Extend Wage Document Gratuito

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

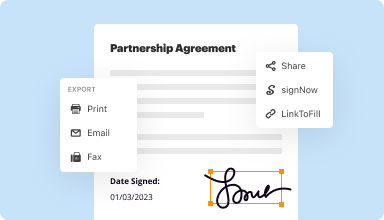

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

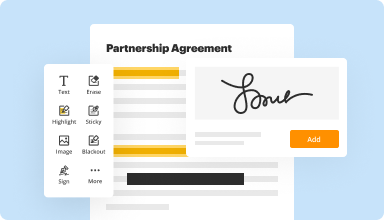

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

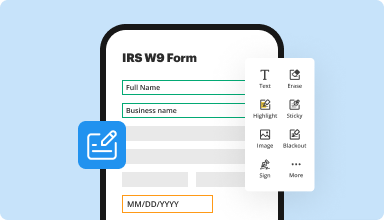

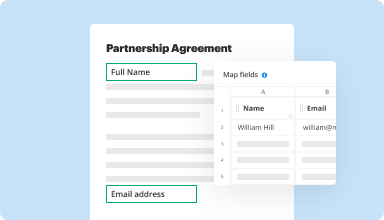

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

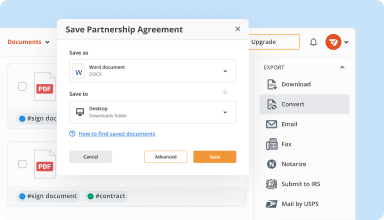

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

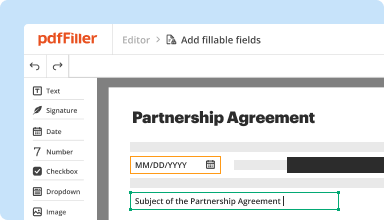

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

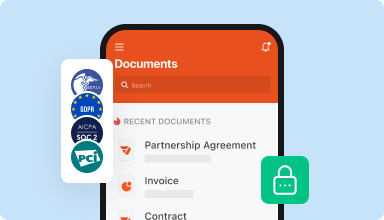

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

cant get page to print. it says its been sent to printer, but doesn't print. Thought it could be my printer, but I checked it and it works fine. had to fax page to myself to get it to print.

2015-11-07

2 things I would like to see changed. The original custom color selector was better than the these presets that are available now. The other is the sizes of the font jump by twos, an input to put in a custom font size would be great

2017-08-01

My handwriting is horrible! PDFfiller not only solves that problem, inn even the smallest print, but is much more convenient too. A big help when you've got some chores to do!

2018-12-24

It.s a verry usefuly app, but i think is a little too expensive! So, please do something with the prices! We are glad to work with you! Thanks for your work.

2019-08-02

Its a good overall program although I had issues uploading my pdf assignment for school, and when I submitted it online, the pdf was completely blank. Not sure why this program did that.

2019-11-12

It is the best PDF to Word conversion I have ever seen. The resulting Word doc was able to be compared with another PDF conversion, giving me a near perfect comparison. This is what I was after and PDFfillre delivered.

2020-03-29

What do you like best?

I like the accessibility of the application. I can access from anywhere by just using my browser.

What do you dislike?

Sometimes the sizing is a bit tricky and I need to play around with the edits to make it work.

What problems are you solving with the product? What benefits have you realized?

I am able to take pdf documents, to which I have lost or never had the source file, and easily change them to what I need. Also, another great use is to fill-in forms in forms to which i only have hardcopy.

I like the accessibility of the application. I can access from anywhere by just using my browser.

What do you dislike?

Sometimes the sizing is a bit tricky and I need to play around with the edits to make it work.

What problems are you solving with the product? What benefits have you realized?

I am able to take pdf documents, to which I have lost or never had the source file, and easily change them to what I need. Also, another great use is to fill-in forms in forms to which i only have hardcopy.

2020-02-03

PDF Filler Support

Used this company (PDFFiller) today and needed support assistance to clear up a situation on my account. The CUSTOMER SUPPORT TEAM were VERY helpful and corrected the issue immediately. Thank you for yourprofessionalism!!

2019-03-23

a little hard to figure out at first but once I got the hang of it was great. Like the variety offorms tonselect from, some forms could be a bit more specific but other than thaat I love the program.

2021-05-15

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can I get an additional tax extension?

You can request an additional extension of time to file taxes beyond the six-month period, but you cannot ask for multiple tax extensions. If the IRS doesn't receive Form 4868 first, it will approve your request for an additional tax extension only in cases of undue hardship.

Can I file a second extension with the IRS?

No, you don't absolutely have to file your tax return with the IRS by mid-April each year. The IRS will obligingly move this deadline back for you by six months. Up until 2005, it used to be that you could request a second extension of time to file your personal income tax return with the IRS.

Can you get more than one tax extension?

You can request an additional extension of time to file taxes beyond the six-month period, but you cannot ask for multiple tax extensions. If the IRS doesn't receive Form 4868 first, it will approve your request for an additional tax extension only in cases of undue hardship.

How many times can I file a tax extension?

Traditionally, federal tax returns are due on April 15 or the first business day thereafter. However, the IRS does grant you an automatic six-month extension to file your taxes every year, as long as you complete Form 4868.

Can I file a second extension on my business taxes?

The simple answer to this question is no. There is a lot of confusion regarding second tax extensions. The IRS used to offer what they called a second extension. The second-extension granted businesses an additional two months to file their taxes. Now, the IRS offers a one-time tax extension of six months.

What happens if I miss the tax extension deadline?

If you missed the tax deadline but are due a refund there is no penalty. The government is happy to hold on to your money, interest-free, for a bit longer. In fact, you have up to three years from the filing deadline to complete a return and get that refund. Don't delay too long though.

Can I file another tax extension after October 15?

You can't extend your tax deadline past October 15, but you can still file your return after October. Just remember that after the October deadline, you'll have failure-to-file penalties added to your account until you file your tax return.

What happens if I file after October 15?

The maximum for this penalty is 25% of your unpaid taxes. You must file or file your 2018 Tax Return by the extended deadline of October 15, 2020, or you will begin to face the failure-to-file penalty, which is 5% of your balance due for every month (or part of a month) in which your taxes go unpaid.

#1 usability according to G2

Try the PDF solution that respects your time.