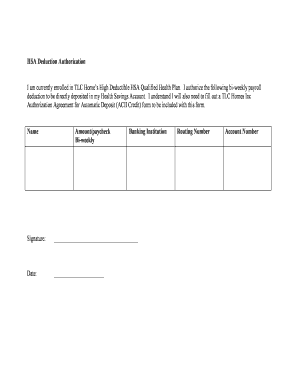

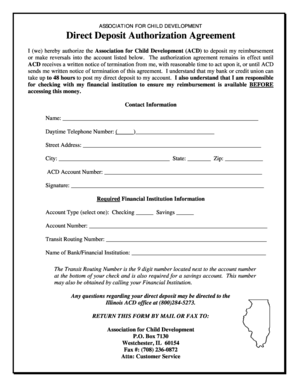

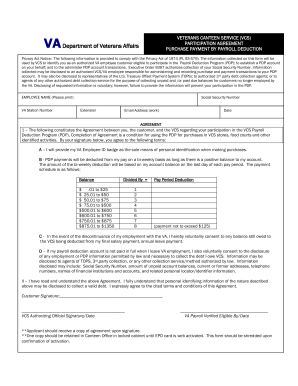

Payroll Deduction Authorization Agreement

What is a payroll deduction authorization agreement?

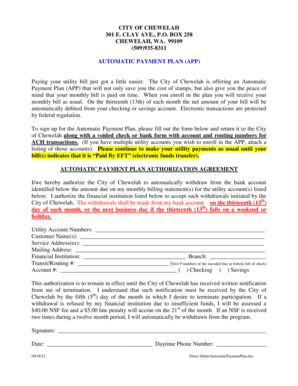

A payroll deduction authorization agreement is a legal document that allows an employer to deduct specified amounts from an employee's paycheck for various purposes, such as taxes, insurance premiums, or retirement contributions. It ensures that the employer and the employee are on the same page regarding the deductions made from the employee's salary.

What are the types of payroll deduction authorization agreements?

There are several types of payroll deduction authorization agreements, including:

Tax withholdings: This type of agreement allows employers to deduct income taxes from employee salaries.

Benefit deductions: Employers can deduct amounts for health insurance premiums, retirement contributions, or other employee benefits.

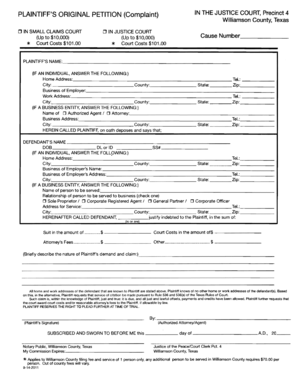

Garnishments or wage assignments: When an employee owes a debt, such as unpaid child support or loans, the employer can deduct a portion of their wages to fulfill the obligation.

Charitable contributions: Some employees may choose to authorize deductions from their paychecks as donations to charitable organizations.

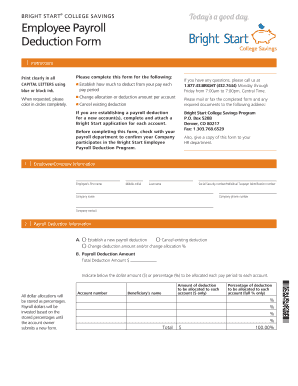

How to complete a payroll deduction authorization agreement?

To complete a payroll deduction authorization agreement, follow these steps:

01

Obtain the form: Request the necessary form from your employer or download it from their online portal.

02

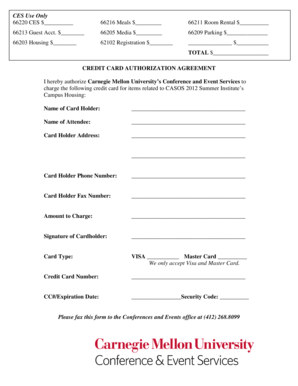

Provide personal information: Fill in your name, address, social security number, and other relevant details as required.

03

Specify the deductions: Indicate the types of deductions you authorize your employer to make and the corresponding amounts or percentages.

04

Review and sign: Carefully review the agreement to ensure accuracy and compliance. Sign the document to validate your consent.

05

Submit the form: Return the completed form to your employer through the designated channel, such as HR or payroll department.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out payroll deduction authorization agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is payroll authorization?

Payroll Authorization means a Participant's written authorization to withhold from his wages, specified percentages which shall be as either a Salary Deferral Contribution or Matched Voluntary Contribution or Nonmatched Voluntary Contribution contributed to this Plan on his behalf. Sample 1Sample 2.

What is the payroll deduction process?

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax. 401(k) contributions.

How do I write a letter of deduction?

How do I write a letter for deductions? I am writing to you to lure your attention on an issue that I have been facing from last few months. As I get my salary on time but some deductions have been made from my salary which I haven't been even informed. (Show your actual problem and situation).

What is payroll deduction authorization form?

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

Related templates