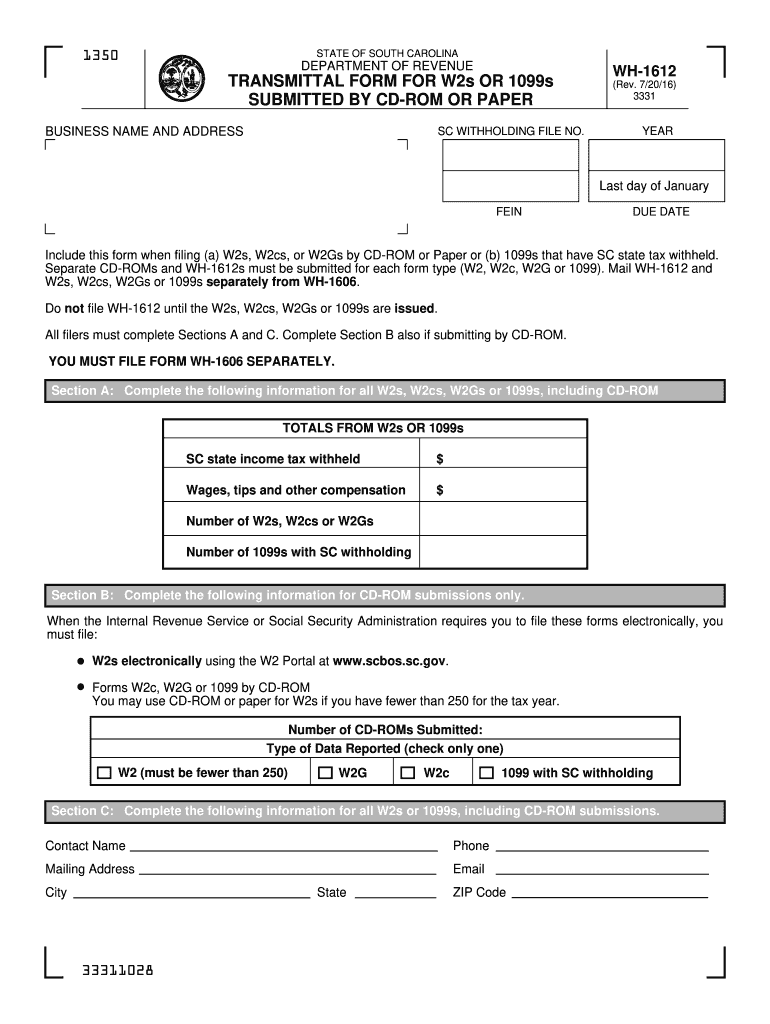

SC DoR WH-1612 2016 free printable template

Get, Create, Make and Sign sc wh form 2016

How to edit sc wh form 2016 online

Uncompromising security for your PDF editing and eSignature needs

SC DoR WH-1612 Form Versions

How to fill out sc wh form 2016

How to fill out SC DoR WH-1612

Who needs SC DoR WH-1612?

Instructions and Help about sc wh form 2016

Dan thanks day and some Republicans are being critical of the president's focus what's expected to happen during the State of the Union on jobs in the economy saying that he's now pivoting back to jobs dropped the ball during his inaugural address do they have a point there that the president hasn't been emphasizing job creation over the last few months and now is suddenly turning back to it well I would argue that all the time we collectively spent at the end of the year right up until New Year's Day focused on a fiscal cliff deal was very much about the need to take action to ensure that we didn't inflict harm on our economy to take action to ensure that regular folks out there middle-class Americans had tax cuts extended to allow them to meet make ends meet and to avoid the so-called fiscal cliff I don't have the numbers for you, but it is simply a fact that while the inaugural address contained within it very powerful lines from the president about issues like comprehensive immigration reform or the need to address climate change or gun violence all of those issues combined got less space if you will in the inaugural dress in the economy and jobs and that reflects the overall approach that the president takes it also reflects the fact that when you talk about an issue like comprehensive immigration reform we're talking about an economic issue as businesses large and small will tell you and that is why we've been seeing so much support for bipartisan efforts from the business community to push forward comprehensive immigration reform, so there's no pivot here

People Also Ask about

What is the state tax withholding for sc?

How do I request to be released from the withholding compliance program?

Does South Carolina have a withholding form?

What is the out of state withholding in South Carolina?

What is South Carolina state withholding tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sc wh form 2016 online?

How can I edit sc wh form 2016 on a smartphone?

Can I edit sc wh form 2016 on an Android device?

What is SC DoR WH-1612?

Who is required to file SC DoR WH-1612?

How to fill out SC DoR WH-1612?

What is the purpose of SC DoR WH-1612?

What information must be reported on SC DoR WH-1612?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.