Report Amount Letter Gratuito

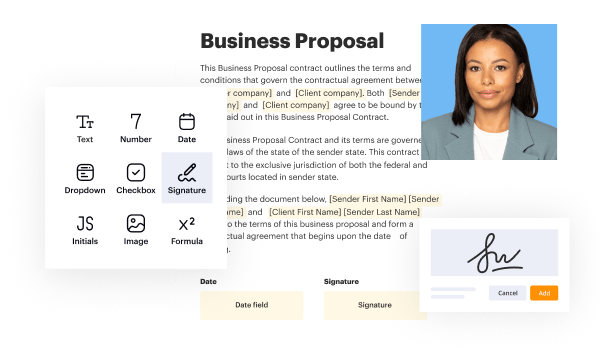

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

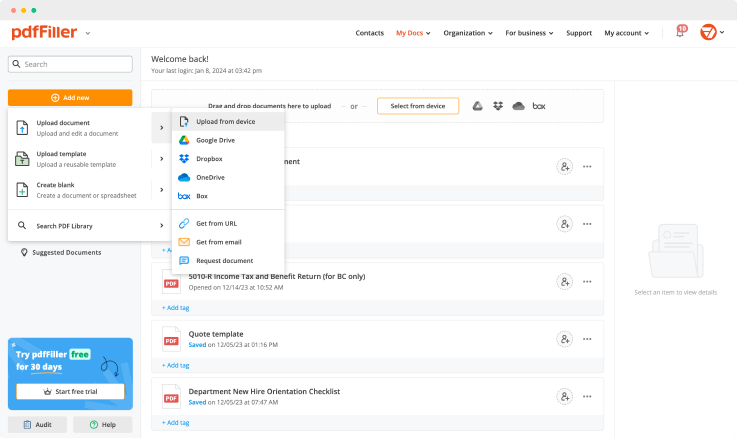

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

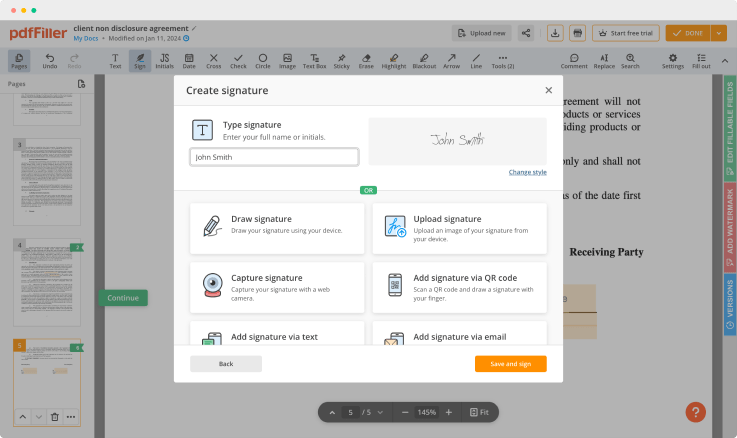

Generate your customized signature

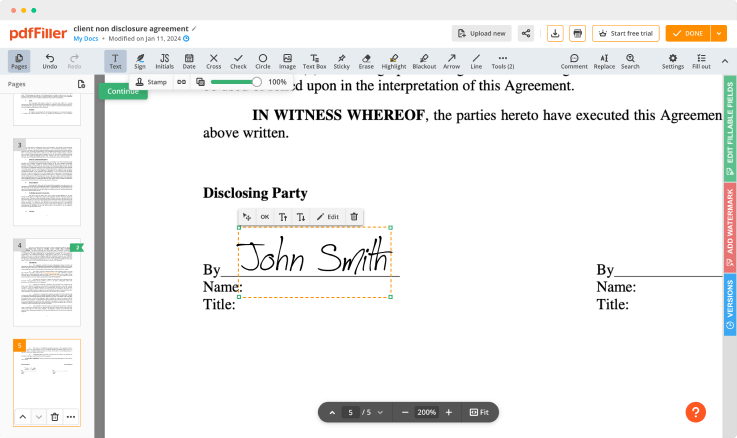

Adjust the size and placement of your signature

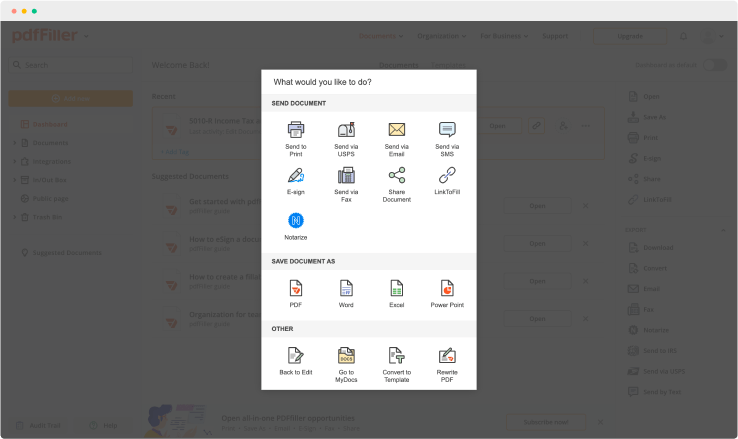

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

Video Review on How to Report Amount Letter

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Report Amount Letter Feature

The Report Amount Letter feature streamlines your financial reporting process, making it easier for you to generate detailed and accurate reports. With this tool, you can simplify your documentation and enhance your decision-making ability.

Key Features

Customizable templates for tailored reporting needs

Automated calculations to reduce manual errors

User-friendly interface that requires no special training

Instant generation and printing of reports

Secure data handling to protect your sensitive information

Potential Use Cases and Benefits

Generating financial reports for businesses to present to stakeholders

Creating personal finance summaries for better money management

Providing clients with clear and concise documentation in consultancy settings

Simplifying tax preparation by offering organized financial data

Enhancing transparency and accountability in financial planning

With the Report Amount Letter feature, you can address your documentation challenges effectively. Instead of struggling with spreadsheets and paper clutter, you can produce precise reports quickly and effortlessly. This solution not only saves time, but also boosts your confidence in the accuracy of your financial data.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is a 4464c letter?

This sample IRS tax notice was sent to one our members. IRS Letter 4464C notifies the taxpayer that the Integrity & Verification Operations is conducting a review of the filed tax return. The letter lets the taxpayer know the IRS received his or her income tax return and are verifying the accuracy.

What is 4464c?

IRS Letter 4464C notifies the taxpayer that the Integrity & Verification Operations is conducting a review of the filed tax return. The letter lets the taxpayer know the IRS received his or her income tax return and are verifying the accuracy.

What does a 4464c letter mean?

The IRS has indicated the 4464C letters are part of the screening program to combat stolen identity refund fraud and do not mean the taxpayer has been selected for audit. Both the IRS and the Department of Justice DOJ Tax Division have increased their efforts to combat stolen identity refund fraud.

Why is the IRS holding my refund for 60 days?

If the IRS thinks you made an error on your return, the IRS can change your refund. After 60 days, you'd need to file an amended return to reverse any errors and get your refund back. If the IRS thinks you claimed erroneous deductions or credits, the IRS can hold your refund.

How long can the IRS hold your refund for review?

In an effort to combat this, the IRS is now going to hold some refunds until February 15, 2020. The goal here is to see if two tax returns are filed for the same individual. If you're concerned you are a victim of identity theft, read our common IRS questions and answers here for more information.

What is an IRS 60 day review?

You don't need to take any action. Please do not call us until 60 days after the letter date and only if you haven't received your refund or heard from us by then. We recommend you review your return for any errors and file a corrected or amended return to correct the information.

What is a 4464c letter 2019?

I have gotten a 4464C LTR Letter form the IRS, what does it mean? It means the IRS has pulled your return for review, but it is not an audit. They are verifying the information reported on your tax return and matching documents they received from payers such as employers, banks, etc.

What is a 4464c letter 2018?

If you receive a 4464C Letter from the IRS, you aren't required to do anything. The letter indicates that if you haven't received your refund or been contacted by the IRS in writing within 60 days from the date of the letter you can call for more information.

Ready to try pdfFiller's? Report Amount Letter Gratuito

Upload a document and create your digital autograph now.