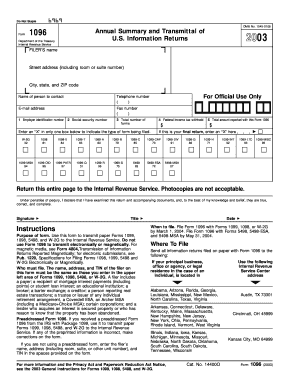

2014 Form 1096

What is 2014 form 1096?

The 2014 form 1096 is a tax form used by businesses to summarize and transmit information returns to the Internal Revenue Service (IRS). It is commonly known as the Annual Summary and Transmittal of U.S. Information Returns. This form is used to report various types of income, such as dividends, interest, and non-employee compensation.

What are the types of 2014 form 1096?

There are several types of 2014 form 1096, each corresponding to different information returns. Some of the common types include:

How to complete 2014 form 1096

Completing the 2014 form 1096 is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.