Email Independent Contractor Agreement

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

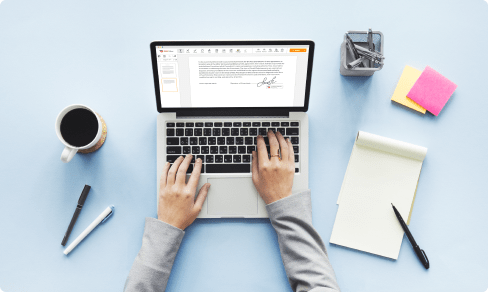

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Introducing Independent Contractor Agreement Email Feature

Upgrade your contracting process with our new Independent Contractor Agreement Email feature. Say goodbye to traditional paperwork and hello to a streamlined, efficient solution.

Key Features:

Automated Email Generation

Customizable Contract Templates

Electronic Signature Capability

Potential Use Cases and Benefits:

Hiring Independent Contractors Quickly and Easily

Reducing Administrative Burden

Ensuring Compliance with Legal Requirements

Simplify your contractor agreements, save time, and improve your workflow with our Independent Contractor Agreement Email feature. Take control of your contracting process and start enjoying the convenience and efficiency today.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

How to Email Independent Contractor Agreement

01

Go into the pdfFiller site. Login or create your account for free.

02

Having a protected online solution, you can Functionality faster than before.

03

Go to the Mybox on the left sidebar to access the list of your documents.

04

Pick the template from the list or press Add New to upload the Document Type from your desktop computer or mobile phone.

As an alternative, you may quickly transfer the necessary sample from well-known cloud storages: Google Drive, Dropbox, OneDrive or Box.

As an alternative, you may quickly transfer the necessary sample from well-known cloud storages: Google Drive, Dropbox, OneDrive or Box.

05

Your form will open inside the feature-rich PDF Editor where you may change the sample, fill it up and sign online.

06

The highly effective toolkit enables you to type text on the document, insert and change images, annotate, and so on.

07

Use sophisticated capabilities to incorporate fillable fields, rearrange pages, date and sign the printable PDF document electronically.

08

Click on the DONE button to finish the modifications.

09

Download the newly created file, share, print, notarize and a lot more.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Elizabeth Davidsmeier

2020-09-11

This made filing my documents SOOO much…

This made filing my documents SOOO much easier! It also looks so much more professional than handwriting or typing in. Was so happy to find this.

Nolan M.

2020-05-07

Great improvement on traditional Adobe products.

Good experience. I would recommend this to other in lieu of mainstream products.

Simple, easy to use and operates seamlessly with other programs. It also maintains the appropriate information for future use in other forms.

At times, information is lost when downloading forms from websites or is not saved when transmitting via email.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can independent contractors use company email?

Many organizations provide company email to independent contractors to ease communications. When you can only direct or control the result of someone's work and not what will be done and how it will be done, then the worker is typically defined as an independent contractor. These are self-employed workers.

Do independent contractors have to follow company policies?

You are not an independent contractor if you perform services that can be controlled by an employer -- what will be done and how it will be done, the IRS rule says. ... And many employers increasingly are requiring independent contractors to behave like employees.

Do independent contractors have to follow dress code?

Independent contractors are not subject to minimum wages, overtime compensation, employee benefits or tax withholding, so don't include this language. Promises of future employment. ... Independent contractors are not subject to workers' compensation in the event of injury. Dress code and disciplinary policies.

Do independent contractors have rights?

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

Do independent contractors use their own equipment?

You provide equipment or supplies: A hallmark of independent contractors is the fact they supply their own tools, equipment and supplies. After all, contractors are, by definition, independent professionals. It makes sense they would have their own ladder, laptop or lawn mower.

Can you tell an independent contractor when to work?

Here are seven warning signs your contractor might actually be an employee under the law: You define the work hours: Generally, independent contractors do the job as they see fit. They set their own hours and work how and when they want. And they should be paid by the project -- never on an hourly basis.

Can an independent contractor be a company?

An independent contractor can itself be a business with employees; however, in most cases in the United States independent contractors operate as a sole proprietorship or single-member limited liability company.

Can a corporation be an independent contractor?

An independent contractor is someone who is working for someone else and who provides services, but who is not an employee. ... An independent contractor can be any type of business entity (sole proprietor, corporation, LLC, partnership), but most independent contractors are sole proprietors.

Does an independent contractor need a business license?

Independent contractors and freelancers must comply with several laws. ... At a minimum, do these three things when you're first starting out as an independent contractor: Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession).

What qualifies someone as an independent contractor?

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

Other ready to use document templates

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.