Mortgage Forms

What are Mortgage Forms?

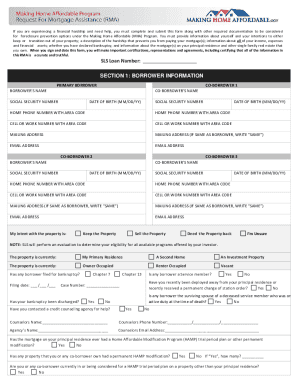

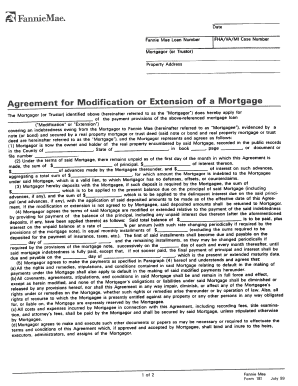

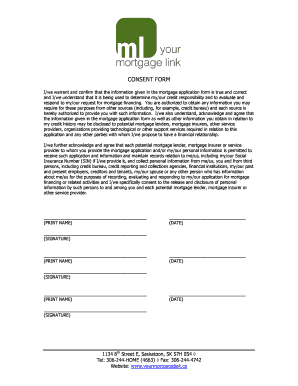

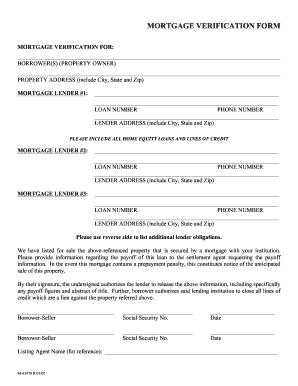

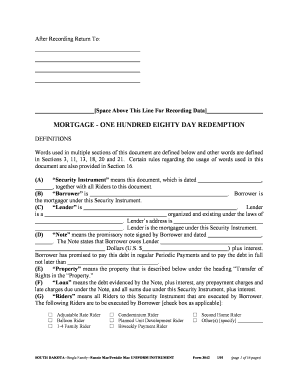

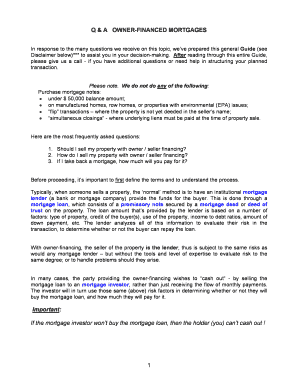

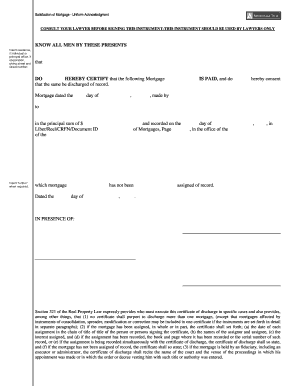

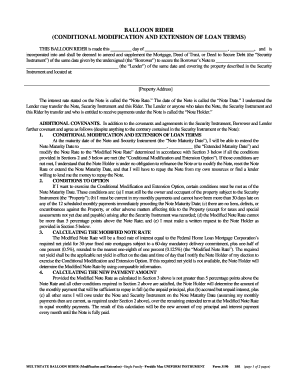

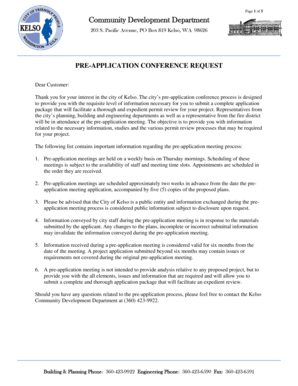

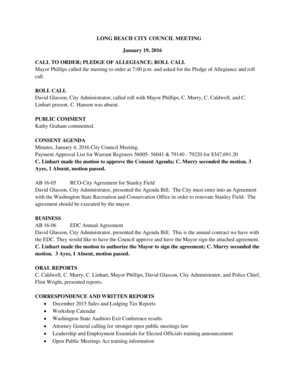

Mortgage forms are legal documents that are used when obtaining a mortgage loan. These forms help facilitate the process of borrowing funds to purchase a property. They contain important information about the terms and conditions of the loan, the property being purchased, and the obligations of both the borrower and the lender.

What are the types of Mortgage Forms?

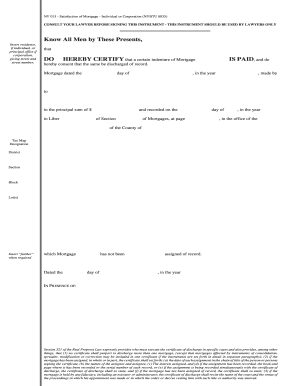

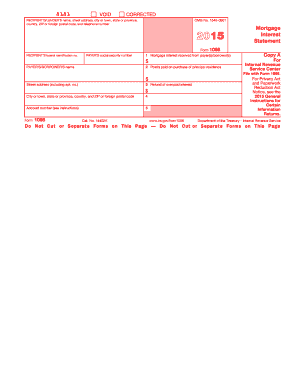

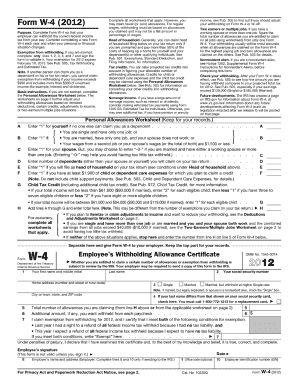

There are several types of mortgage forms that may be required during the loan process. Some common types include:

How to complete Mortgage Forms

Completing mortgage forms can seem daunting, but with the right guidance, it can be a straightforward process. Here are some steps to help you complete mortgage forms:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.