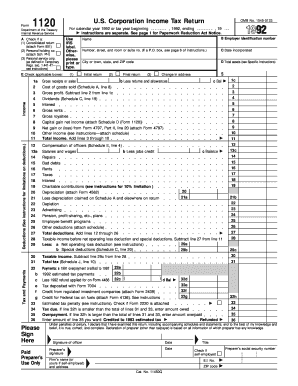

Tax Form 1120

What is tax form 1120?

Tax form 1120 is an IRS document that corporations use to report their income, deductions, and taxes. It is also known as the U.S. Corporation Income Tax Return. By filing this form, businesses provide the IRS with a comprehensive overview of their financial activities for the year.

What are the types of tax form 1120?

There are two main types of tax form 1120: 1. Form 1120: This is the standard form used by most corporations to report their income, deductions, and taxes. 2. Form 1120S: This form is specifically designed for S corporations, which are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

How to complete tax form 1120

To complete tax form 1120, follow these steps: 1. Gather all necessary financial documents, including income statements, expense records, and balance sheets. 2. Fill out the general information section, including the corporation's name, address, and EIN (Employer Identification Number). 3. Enter the corporation's income and deductions in the corresponding sections. 4. Calculate the corporation's tax liability and make any required estimated tax payments. 5. Complete any additional schedules or forms that are required based on the corporation's specific circumstances. 6. Review the completed form for accuracy and completeness. 7. Sign and date the form before submitting it to the IRS. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.