Salary Payroll Xls Excel Sheet

What is salary payroll xls excel sheet?

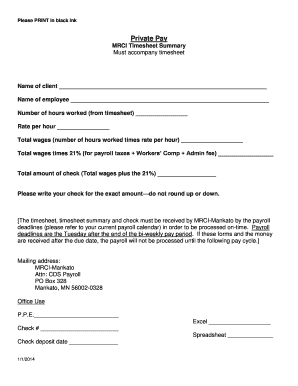

A salary payroll xls excel sheet is a spreadsheet file that is used to calculate and record salary-related information of employees. It is primarily used by businesses and organizations to manage their payroll process efficiently. The xls excel sheet format allows for easy data entry and manipulation, making it a popular choice among employers.

What are the types of salary payroll xls excel sheet?

There are several types of salary payroll xls excel sheets available, depending on the specific needs of an organization. Some common types include: 1. Basic Salary Payroll Sheet: This type of sheet includes the employee's basic salary information, such as hourly rates or monthly salaries. 2. Overtime Payroll Sheet: This sheet is used to calculate and record overtime hours and rates for employees. 3. Deduction Payroll Sheet: This sheet focuses on deductions such as taxes, insurance premiums, and other payroll deductions. 4. Bonus Payroll Sheet: This sheet is used to calculate and record bonuses, incentives, or commissions for employees. 5. Time and Attendance Payroll Sheet: This sheet tracks employee attendance, leaves, and absences to calculate pay accurately. These are just a few examples, and organizations can create customized xls excel sheets based on their specific requirements.

How to complete salary payroll xls excel sheet

Completing a salary payroll xls excel sheet requires attention to detail and following a systematic process. Here is a step-by-step guide to help you: 1. Open the xls excel sheet on your preferred spreadsheet software. 2. Enter the necessary employee information, such as names, employee IDs, and positions. 3. Input the relevant salary details, including hourly rates, monthly salaries, or any other applicable pay structure. 4. Calculate and record any overtime hours and rates if applicable. 5. Fill in the deductions details, such as taxes, insurance premiums, and other relevant deductions. 6. If there are any bonuses, incentives, or commissions, calculate and record them in the corresponding sections of the sheet. 7. Use the time and attendance section of the sheet to track employee attendance, leaves, and absences for accurate pay calculation. 8. Double-check all the entered data for accuracy and completeness. 9. Save and store the completed salary payroll xls excel sheet for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.