Second Mortgage Loan Agreement

What is second mortgage loan agreement?

A second mortgage loan agreement is a legal contract between a borrower and a lender that allows the borrower to use their property as collateral to secure a loan. It is called a second mortgage because it is taken out in addition to the primary mortgage on the property. This agreement outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any additional fees or charges.

What are the types of second mortgage loan agreement?

There are several types of second mortgage loan agreements that borrowers can choose from, depending on their specific needs and financial situation. - Home Equity Loan: This type of second mortgage loan agreement allows borrowers to borrow a lump sum of money using the equity in their property as collateral. - Home Equity Line of Credit (HELOC): A HELOC is a revolving line of credit that allows borrowers to borrow money as needed, up to a predetermined limit, using their property as collateral. - Piggyback Loan: A piggyback loan involves taking out a second mortgage alongside the primary mortgage to avoid paying private mortgage insurance (PMI). - Bridge Loan: A bridge loan is a short-term loan that is used to bridge the gap between buying a new home and selling the current one. It can be a second mortgage loan agreement that helps finance the purchase of a new property.

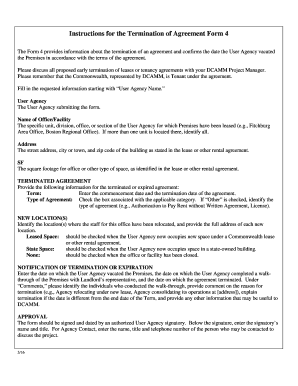

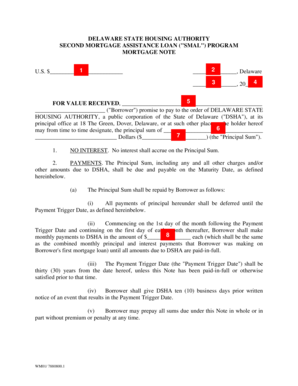

How to complete second mortgage loan agreement

Completing a second mortgage loan agreement involves several steps to ensure that all the necessary information is provided and the terms of the loan are clearly stated. Here is a step-by-step guide: 1. Gather the required information: Collect all the relevant details, including personal information, property details, loan amount, and desired terms. 2. Review the agreement: Carefully read through the second mortgage loan agreement to understand the terms and conditions. 3. Fill in the necessary information: Use a reliable online PDF editor like pdfFiller to input the required information into the loan agreement form. 4. Double-check the information: Verify that all the information you have entered is accurate and complete. 5. Review and sign: Read the agreement once again to ensure you are comfortable with the terms, then sign the document. 6. Share and store: Share the completed loan agreement with all relevant parties and securely store a copy for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.