Amend Us Phone Notice Gratuito

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

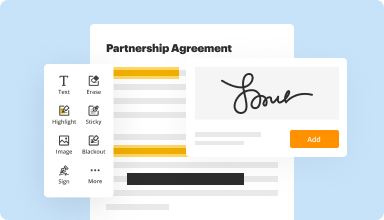

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

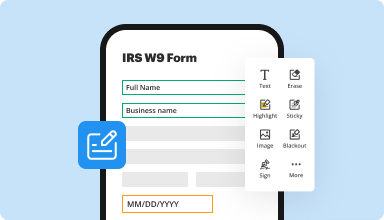

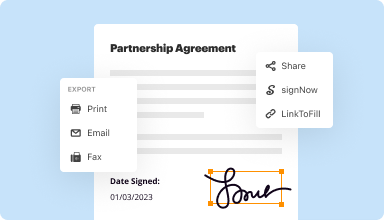

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

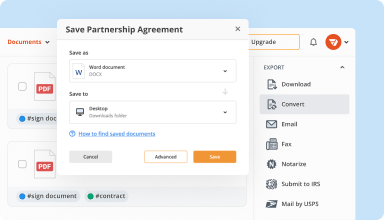

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

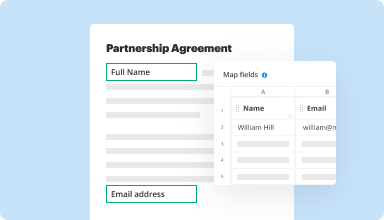

Collect data and approvals

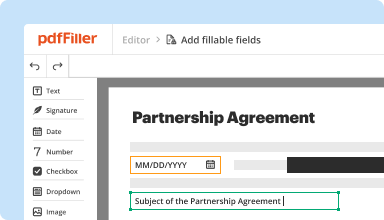

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

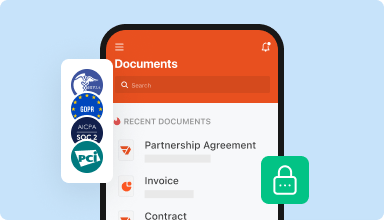

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I needed this for an emergency document and paid for it thinking I probably will not use this much....but was I wrong. I use it all the time and LOVE IT!!!

2016-06-15

I LOVE THIS SERVICE SO FAR. IT HAS ALLOWED ME TO CREATE THE DEMOGRAPHICS FORM FOR TAX PAYERS IN THE LAY OUT THAT I ALWAYS DESIRED. THE BONUS TO THE LAYOUT IS THE PDF FILL IN THAT ALLOWS YOU TO INSTRUCT THE CLIENT RIGHT WITHIN THE CELL. THE SEND TO SIGN FEATURE IS AMAZING IT ALLOWS ME TO OFFER A FASTER SERVICE WITH OUT HAVING TO HAVE A PERSONAL INTERVIEW.

2017-01-11

FINDING NEW THINGS I CAN DO EVERY DAY. WOULD LIKE TO SEE MORE HELP / TROUBLESHOOTING GUIDES OR A VIDEO TUTORIAL SHOWING THE DIFFERENT PROCESSES YOU CAN DO WITH PDFFILLER.

2019-11-01

Simple Way To Edit PDF Files Right on Your Computer

I don't need this service too often but it is nice to have the ability to edit and fill PDF files when I do need it. It's great that you can edit, annotate and even post notes right onto the PDF files. Not too much else to tell - it just does what I need it to do.

I like best the ability to edit and fill PDF files from the convenience of my own computer. The program is easy to use and provides all the functions I need.

When filling in PDF forms it would be nice if the software could read the empty fields and tab directly to the appropriate locations rather than needing to manually place the cursor and then drag and drop to dial in the exact spot you want the text to land.

2019-09-07

An easy and effective tool for PDF files in daily office work.

It's an amazing alternative of Adobe's pro version and I don't need any file to install on my system. I can do my work through this application on my web browser itself.

It is very easy to use. It helps to add notes to your PDF files easily. It also has the feature of importing files from a URL. After editing your pdf file you can directly send it to your email id.

Its inefficiency of uploading multiple files in one operation. Sometimes it become slow when uploading slightly large file irrespective of internet speed.

2018-11-27

literally this app has changed my life and has made it so much easier and convienant for me always being on the go and now i dont really need to be on the go its just right here everything in one

2021-09-05

Great app. It has everything needed and then some. I can see using this app in many different ways and situations as a business person and as an individual user. Thanks for creating this piece of art!!!

2021-08-15

She was incredible she Should be the example on how to train your customer service representatives and she needs a raise maybe even a new house, definitely 🎂 at the leAst

She was incredible she should be given a raise, a brand new house, a new puppy, and definitely a homemade cake. you should use her to train for your customer service experience there’s not very many people that are helpful as she has been and actually help the problem without getting an attitude and saying it’s your fault.

2021-02-16

Excellent product

Excellent product, Quick and simple to use. Integrates with google drive and my other products with ease. Highly recommend! Add on services have value as well.

2021-02-03

Amend Us Phone Notice Feature

The Amend Us Phone Notice feature simplifies communication for your business by keeping customers informed and engaged. With this tool, you can easily notify customers about important updates, changes, or promotions directly through phone notices.

Key Features

Automated phone notices for timely updates

Customizable templates for personalization

Multilingual support to reach diverse customers

User-friendly interface for easy setup

Real-time tracking of notice delivery

Potential Use Cases and Benefits

Inform customers about appointment reminders

Notify users about service changes or interruptions

Send out promotional offers to enhance engagement

Provide important updates during emergencies

Facilitate feedback collection for service improvement

By using the Amend Us Phone Notice feature, you solve the challenge of reaching customers effectively. Instead of relying on emails or texts that might get overlooked, phone notices ensure your message gets delivered directly. This feature helps you keep your customers informed and boosts their satisfaction while reducing missed appointments and complaints.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I amend my state tax return?

How do I amend my state tax return? First, fill out an amended federal income tax return, Form 1040X. Then, get the proper form from your state and use the information from Form 1040X to help you fill it out. Like the IRS, your state uses a special form for an amended return.

What if I made a mistake on my state tax return?

You might be due a refund. To claim a refund, you typically must file your form 1040X within three years after the date you filed your original return or within two years after the date you paid the tax, whichever is later. If you file after the statute of limitations has run, you may be out of luck.

What happens if you make a mistake on your state tax return?

Making a mistake on your tax return could end up costing money. Whether it's an additional tax bill or a penalty for a miscalculation, HMRC's system of penalties could be as much as 70% of the tax owed. If you miss it, you'll be fined £100 even if there is no tax to pay, or if the tax due is paid on time.

Can you submit your taxes if you made a mistake?

What to do if you made a mistake on your taxes. You can fix the problem yourself by filing an amended tax return on Form 1040-X. The process is simple: Fill out a 1040-X form, complete it, and mail it to the IRS. Unfortunately, electronically filing an amended tax return is not possible.

What if my taxes were filed wrong?

To amend your taxes, you'll use a form called a 1040X. If your mistake results in you owing additional taxes, then you should complete the 1040X immediately in order to avoid penalties and late fees. The IRS will typically take note of math errors and missing documents on their own.

Can you go to jail for doing your taxes wrong?

So late filing penalties are much higher than late payment penalties. The IRS will not put you in jail for not being able to pay your taxes if you file your return. Tax Evasion: Any action taken to evade the assessment of a tax, such as filing a fraudulent return, can land you in prison for 5 years.

Can I amend my return online?

If you need to amend tax return(s) that you prepared using an online program, you might be able to prepare an amended return using that program. However, the IRS doesn't accept e-filed amended returns. You'll need to print and mail the amendment using Form 1040X.

How do I amend my 2019 tax return?

Step 1: Collect your documents. Gather your original return and all new documents. Step 2: Get the right forms together. Download the necessary forms for the tax year you are amending. Step 3: Fill out a 1040X. Download a current IRS Form 1040X, Amended U.S. Individual Income Tax Return. Step 4: Submit your amended return.

#1 usability according to G2

Try the PDF solution that respects your time.