Convert On Salary Record Gratuito

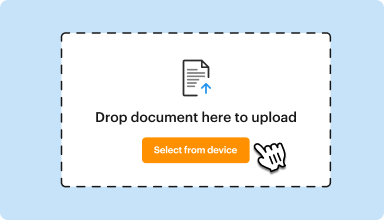

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

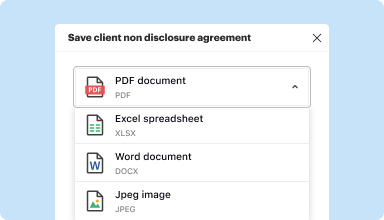

Edit, manage, and save documents in your preferred format

Convert documents with ease

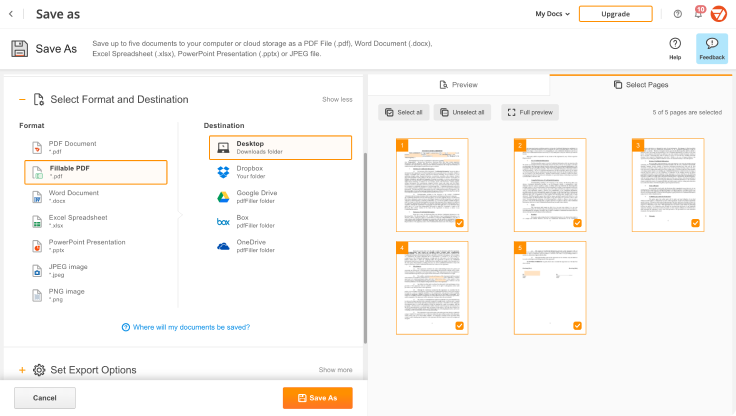

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

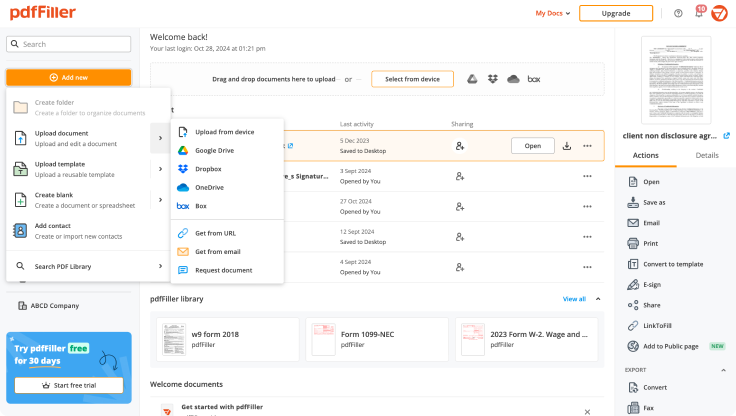

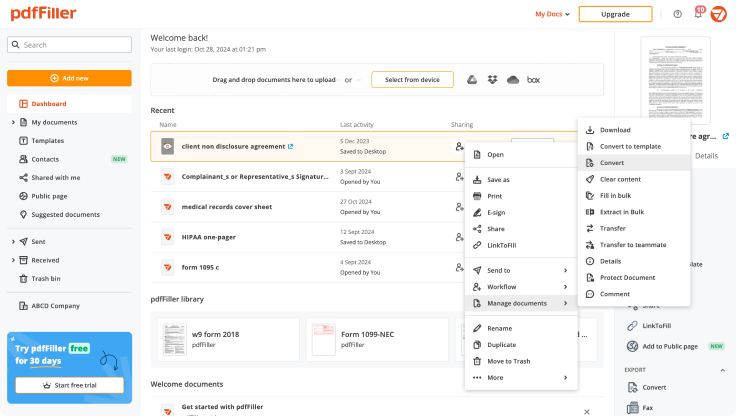

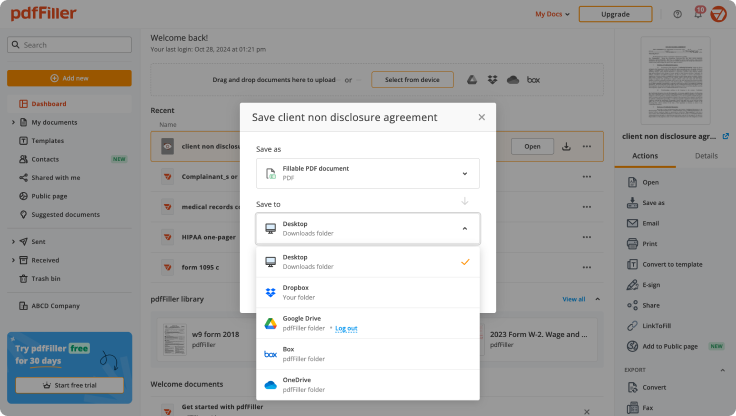

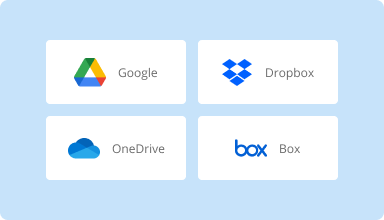

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

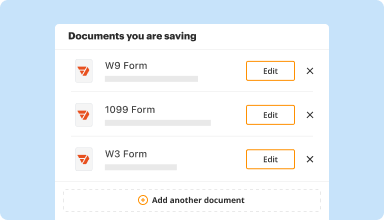

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

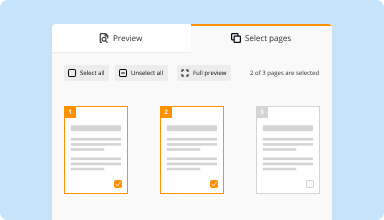

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

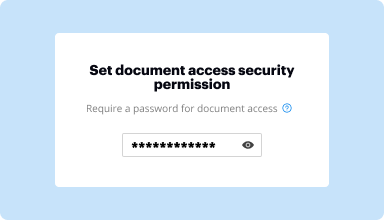

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I love it! my only gripe is not being able to send emails with pdf's as normal attachments. I have to send a lot of PDF's to insurance companies and they complain that their systems cannot open the PDF's as sent from pdffiller so I have to take the time to download them from pdffiller, upload them to my CRM, and then attach them in emails. It would be great to be able to save that time. But other than that I am very impressed with the service.

2019-02-14

Easy to Use

It's kind of a time saver in the end with not have to use the typewriter or hand write them, would be easier though if you didn't have type each form, if they are the same it should copy the data onto each one.

I liked that I didn't have to pull out (yes it's a dinosaur) typewriter to fill out my 1099's every year any more once I found this program online. I can also use it for other forms as well.

I don't like that you have to retype each 1099 for each copy of the form, it should carry them forward to each copy and you just review them for differences.

2019-03-12

Need a dark background theme and to improve the highlighter color so that the text remains "clear" after highlighting! "Everything thing else is very good!"

2023-08-21

One of the best out there to manage digital files.

It consists everything that a working individual needs for working from data to managing data in various file forms and conversion of data into different needs.

The pricing of pdfFiller can be revised as it is a bit expensive to afford for some users.

2023-03-07

Very useful tool

Useful app for managing all your pdf tasks. I always use this app to sign. Very recommended.

It doesn't have many free features, you have to pay for the good ones.

2023-02-12

Really easy to use

The web interface is really easy to use.

The "wow" feature for me is that you can setup a default signature and copy and paste it on documents as you need.

This has saved me from losing time with some legal documents I need to sign while I'm away.

2022-09-01

Absolutely worth it!

Wonderful program. Slight learning curve, but then it's off to the races. Worth it if you are editing PDF's on the daily. Great save, download and share options all at once. Thank you for a great program!!

2021-06-29

Thomas from PDFFILLER did an AMAZING…

Thomas from PDFFILLER did an AMAZING job helping me resolve my matter. He was professional and helped me as a consumer. I will definitely keep doing business with you guys!!

2021-01-12

I was happy that I found my forms, but you should have said from the first that it was a trial, I do not remember being told that It would cost me, but that's ok, I filled out and printed 3 N-311 Hawaii forms, which printed 5 sheets, I will gladly pay for them, but I do not want to continue my subscription to pdfFiller. I don't think I will ever need it again, but I do thank you for being there when I needed you.

2020-06-02

Convert On Salary Record Feature

The Convert On Salary Record feature simplifies your payroll processes by streamlining salary calculation and record management. It allows businesses to easily convert salary data for various needs, ensuring accuracy and efficiency in financial reporting and employee management.

Key Features

Automated salary conversion based on predefined parameters

Seamless integration with existing payroll systems

Real-time updates to salary records

User-friendly interface for easy navigation

Secure data handling to protect employee information

Potential Use Cases and Benefits

Accountants can maintain accurate payroll records and produce reports with ease

HR departments can quickly adjust salaries and communicate changes to employees

Businesses can improve compliance with local regulations concerning payroll

Managers can enhance decision-making through precise financial insights

Organizations can save time and reduce errors in salary calculations

By implementing the Convert On Salary Record feature, you address common challenges in payroll management. This tool helps you eliminate manual errors, reduces time spent on repetitive tasks, and empowers you to make informed financial decisions. It ultimately leads to better employee satisfaction and trust, as staff see the transparency in how their salaries are managed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you calculate hourly rate for salaried employees?

To calculate the hourly rate for a salaried employee, divide the yearly salary by 52. For example, divide an annual salary of $37,440 by 52, which equals a weekly pay amount of $720. When the employee normally works 40 hours per week, divide the weekly pay of $720 by 40 to calculate the hourly rate.

How do you calculate hourly rate from monthly salary?

If you know you work 40 hours a week for 50 weeks a year then you would multiply the hourly stated wage by 2,000 to get the annual total & then divide by 12 to get the monthly equivalent.

How do you calculate hourly wage from monthly salary?

For hourly employees, the calculation is a little more complicated. First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week, and then multiply the total by 52. Now that you know your annual gross income, divide it by 12 to find the monthly amount.

How do you calculate your hourly rate?

To calculate the hourly rate for a salaried employee, divide the yearly salary by 52. For example, divide an annual salary of $37,440 by 52, which equals a weekly pay amount of $720. When the employee normally works 40 hours per week, divide the weekly pay of $720 by 40 to calculate the hourly rate.

How do you calculate hourly rate from gross pay?

When figuring the hourly rate, use the gross pay to the employee, rather than after-tax pay. Multiply the number of overtime hours by 1.5 because overtime hours pay time and a half. For example, if the employee worked 40 regular hours and 10 overtime hours, multiply 10 by 1.5 to get 15.

How do you calculate daily salary from monthly salary?

Daily Rate = (Monthly Rate X 12) / Total working days in a year.

How do I calculate my hourly pay?

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay.

How do I calculate my biweekly salary?

Biweekly to annual: To convert biweekly income to annual income you would typically multiply your biweekly income by a number between 24 and 26. There are 52 weeks per year. Divide weeks by 2 in order to covert them into biweekly pay periods.

#1 usability according to G2

Try the PDF solution that respects your time.