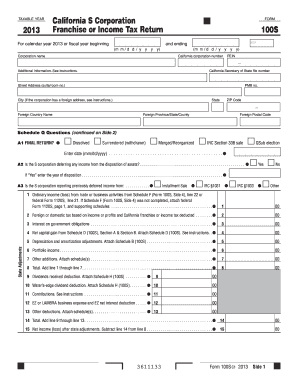

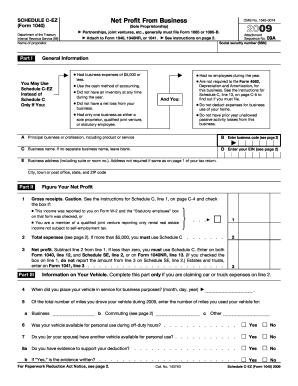

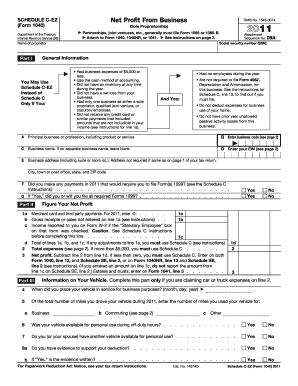

2013 Schedule C Form

What is 2013 schedule c form?

The 2013 Schedule C form is a tax document used by self-employed individuals to report their business income and expenses for the year 2013. It is filed as part of an individual's personal tax return and is used to calculate the net profit or loss from their business.

What are the types of 2013 schedule c form?

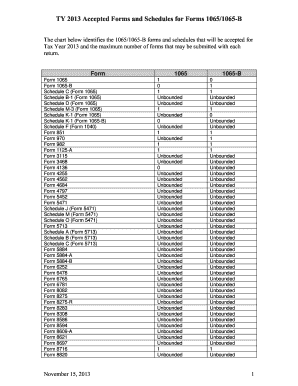

There are different types of 2013 Schedule C forms that cater to specific business types. The available types include: 1. Sole Proprietorship 2. Single-Member LLC 3. Partnership 4. Limited Liability Partnership (LLP) 5. Limited Liability Company (LLC) 6. S Corporation 7. C Corporation It's important to select the correct form based on the structure of your business. Consulting with a tax professional can help determine the most appropriate form for your needs.

How to complete 2013 schedule c form

Completing the 2013 Schedule C form requires attention to detail and accurate reporting of your business income and expenses. Here is a step-by-step guide to help you complete the form: 1. Gather all relevant financial records, including your business income statements and expense receipts. 2. Provide your personal and business information, including your name, address, and Employer Identification Number (EIN). 3. Report your business income, including any gross receipts or sales, on the designated line. 4. Deduct your allowable business expenses, such as advertising costs, office supplies, and utilities. 5. Calculate your net profit or loss by subtracting your total expenses from your total income. 6. Transfer your net profit or loss amount to your personal tax return. Remember, accuracy is vital when completing the form to ensure proper tax filing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.