What is Payroll Template?

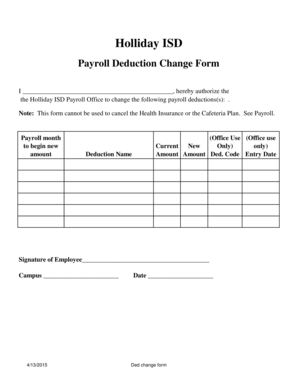

A Payroll Template is a pre-designed document that helps businesses organize and calculate their employees' salaries and wages. It serves as a framework for recording important payroll information such as employee details, hours worked, deductions, and other financial data. By using a Payroll Template, businesses can streamline their payroll processes, reduce errors, and ensure accurate payment to their employees.

What are the types of Payroll Template?

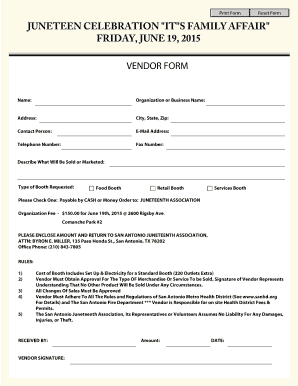

There are various types of Payroll Templates available to suit different business needs. Some common types include:

Basic Payroll Template: This template covers the essential elements of payroll management and is suitable for small businesses with straightforward payroll requirements.

Timecard Payroll Template: A timecard template focuses on tracking hours worked and is ideal for businesses that pay employees based on their working hours.

Salary Payroll Template: This template is designed for businesses that employ salaried employees and need to calculate their monthly or annual salaries.

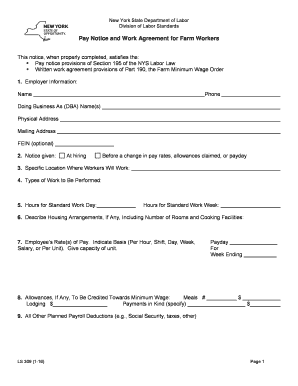

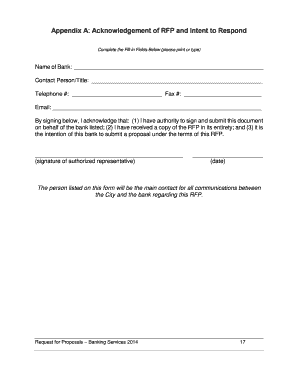

Pay Stub Template: A pay stub template provides detailed information about an employee's earnings, deductions, and net pay. It is often given to employees along with their paychecks or as a digital copy.

Tax Payroll Template: This template helps businesses calculate and track payroll taxes, including federal and state income tax withholding, Social Security, and Medicare taxes.

Bonus Payroll Template: Designed for businesses that give bonuses to their employees, this template helps calculate and track bonus payments.

Commission Payroll Template: This template is useful for businesses that pay employees based on sales commissions. It helps calculate commission payments accurately and efficiently.

How to complete Payroll Template

Completing a Payroll Template is a straightforward process. Here are the steps to follow:

01

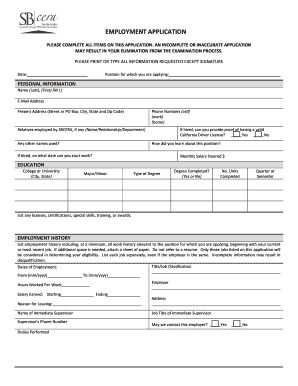

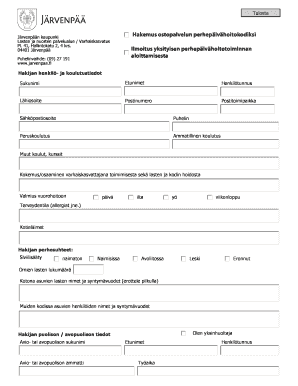

Gather employee information: Collect all necessary information about your employees, including their names, contact details, tax identification numbers, and employment status.

02

Record working hours: Enter the hours worked by each employee during the pay period. This may involve tracking regular hours, overtime hours, and any other applicable time categories.

03

Calculate earnings: Use the provided formulas or functions in the Payroll Template to calculate gross earnings for each employee, considering factors such as regular pay rate, overtime rate, and any bonuses or commissions.

04

Deduct taxes and contributions: Subtract the required tax withholdings, such as federal and state income taxes, Social Security, and Medicare, from the gross earnings to determine the net pay for each employee.

05

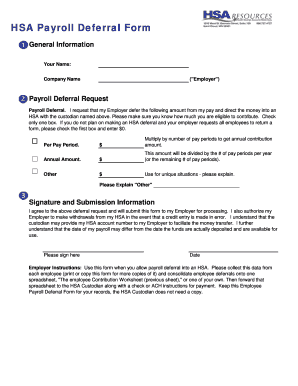

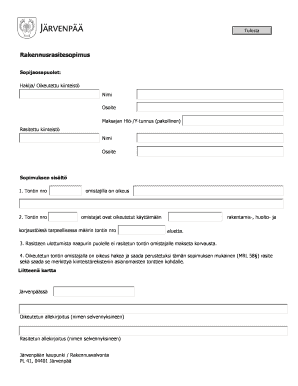

Include additional deductions: If applicable, deduct other deductions such as health insurance premiums, retirement contributions, or loan repayments.

06

Verify accuracy and make adjustments: Double-check all calculations and ensure the accuracy of the payroll data. Make any necessary adjustments or corrections if errors are found.

07

Generate payroll reports: Once the Payroll Template is completed and verified, generate reports summarizing employee earnings, taxes, and other relevant payroll information.

08

Distribute paychecks or pay stubs: Provide employees with their paychecks or pay stubs, including all necessary details and breakdowns of their earnings and deductions.

09

Keep records: Keep a copy of the completed Payroll Template for your records, as well as any supporting documents related to taxes and payroll compliance.

With pdfFiller, completing a Payroll Template becomes even easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.