Safeguard Table Of Contents Settlement Gratuito

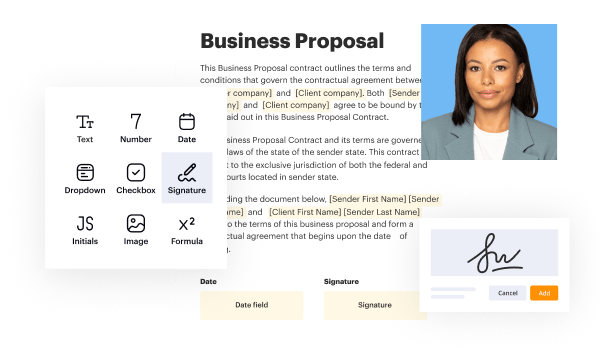

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

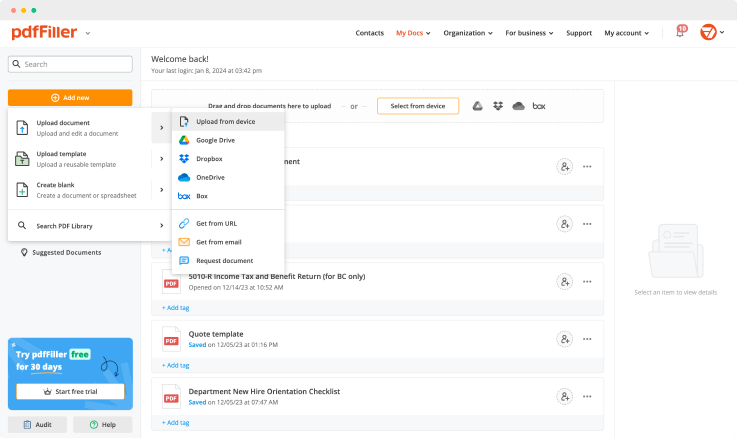

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

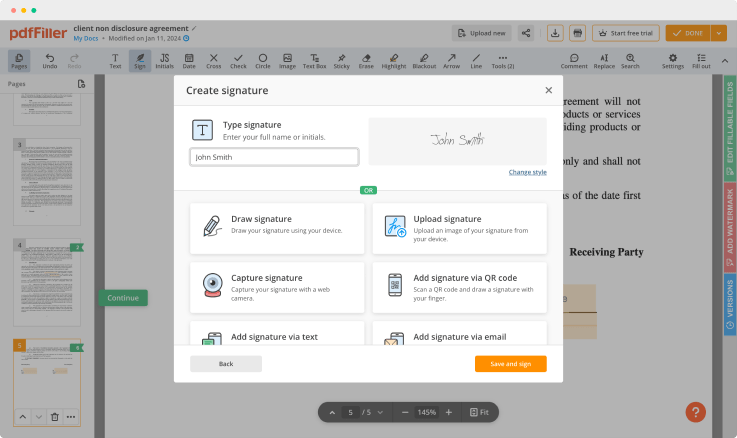

Generate your customized signature

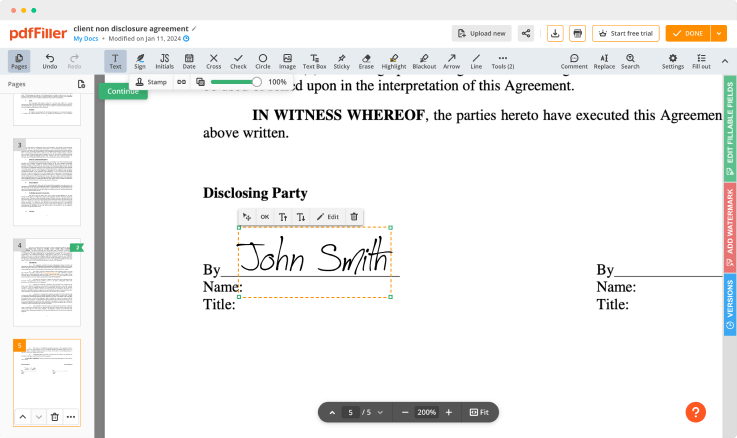

Adjust the size and placement of your signature

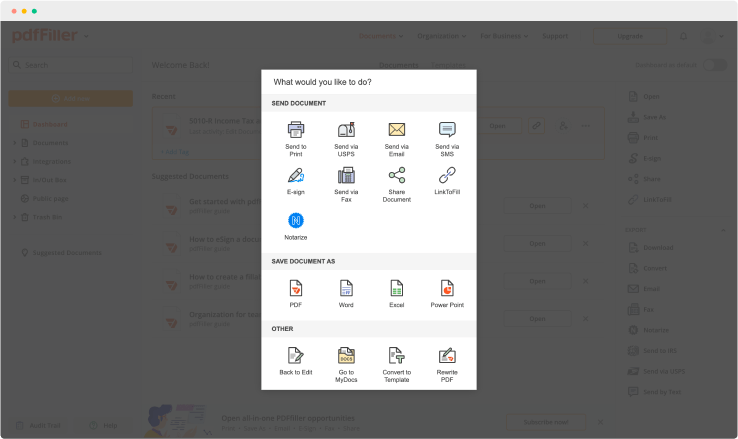

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Safeguard Table Of Contents Settlement Feature

The Safeguard Table Of Contents Settlement feature provides an organized and efficient way to manage your documents. By streamlining the navigation process, this tool allows you to access critical sections quickly. You can enhance your document management experience, whether for personal or professional use.

Key Features

Easy navigation through sections and subsections

Quick access to essential information

User-friendly interface for smooth operation

Customizable table of contents options

Support for multiple document formats

Potential Use Cases and Benefits

Ideal for educators preparing course materials

Useful for businesses organizing reports and proposals

Great for writers managing chapters in books

Helpful for legal professionals creating case files

Perfect for anyone looking to enhance document clarity

This feature addresses common issues like disorganization and time wastage when seeking specific content within lengthy documents. By providing a clear framework, you can focus on what matters most. Streamline your workflow and increase productivity with the Safeguard Table Of Contents Settlement feature.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How much do insurance companies depreciate contents?

In many cases, your covered asset has depreciated by 50% or more in value since you purchased it. That means your insurance company might offer a settlement that's twice as much as what you would receive without recoverable depreciation.

How do you calculate depreciation on insurance?

Generally, depreciation is calculated by evaluating an item's Replacement Cost Value (REV) and its life expectancy. REV represents the current cost of repairing the item or replacing it with a similar one, while life expectancy is the item's average expected lifespan.

How do you calculate depreciation on personal property?

Depreciation is calculated each year for tax purposes. The first-year depreciation calculation is: Cost of the asset — salvage value divided by years of useful life = adjusted cost. Each year, use the prior year's adjusted cost for that year's calculation.

How do insurance companies depreciate roofs?

Generally, the older your roof, the higher the amount depreciated or not covered under your policy. If your policy is for REV, your insurance company will pay the replacement cost value of your roof at the time of a covered loss. This means the replacement cost value minus your deductible.

How much do tools depreciate?

According to the Claims Pages website, for the purposes of depreciating property, manual and power tools both have a lifespan of 20 years and an annual depreciation rate of 5 percent.

Do insurance companies depreciate things?

Insurance companies use a two-step payment process to compensate you for your loss in the event of a disaster under replacement cost coverage. Depreciation is used to determine the amount of the initial check the adjuster issues to start your repairs. Your first check will be for the actual cash value of the property.

How do insurance companies figure depreciation?

Under most insurance policies, claim reimbursement begins with an initial payment for the Actual Cash Value (ACV) of your damage, or the value of the damaged or destroyed item(s) at the time of the loss. Generally, depreciation is calculated by evaluating an item's Replacement Cost Value (REV) and its life expectancy.

Why do insurance companies hold depreciation?

Home insurance companies usually pay replacement cost claims in two parts actual cash value, then recoverable depreciation to dissuade fraud and to limit excessive payouts. After you've repaired or replaced the damaged property, your insurer will write you a check for the recoverable depreciation amount.

Ready to try pdfFiller's? Safeguard Table Of Contents Settlement Gratuito

Upload a document and create your digital autograph now.