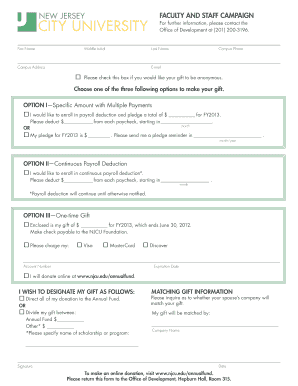

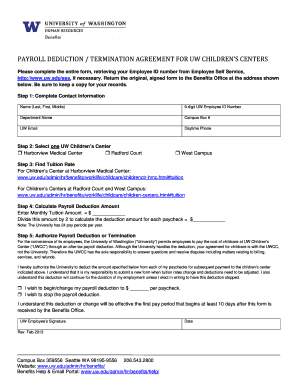

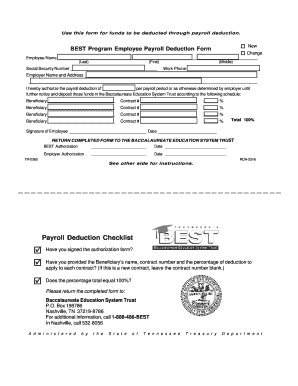

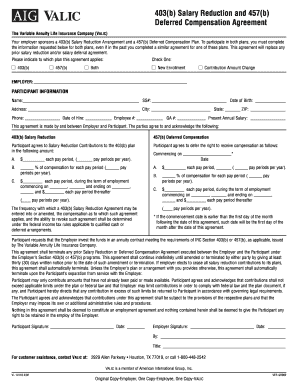

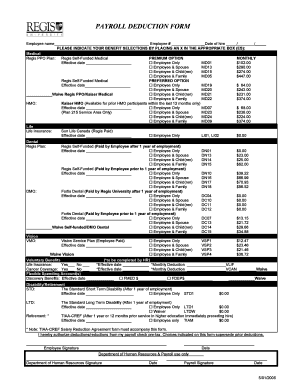

Payroll Deduction Form - Page 2

What is the Payroll Deduction Form?

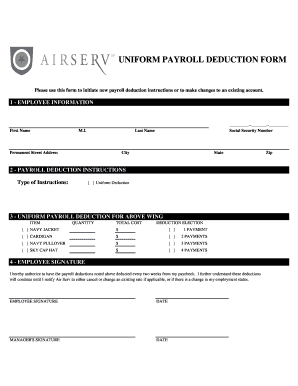

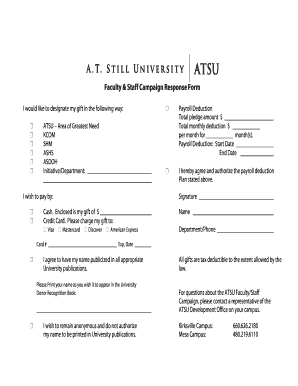

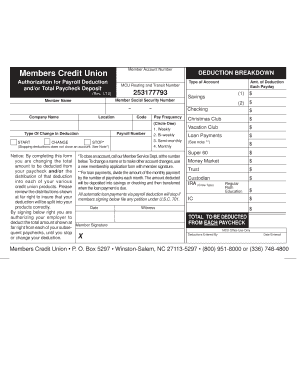

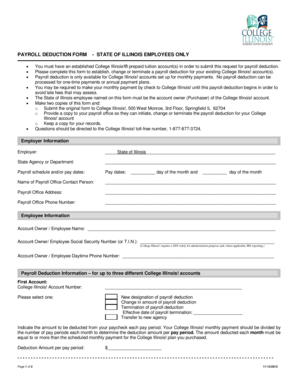

The payroll deduction form is the report of all taxes, withholdings, insurance payments and contributions, issued by the company for every employee. The withholding may be voluntary or involuntary like Medicare or Social Security payments. Keep in mind, that employers should always be aware of all government regulations in order to make all withholdings correctly.

The document covers various withdrawals, that do not depend on working hours. It is better to keep careful tracking of all payments and make them regularly. Also, it’s necessary to collect all dates and payment sums to provide them in the report at the end of the year. This will help both parties to understand the amount of state and local taxes and the payment sum, issued during the tax year.

By using the PDFfiller library, you can select the sample you need.

It’s important to provide all the information, as it’s given in the official documents.

How can I Fill Out the Payroll Deduction Form?

To complete the payroll deduction template correctly, follow the recommendations given below:

There's a wide variety of withdrawings, commonly used in the payroll deduction template: