CT Housing Finance Authority DAP07NOT 2016-2024 free printable template

Show details

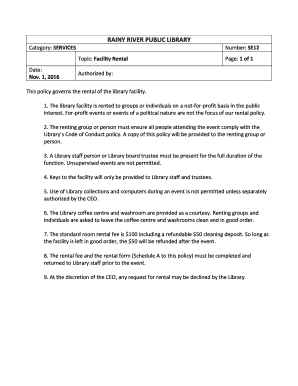

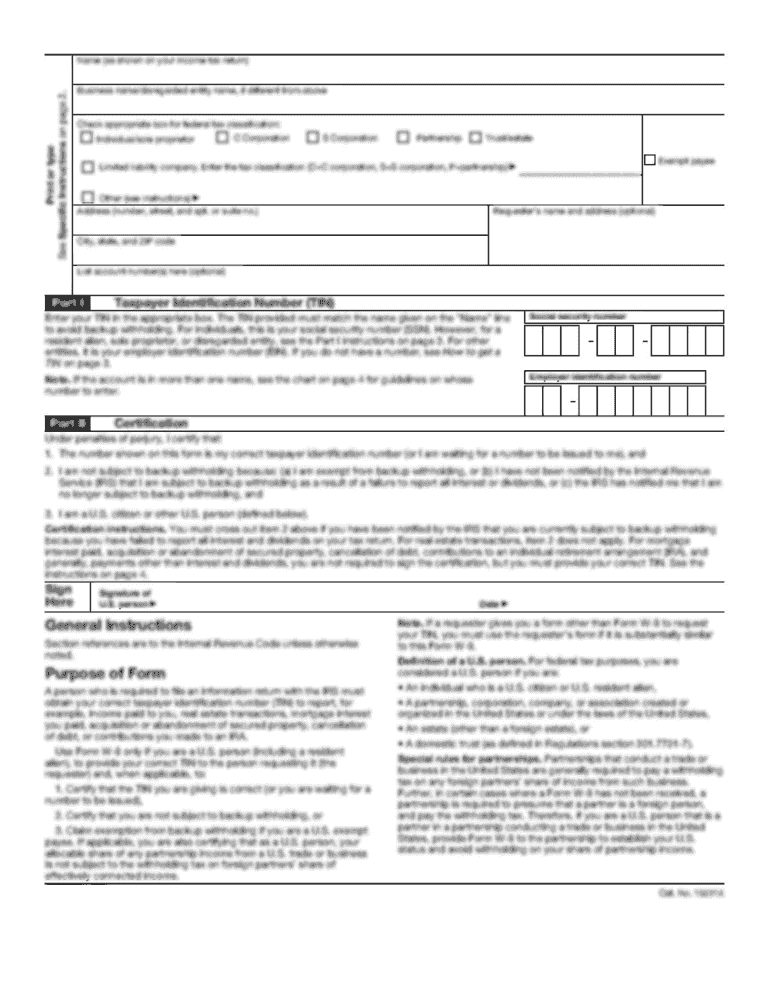

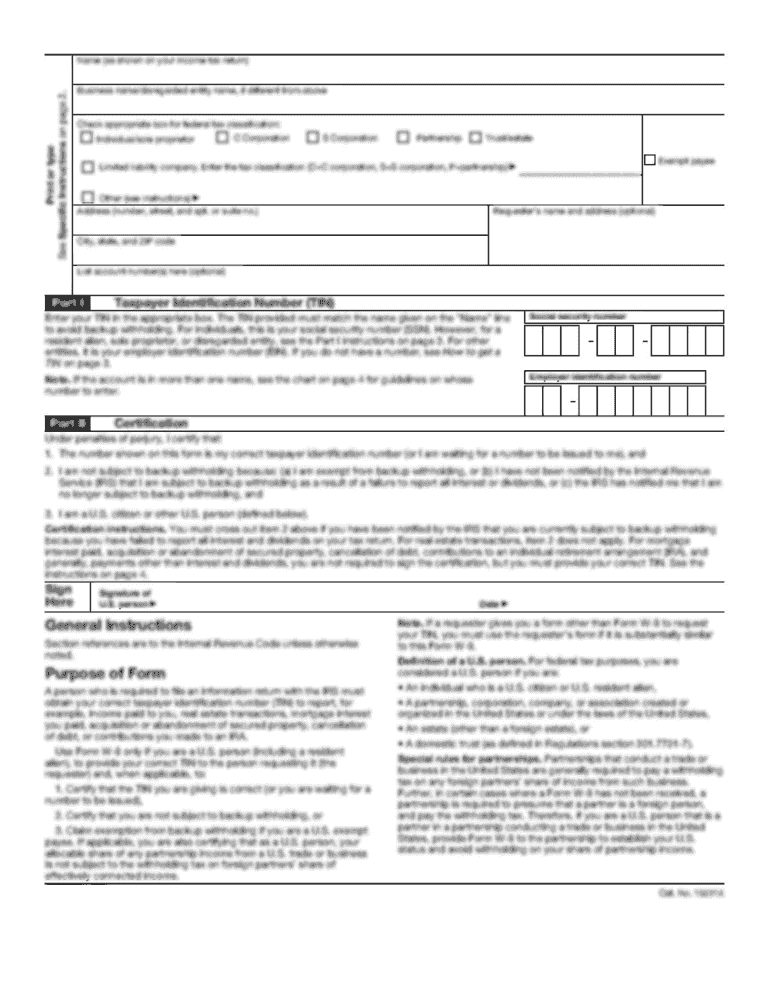

SECOND MORTGAGE NOTE Down payment ASSISTANCE PROGRAM CFA Loan # $, Connecticut Date: AFTER DATE, FOR VALUE RECEIVED, the undersigned (“Borrower “), promises to pay to the order of CONNECTICUT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your second mortgage note loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your second mortgage note loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit second mortgage note loan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit second mortgage note loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out second mortgage note loan

How to fill out a second mortgage note loan:

01

Start by gathering all the necessary documents required for the loan application. This typically includes your personal identification documents, proof of income, employment history, credit history, and property details.

02

Next, carefully read through the second mortgage note loan application form provided by the lender. Pay close attention to the instructions and ensure you understand all the terms and conditions of the loan.

03

Begin filling out the application form by providing your personal information such as your name, address, contact details, and social security number. Be sure to provide accurate information to avoid any delays or complications during the loan processing.

04

Move on to the financial section of the application. Here, you will need to provide details about your income, employment history, and any other sources of income or assets you may have. This information helps the lender assess your financial capability to repay the loan.

05

Provide details about the property you are securing the second mortgage note loan against. This includes the address, current value, any existing mortgages or liens, and any other relevant property details requested by the lender.

06

Read and understand the terms and conditions section of the application form. This section outlines the interest rate, repayment terms, and any penalties or fees associated with the loan. If you have any questions or concerns, don't hesitate to seek clarification from the lender.

07

Review the completed application form thoroughly before submitting it. Ensure all the information provided is accurate and complete. Double-check for any errors or missing information that may require correction.

08

Finally, submit the filled-out application form along with all the required documents to the lender as instructed. Some lenders may also require additional documentation, so be prepared to provide those if necessary.

Who needs a second mortgage note loan:

01

Homeowners who require additional funds for major expenses such as home renovations, medical bills, education costs, or debt consolidation.

02

Individuals who have built up equity in their property and want to leverage it for additional financing.

03

Borrowers with a good credit history and a stable income who are confident in their ability to meet the repayment obligations.

It is important to note that the need for a second mortgage note loan will vary depending on individual circumstances and financial goals. Consulting with a financial advisor or mortgage specialist can help determine if a second mortgage note loan is the right choice for your specific situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute second mortgage note loan online?

pdfFiller has made it easy to fill out and sign second mortgage note loan. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit second mortgage note loan on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit second mortgage note loan.

How do I fill out second mortgage note loan on an Android device?

Complete your second mortgage note loan and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your second mortgage note loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.