Protected Appoint Lease Gratuito

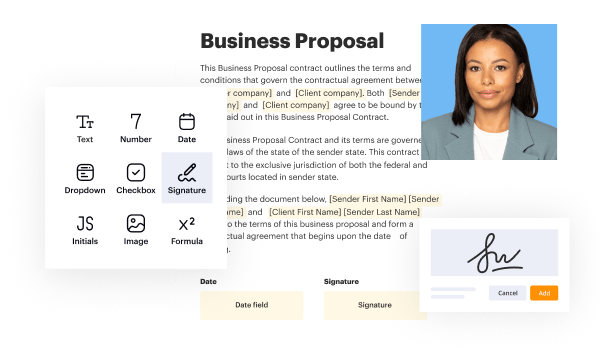

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

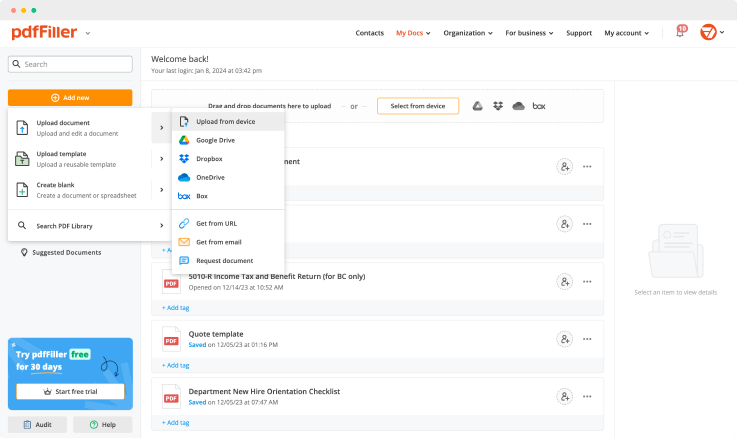

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

Generate your customized signature

Adjust the size and placement of your signature

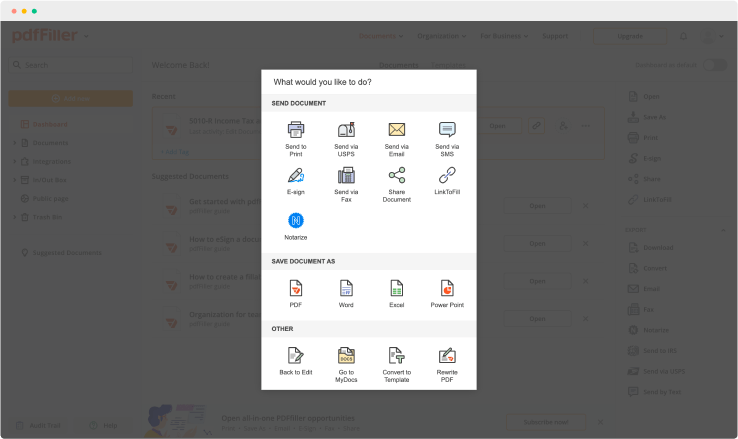

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

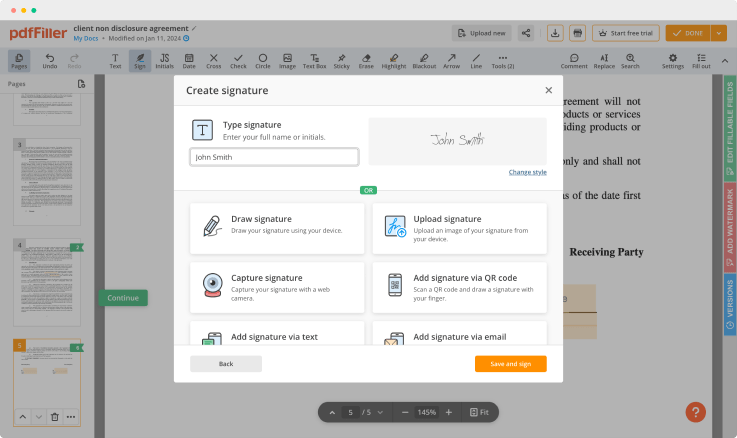

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

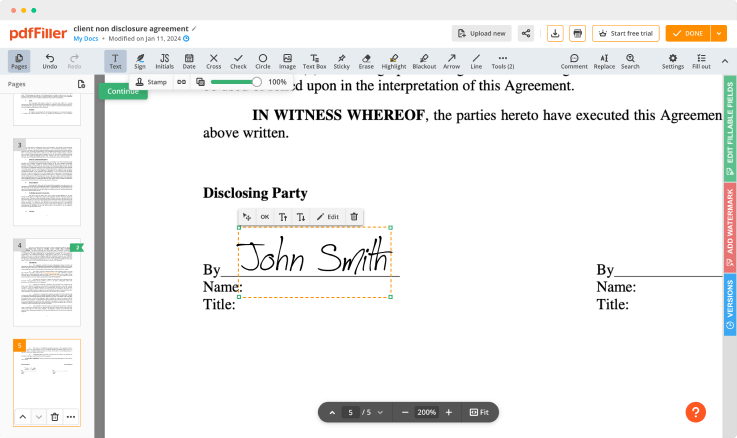

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Protected Appoint Lease Feature

The Protected Appoint Lease feature offers a reliable way to manage appointments while keeping your data secure. This tool streamlines the leasing process, giving you peace of mind as you connect with your clients. With this feature, you can easily safeguard sensitive information and maintain control over your leasing activities.

Key Features

Data encryption to protect sensitive information

User-friendly interface for easy navigation

Real-time appointment scheduling and updates

Customizable notifications to keep you informed

Compliance with legal standards for data protection

Potential Use Cases and Benefits

Real estate agents can securely manage client appointments and lease agreements

Property managers can coordinate viewings without risking data breaches

Tenants can keep track of lease renewals and appointments easily

Businesses can facilitate secure meeting arrangements with clients

This feature solves your problems by ensuring that your appointment scheduling is secure and efficient. You no longer need to worry about data breaches or missed appointments. With Protected Appoint Lease, you can focus on building strong relationships with your clients, knowing that their information is safe. Embrace a smarter way to manage your appointments today.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How are lease buyouts calculated?

Add sales tax to the residual value, as well as any fees. The residual value is the payoff amount for the lease--it's not your buyout amount. When you buy out a lease, you will need to pay sales tax. Add your local tax rate to that amount to arrive at the buyout value.

How is early lease buyout calculated?

Determine the residual value of the vehicle. This information will be found in your lease contract, as it was calculated at the beginning of the lease. Determine the actual value of the vehicle. Compare the residual value and the actual value. Account for license and registration fees. Account for sales tax.

Can I Buyout my car lease early?

At any point during your lease you have the option to buy the vehicle, called an early buyout. The leasing company will determine the price based on your remaining payments and the car's residual value. If the car's buyout price is lower than its market value, you're in good shape because you have some equity.

Can you negotiate a lease buyout?

You negotiate a lower buyout price Buying your leased car saves the leasing company shipping and auction fees. That's why, in some cases, they'll call and offer you a lower buyout price than what's in the contract. Banks writing leases may be more likely to negotiate than automakers' finance companies.

Why is lease buyout rate higher?

A lease buyout loan is financing for buying the car you leased, if the leasing company allows. Although a lease buyout loan could help you own a car you already know and love, these loans tend to come with higher interest rates than new car loans. And not all lenders offer them, so your options could be limited.

What is the lease buyout price?

The good news is that if you purchase your leased vehicle, you do not pay any mileage fees. For this reason alone, many lessees decide to purchase their leased cars. As an example, suppose your leased car's residual value (i.e. purchase option price) is $16,000, but it is worth only $14,000 on the open market.

How are lease payoffs calculated?

The payoff amount is calculated by considering the projected residual value of the car plus the amount that you still owe on it, including any interest. For example, if you were to lease a 2014 Buick Enclave 2WD for five years -- 60 months -- the projected residual value would be $12,200 at the end of your lease.

What is lease payoff?

The term lease payoff, in car leasing, refers to the process of ending a lease before the normal end-of-lease date. It's also called a lease termination or early termination.

Ready to try pdfFiller's? Protected Appoint Lease Gratuito

Upload a document and create your digital autograph now.