ez Tax Return Split PDF shortcut alternative Gratuito

Use pdfFiller instead of ez Tax Return to fill out forms and edit PDF documents online. Get a comprehensive PDF toolkit at the most competitive price.

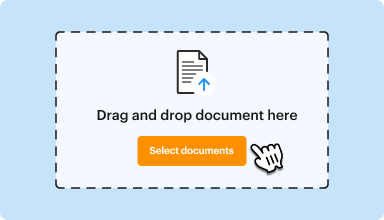

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

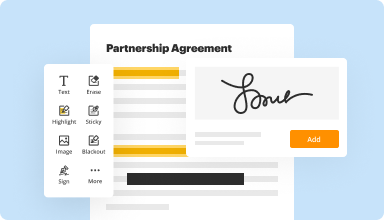

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

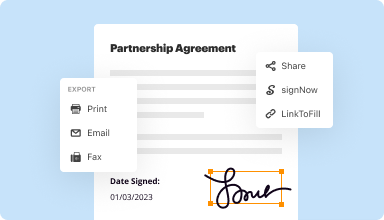

Fill out & sign PDF forms

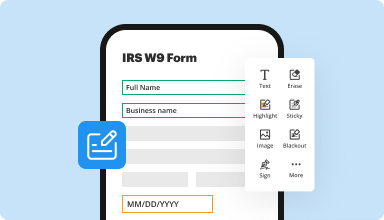

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

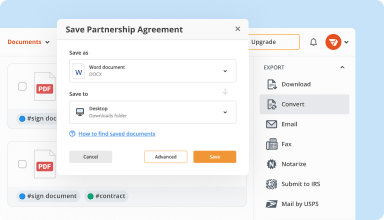

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

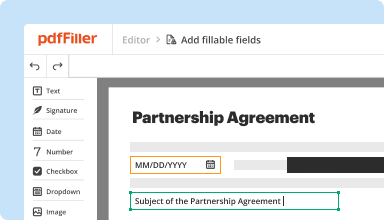

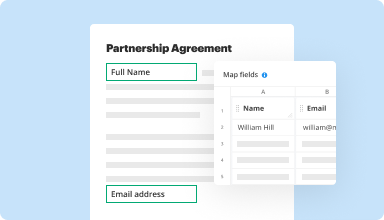

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

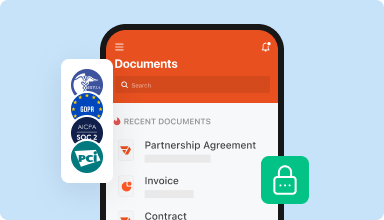

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I found this site by using Google. I then had a few questions that were resolved by chatting with an agent. The agent gave me a 3 day free trial. I was able to do what I needed and purchased a subscription.

2017-09-02

simply the best online PDF document…

simply the best online PDF document handling online. I have had zero problems with this program and will continue to use it over the other available options online.

2020-01-13

This is the only app I can erase and…

This is the only app I can erase and fill-in easily so I love it. However, the signing function is glitchy so I use Docu or Adobe sign for that. Still, soooo worth it b/c of the Erase and Fill features.

2019-11-27

Spectacular PDF Editing Program!

I work with PDFs every day as part of my job and being able to unlock PDFs or make edits has become so easy and seamless with this program. I could not do without it!

2024-11-05

Worth the money

I've been subscribing to this service for several years! I love it! It's nice to be able to start on my laptop or phone and pick up where I left off on the other device. The download notification feature is nice because it ensures the person got your email and actually downloaded the file. Will maintain my subscription for the immediate future.

2024-03-23

Very helpful and insightful about the…

Very helpful and insightful about the documented material I was in search for and needed. Very well rounded amount of diverse material. Definitely will be a great and very useful tool when it comes to my business

2021-02-16

Handy service. Swift support. I am amazed

Let me share with you my experience frankly. I needed to edit a one single pdf document. Found this service. Registered for a free trial. Edited the document swiftly and smoothly. And forgot about it. Till the moment I received a charge for the yearly subscription. Which, admittedly, is not low at all (though may be reasonable to those who use this service).Anyway, I contacted pdfFiller support team, and I was surprised by both: 1) the fact that they immediately agreed to issue a refund, as it met their policy (I canceled in less than 24 hours, actually, immediately) 2) that even though they told that I will receive the money back within 1-5 business days - I got it within a few minutes. I am perplexed. The only pity really is that I can't afford it

2020-12-23

Private individual, basic version

I'm using the basic version which obviously has some limitations but it's good for the tasks I have in hand

2020-11-07

It's essential for digital nomads

It's essential for digital nomads. Since my base is in the US. I rely on these solutions to continue operations in the US from abroad. I would integrate payment systems, especially with the banking networks to be able to send money orders or checks physically. And I would suggest connecting with virtual offices to be able to interact with clients in a virtual office setting. I'm thinking a virtual secretary solution... just some thoughts to improve. Abe

2020-06-24

Get documents done from anywhere

Create, edit, and share PDFs even on the go. The pdfFiller app equips you with every tool you need to manage documents on your mobile device. Try it now on iOS or Android!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

When should married couples file separate tax returns?

Eligibility requirements for married filing separately If you're considered married on Dec. 31 of the tax year, then you may choose the married filing separately status for that entire tax year. If two spouses can't agree to file a joint return, then they'll generally have to use the married filing separately status.

Is EZ tax return legit?

ezTaxReturn has been an Authorized IRS e-file Provider for 21 years and has successfully e-filed millions and millions of federal and state tax returns.

Can you do 2 separate tax returns?

You cannot file them separately. The amount of tax you owe is based on your total income for the year. If your total income was reported on one W-2 instead of two, the result would be the same. The only refund you are entitled to is the amount shown after entering both W-2s.

How do married couples split tax refund?

One solution is to prepare two married filing separate returns, figure out refunds based on that, and then apportion the actual refund based on that percentage. Or do the same for two single returns. Example: Married joint return has refund of $1400. Your MFS return has refund of $1200.

Do I have to split my tax return with my spouse?

Unless your divorce is final by December 31, your only filing options are a separate married return, a joint married return or in a few cases a return as head of household. It doesn't matter if you and your spouse are actually living apart.

What amount is determined by adding lines 1/2 and 3 of the 1040ez tax form?

On Line 4, add lines 1, 2 and 3 to get your Adjusted Gross Income (AGI). On Line 5, indicate whether someone can claim you (or your spouse if you're filing a joint return) as a dependent.

Do married couples get separate stimulus checks?

Checks will be $600 per person — or $1,200 for married couples filing jointly — and an additional $600 per child.

How to ez Tax Return Split PDF shortcut alternative - video instructions

#1 usability according to G2

Try the PDF solution that respects your time.