Last updated on

Jan 19, 2026

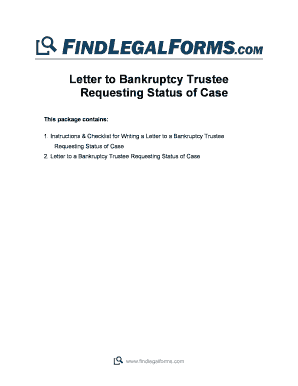

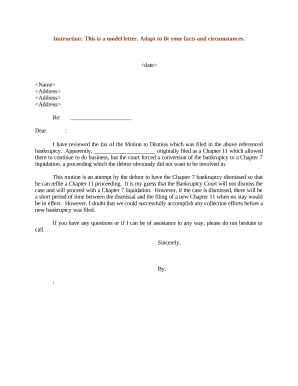

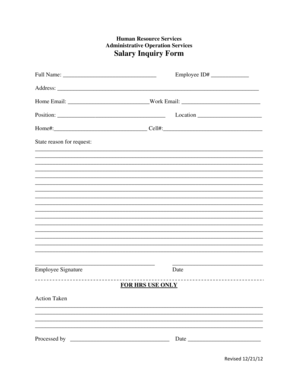

Customize and complete your essential Letter Bankruptcy Inquiry template

Prepare to streamline document creation using our fillable Letter Bankruptcy Inquiry template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

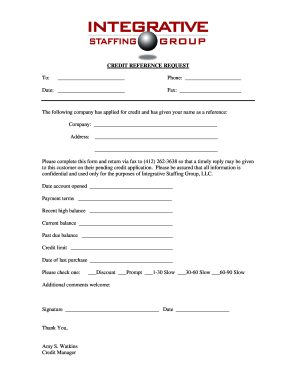

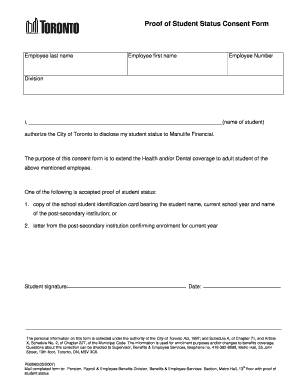

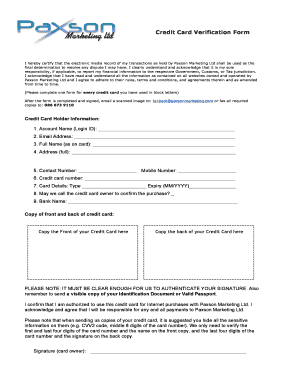

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Essential Letter Bankruptcy Inquiry Template

Are you facing bankruptcy and need to communicate with creditors effectively? Our Customize and Complete your Essential Letter Bankruptcy Inquiry Template is designed to help you navigate this challenging time with clarity and confidence. This tool provides you with a professional framework to express your financial situation and inquiries.

Key Features

Easy customization options to fit your specific needs

Pre-written sections ensure all critical information is included

Clear format that enhances readability

Option to add personal touches for a more human touch

Guidance on legal language to use when necessary

Potential Use Cases and Benefits

Contacting creditors to discuss payment options

Requesting account information for pending debts

Inquiring about the status of your bankruptcy case

Communicating with financial advisors for assistance

Providing necessary documentation to legal representatives

This template streamlines your communication, reduces confusion, and allows you to focus on your financial recovery. By using our tool, you minimize the stress associated with bankruptcy inquiries and present a clear case to your creditors. You are not alone in this process, and with our template, you can take charge of your financial communication effectively.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to build a Letter Bankruptcy Inquiry

Creating a Letter Bankruptcy Inquiry has never been easier with pdfFiller. Whether you need a professional forms for business or individual use, pdfFiller offers an easy-to-use solution to build, customize, and handle your paperwork effectively. Utilize our versatile and editable templates that align with your precise demands.

Bid farewell to the hassle of formatting and manual editing. Employ pdfFiller to effortlessly craft accurate forms with a simple click. Start your journey by following our detailed instructions.

How to create and complete your Letter Bankruptcy Inquiry:

01

Register your account. Access pdfFiller by signing in to your account.

02

Search for your template. Browse our comprehensive collection of document templates.

03

Open the PDF editor. Once you have the form you need, open it up in the editor and use the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can choose from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Include text, highlight areas, add images, and make any required adjustments. The user-friendly interface ensures the procedure remains smooth.

06

Save your edits. Once you are happy with your edits, click the “Done” button to save them.

07

Share or store your document. You can deliver it to others to eSign, download, or securely store it in the cloud.

To conclude, creating your documents with pdfFiller templates is a straightforward process that saves you time and ensures accuracy. Start using pdfFiller right now to take advantage of its powerful features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Why did I file a bankruptcy letter?

Bankruptcy is a legal process to help people who owe money, or debtors, get relief from debts they cannot pay and, at the same time, help people who are owed money, or creditors, get paid from assets property the debtor has.

What is the deadline for objecting to bankruptcy discharge?

Under Federal Rules of Bankruptcy Procedure Rule 4004, a trustee or creditors have sixty (60) days after the first date set for the 341(a) Meeting of Creditors to file a complaint objecting to discharge.

How to write a letter for bankruptcy?

Key Elements to Include in the Letter. A bankruptcy letter should be clear and concise and provide all the necessary information. It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed.

Can I dispute a discharged bankruptcy?

A legitimate bankruptcy cannot be disputed, so you'll need to wait for it to leave the report unless you can prove that some aspect of the bankruptcy is listed incorrectly in your credit report.

How do I object to bankruptcy discharge?

To object to the debtor's discharge, a creditor must file a complaint in the bankruptcy court before the deadline set out in the notice. Filing a complaint starts a lawsuit referred to in bankruptcy as an "adversary proceeding."

How do I force a debtor into bankruptcy?

As a petitioning creditor you may file an involuntary case against the debtor unless the debtor has twelve or more creditors, in which case you need at least two other creditors to join in the petition. If the debtor's answer asserts that there are twelve or more creditors, then pursuant to Fed.

How often do creditors object to discharge?

Creditors rarely object to discharge, but when they do, they can prolong the process and prevent the debtor from having certain debts discharged.

What is an objection in bankruptcy?

If an objection gets filed, the burden shifts to the objecting party to prove to the court that the claim is invalid and should not be paid. Some of the more common reasons to object to a proof of claim include: The creditor fails to attach sufficient documentation to prove that a debt is owed.

How to write a debt recovery letter?

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc); How do I write a debt collection letter? Swipe file samples | Chaser Chaser blog how-do-i-write-a-de Chaser blog how-do-i-write-a-de

How do I write a letter to reduce payment?

Due to my financial hardship and in order to meet necessary household expenses plus credit payments, I am asking each creditor to accept a reduced payment for the next (#) months on my debt. By that time I hope to be back to work. If my situation improves sooner, I will notify you at that time. Reduced Payment Request Sample Letter To Your Creditors Template Credit Counselling Society dealing-with-creditors reduc Credit Counselling Society dealing-with-creditors reduc

How do I write a letter to get out of debt?

Unfortunately, my circumstances are unlikely to improve in the foreseeable future and I have no assets to sell to help clear my debt. I am therefore asking you to consider writing off my debt as I can see no way of ever repaying it. If you are unable to agree to this, please explain your reasons. Request to write off a debt - letter - Citizens Advice Citizens Advice debt-and-money R Citizens Advice debt-and-money R

How to write a letter explaining bad credit?

Provide a clear and concise explanation of the circumstances that led to your bad credit. For example, did you lose your job or experience a significant medical expense? Providing this context can help the employer understand why your credit history looks the way it does. How to Write a Letter Explaining Bad Credit to an Employer - The Neuron The Neuron write communication lette The Neuron write communication lette